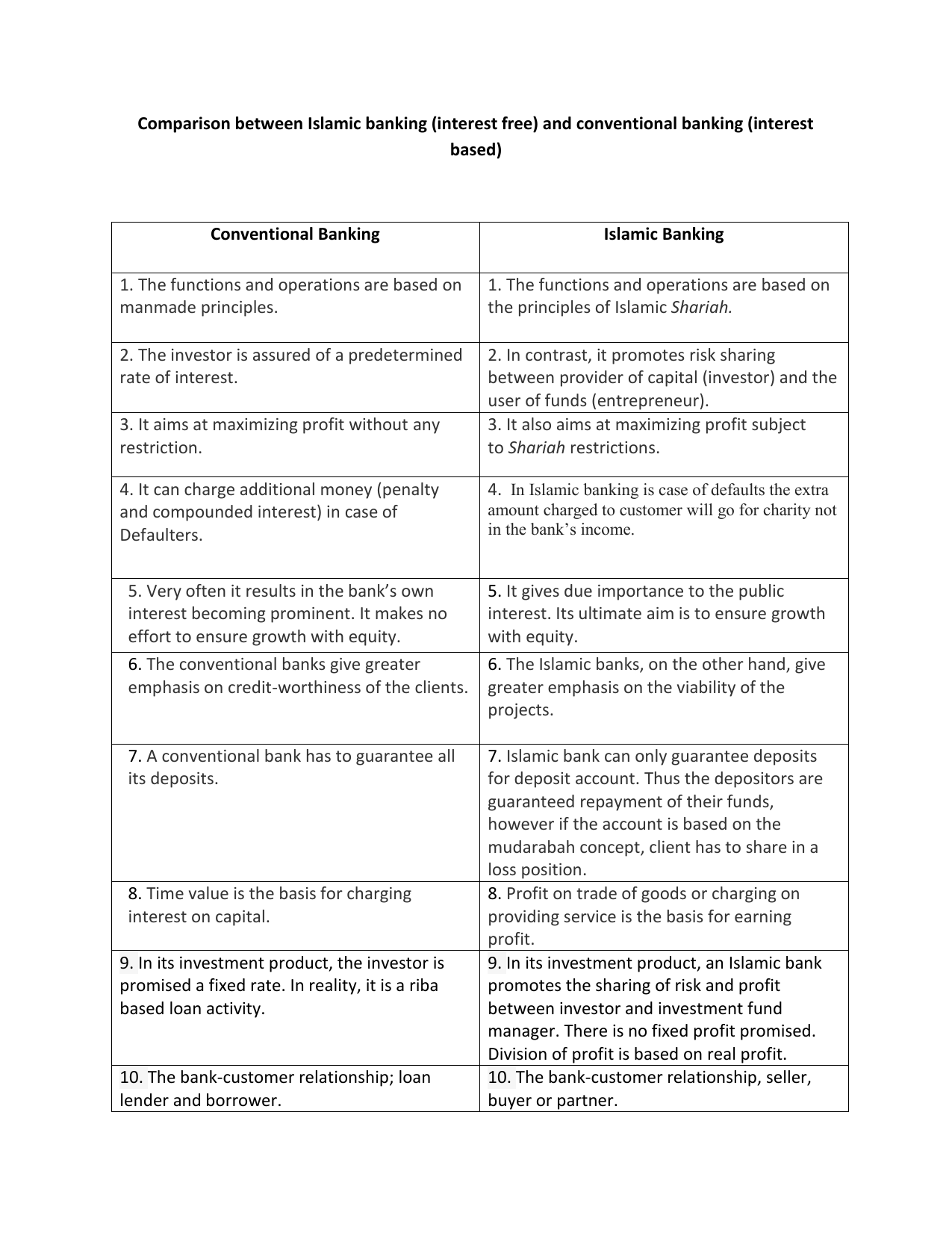

Comparison Between Conventional And Islamic Banking

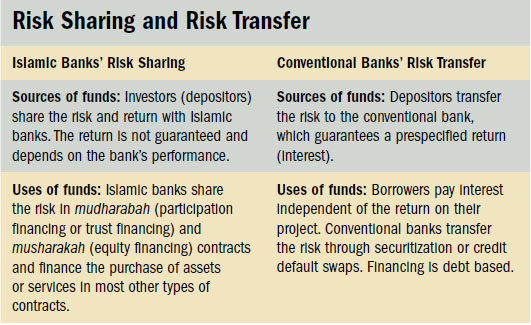

