Credit Card Vs Debit Card Uk

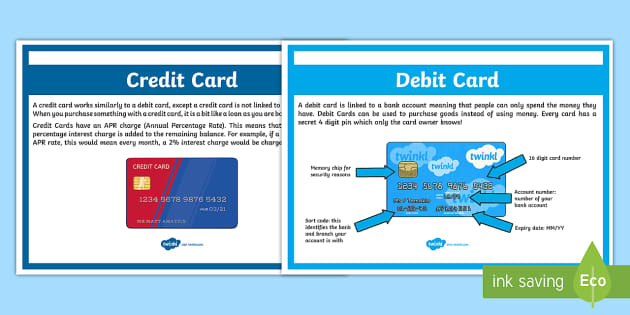

They are linked to your bank account usually a checking account and money is debited withdrawn from the account as soon as the transaction occurs.

Credit card vs debit card uk. If your card charges a flat 2 fee per transaction say then you will know not to use it for small value purchases if possible. A credit card is a card that allows you to borrow money against a line of credit otherwise known as the card s credit limit. For example some of the debit cards provided by the uk s biggest banks also come with the largest overseas usage charges. In fact debit card spending overtook credit card spending online for the first time last year by more than 1bn.

It makes sense that debit card transactions are taking over online particularly when you consider that 91 of the uk population have debit cards while only 61 have credit cards. Before you travel you should check carefully what fees your debit and credit cards impose. The bank pays the merchant and later when you receive your bill you pay the bank. Debit cards are like digitized versions of checkbooks.

Credit cards provide extra protection if you have problems with the goods or services you have bought that cost between 100 and 30 000. According to research by the uk cards association 61 of all credit card users clear their balance in full each month. Some of our debit cards are now contactless which means you don t need to enter your pin if the purchase is for less than 45. Debit and credit cards offer more than a way to access money without having to carry around cash or a bulky checkbook.

Debit card purchases are protected by what is known as the chargeback scheme. Credit cards give good protection against fraud. This scheme lets you claim a refund for goods that have not arrived or arrived damaged goods that are different to how they were described or if the merchant stops trading. Credit cards provide an easy way to pay for the unexpected.

They offer a line of credit i e a loan. Read about our debit cards a credit card such as barclaycard isn t linked to your current account and is a credit facility that enables you to buy things immediately up to a pre arranged limit and pay for them at a later date. Credit cards are different. But if you can be certain that you will always pay off your debts every month then the chances are you may be better off using a credit card rather than a debit card.

/cdn.vox-cdn.com/uploads/chorus_asset/file/11818357/starling2.jpg)

/difference-between-a-credit-card-and-a-debit-card-2385972-Final-5c4731cbc9e77c00018a49e9.png)