Credit Card Vs Debit Card Difference

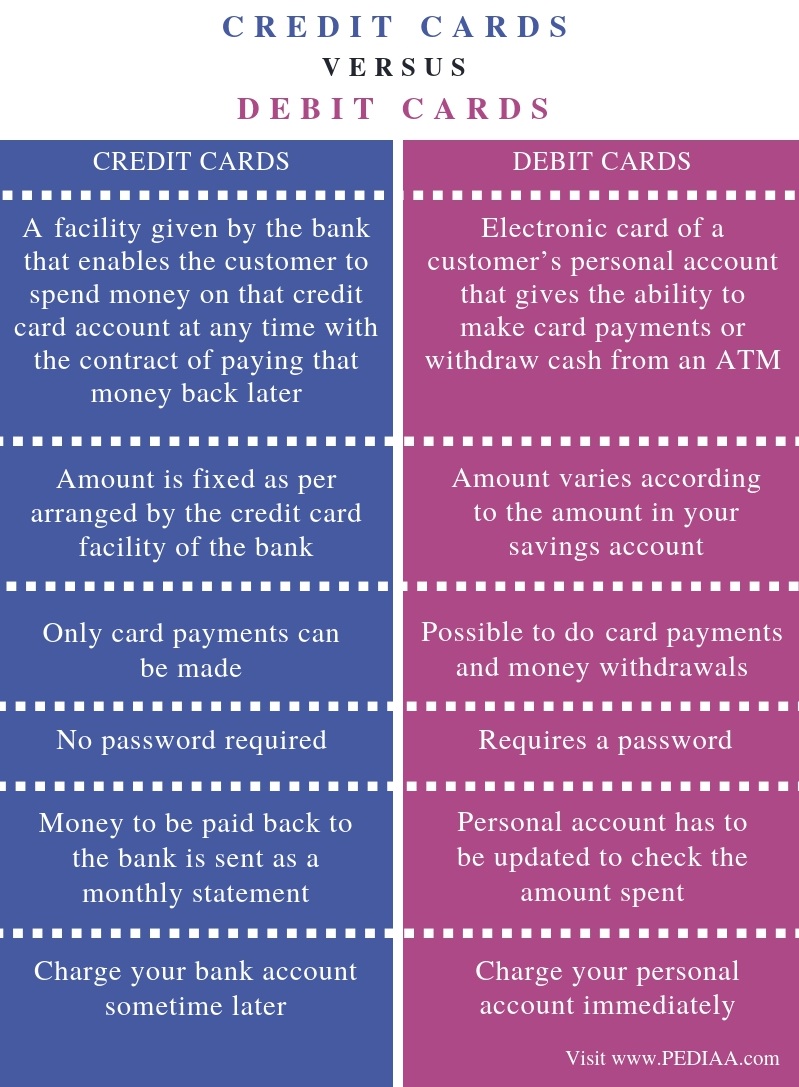

Credit cards unlike most debit or atm cards are the same as taking out a loan and require a bank or lending institution to review an application and approve you for creditworthiness.

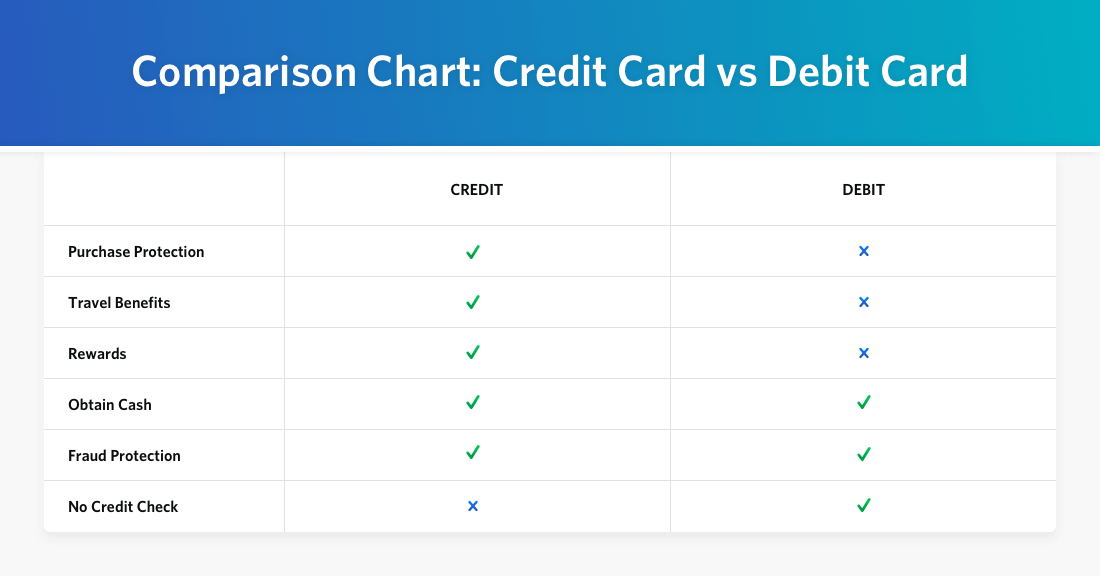

Credit card vs debit card difference. The differences between a credit card and a debit card are more than you can think of. The law limits consumer liability for credit card fraud to 50 and many credit cards including all visa and mastercard credit cards now have zero liability policies your liability for unauthorized transactions is 0. Credit cards debit cards make it more difficult to overspend since you re limited to only the amount available in your checking account. One uses a standard debit card and the other uses a.

Even though both cards often look the same have many similar functions. They offer a line of credit i e a loan. Credit cards often offer a variety of rewards which can include cash back travel miles and more. Credit cards and debit cards may seem like the same thing after all they re both rectangular pieces of plastic but they act quite differently.

This is where you begin to see a difference between credit and debit cards. Business credit cards and charge cards are not covered by this law though many major card issuers have adopted many of these protections voluntarily. Debit cards consumer or business are not covered by the card act. While credit cards appear very much like debit cards and atm cards they have a very different impact on your bottom line.

An example consider two customers who each purchase a television from a local electronics store at a price of 300. Debit cards are like digitized versions of checkbooks. Credit card companies are held to strict liability laws. Credit cards and debit cards typically look almost identical with 16 digit card numbers expiration dates and personal identification number pin.

They are linked to your bank account usually a checking account and money is debited withdrawn from the account as soon as the transaction occurs. Credit cards are different. However a debit card is linked to your bank account while a credit card allows you to borrow money from the card issuer. Debit and credit cards offer more than a way to access money without having to carry around cash or a bulky checkbook.

The major difference is that with a credit card the bank lends you money to use which you can use and pay them back with interest on a monthly basis.

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)