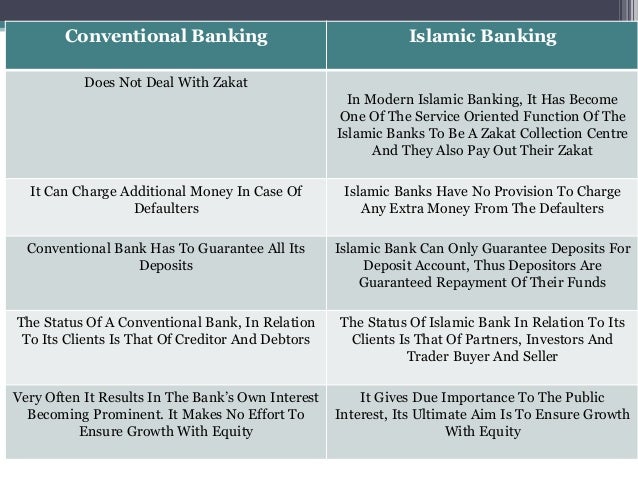

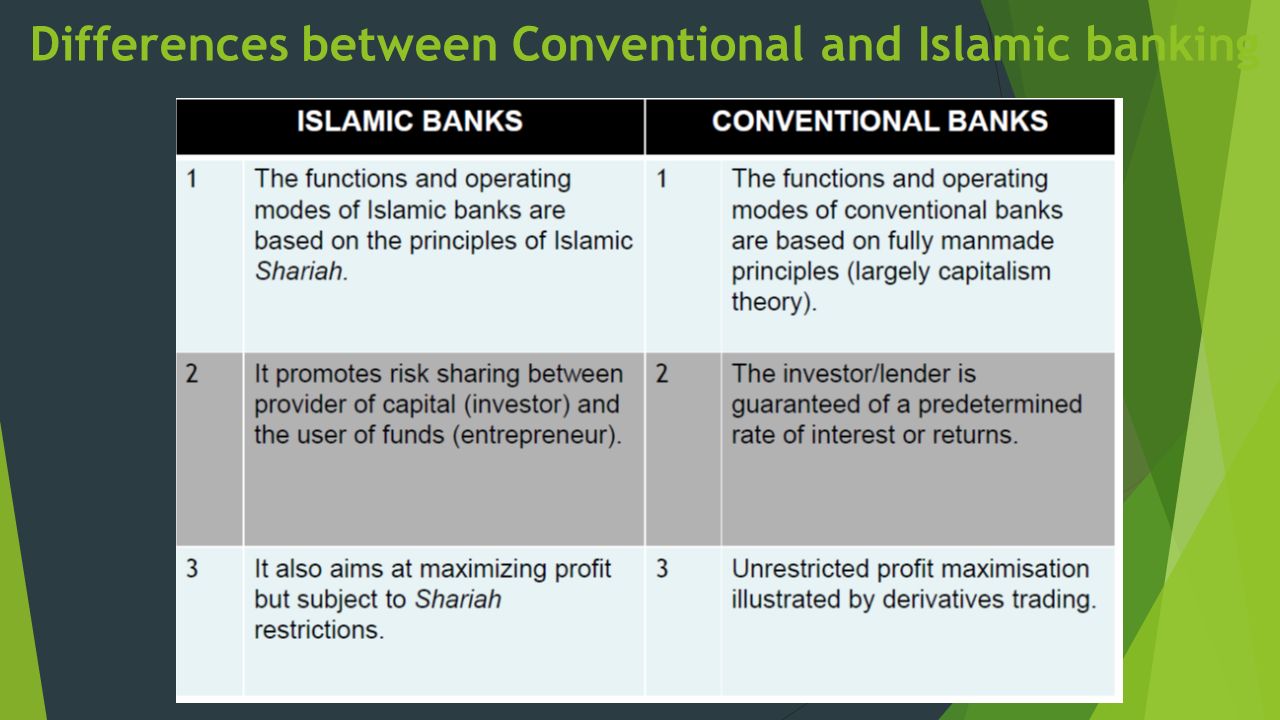

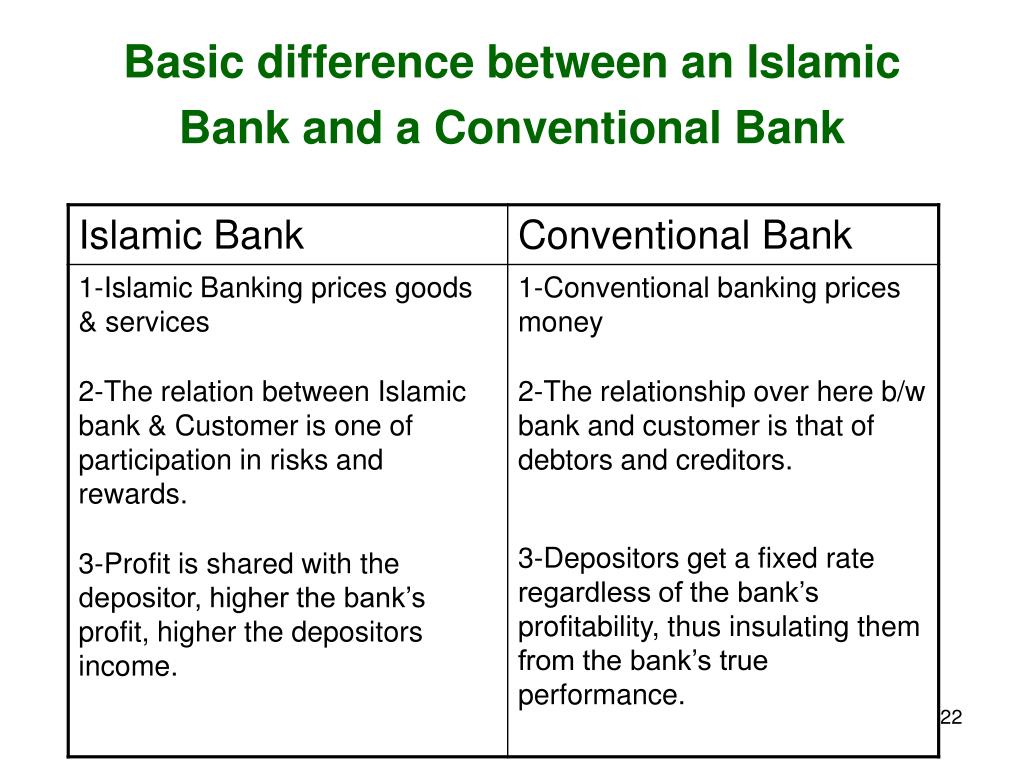

Fundamentally the difference between islamic banking and conventional banking is that the idea fairness to the clients is theoretically focused on the idea of islamic banking itself.

