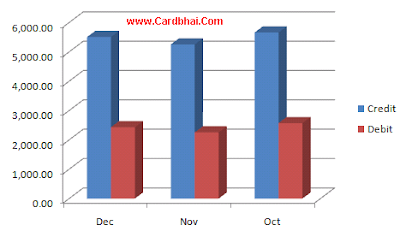

Credit Card Vs Debit Card India

It is preferred more than carrying a debit card cash or a checkbook.

Credit card vs debit card india. Simply put a debit card is what you use when you want to spend your own money whereas in case of a credit card you borrow money from a lender to pay for your expenses. Online or offline shopping is made convenient with credit since they can keep you protected in multiple ways like guarding your checking account provide warranties and many more which debit cards cannot. Credit cards are usually a good choice for purchases. The reserve bank of india issued new directives with the aim of enhancing the security of debit cards and credit cards.

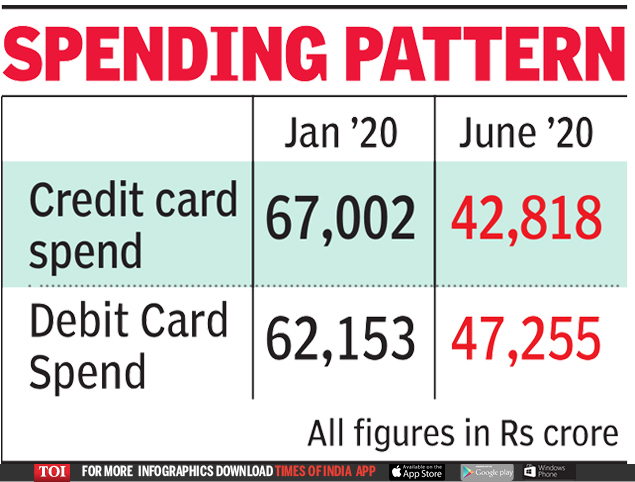

Debit card which one should you use. Answer to is using a credit card better than using a debit card just to know if one doesn t have a problem with the balance on their debit card. This notification was issued on 15 january 2020 to all banks. There is similar question that i answered earlier below is the link.

It is true that a credit card does come in greatly handy during times of emergency when we need to spend on say flight tickets or medical purposes but do not have that amount of cash at our disposal. In addition to that your questio. They believe that a debit card offers enhanced security in comparison to a credit card. Convenience while traveling it is considered that a credit card is much easier and safe to keep while traveling.

6 key differences between debit card credit card. In terms of security a lot of people think that it is more secure to use a debit card than a credit card. Starting from 16 march 2020 banks should have features that limit debit and credit card usage in india when the cardholder is abroad. Credit card avoids money to be frozen while in a debit card if balance is unavailable it can freeze the.

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)