Current S P 500 Pe Ratio 2020

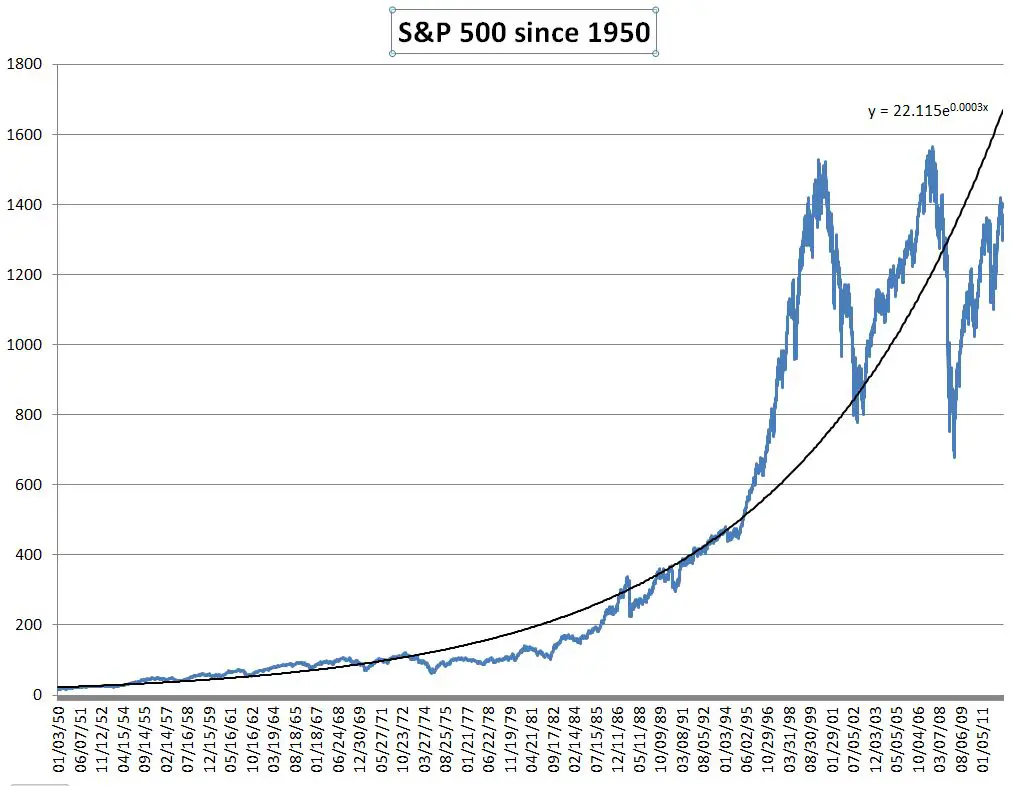

About s p 500 index the s p 500 is widely regarded as the best single gauge of large cap u s.