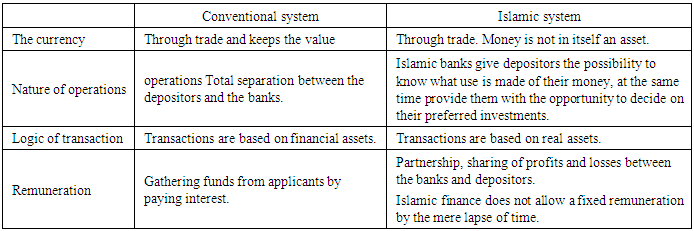

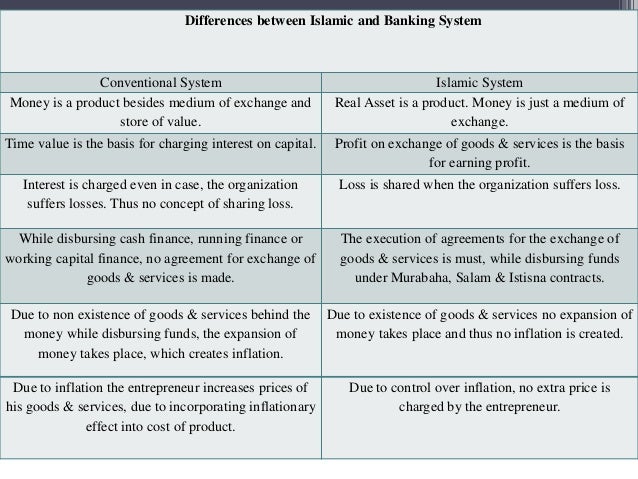

Comparison between conventional and islamic banking. An islamic loan is based on shariah laws the islamic religious law as stated in the quran hadith and sunnah. Islamic banking is an ethical banking system and its practices are based on islamic shariah laws. The basic purpose for establishing an islamic bank is to promote and encourage islamic principles. Unlike conventional loans where money is seen as a commodity there is no money loaned to the borrower as the bank will purchase the item for the borrower and sell it to them at a higher price.

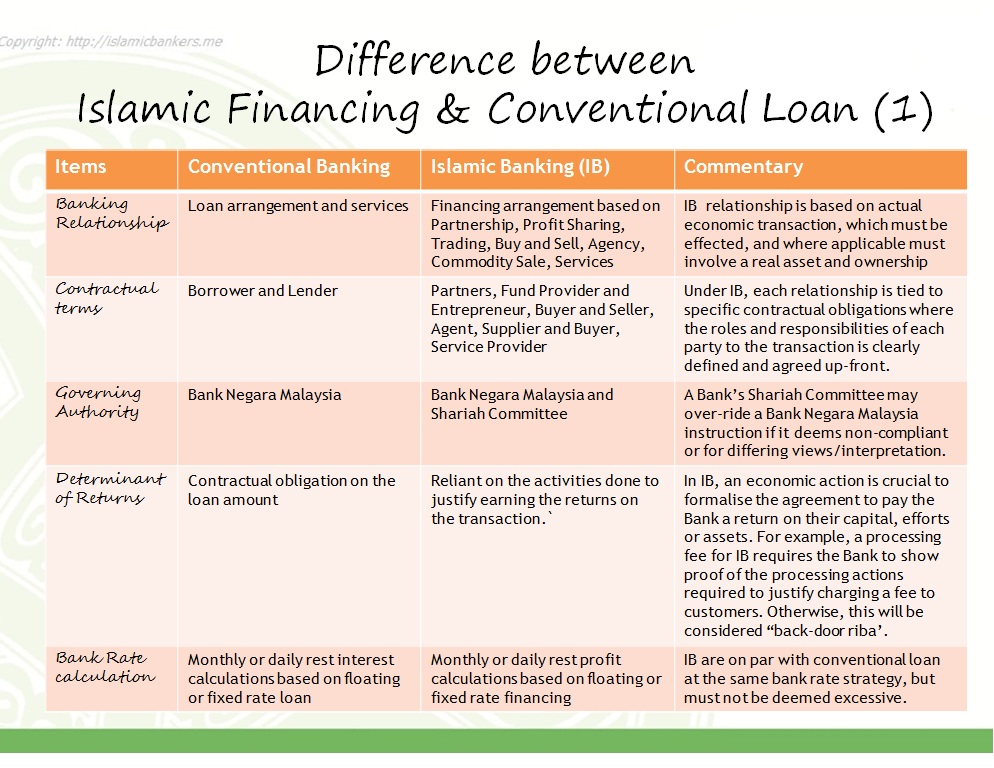

Interest in completely prohibited in islamic banking. The bank s interest comes before the client s as opposed to the islamic banking system. Difference between islamic banking and conventional banking. That difference is just one of many ways that the fundamentals of islamic banking differ from those of conventional commercial banking.