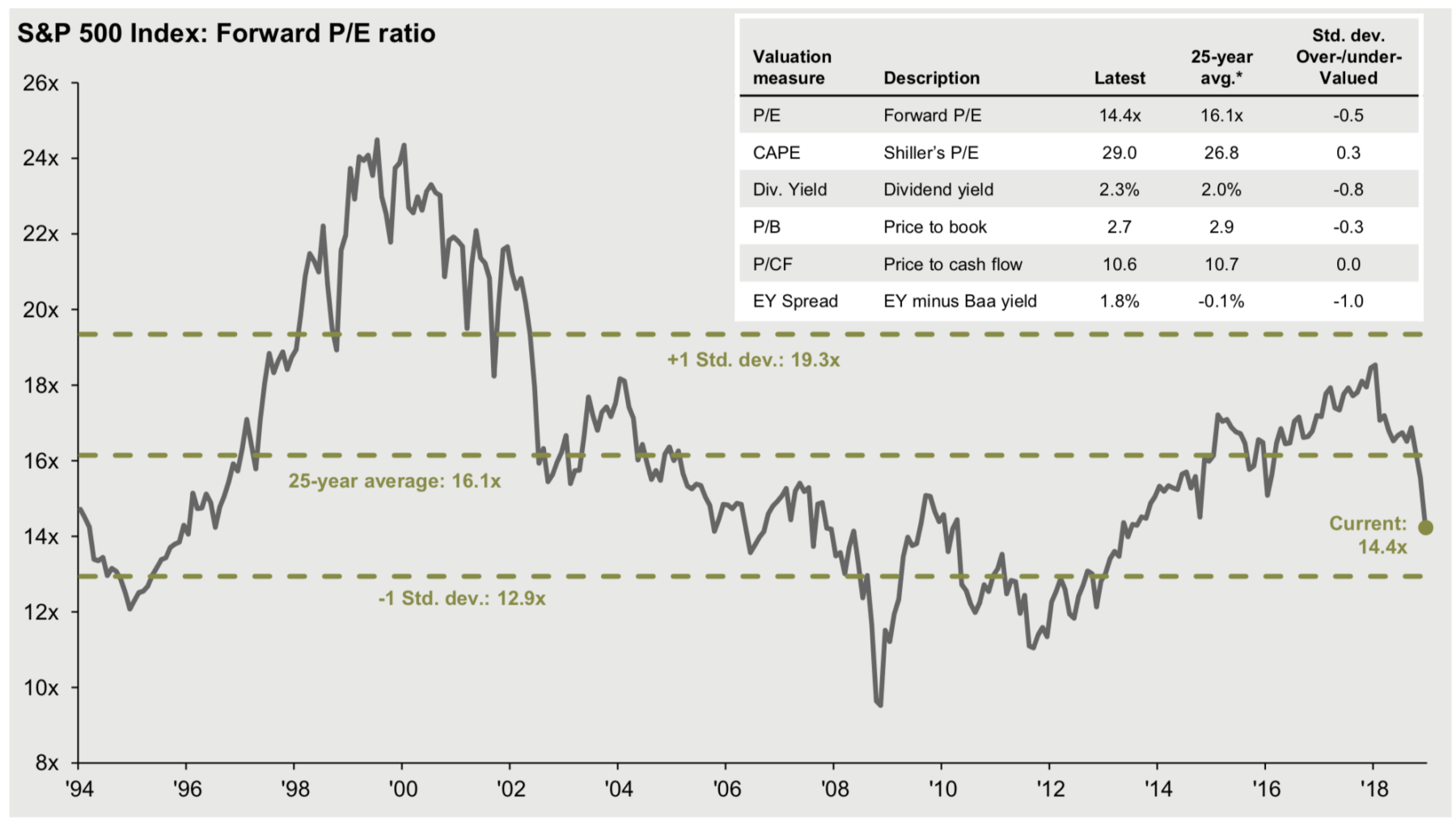

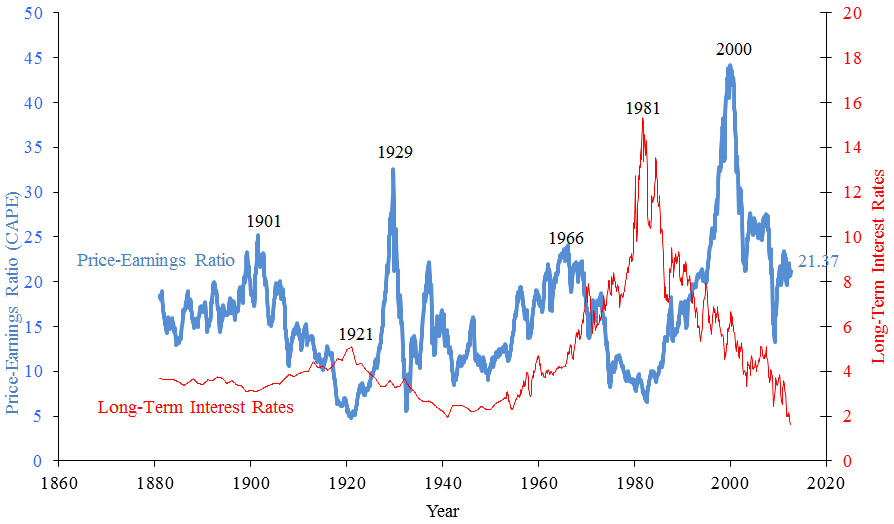

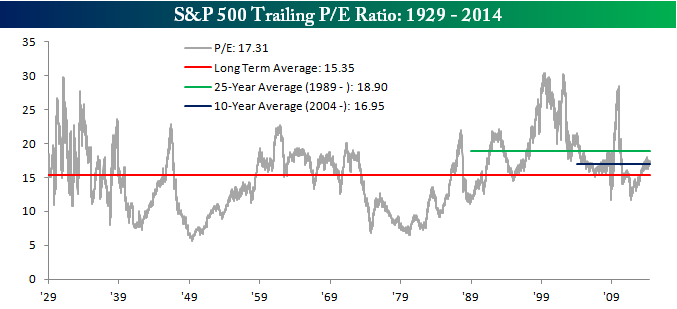

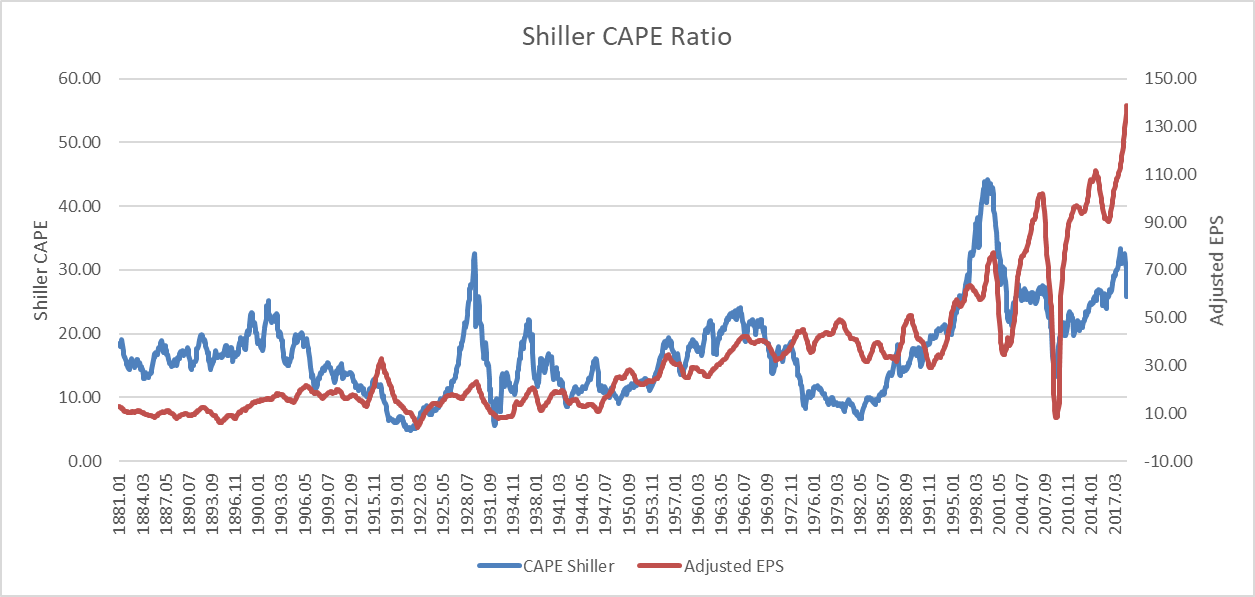

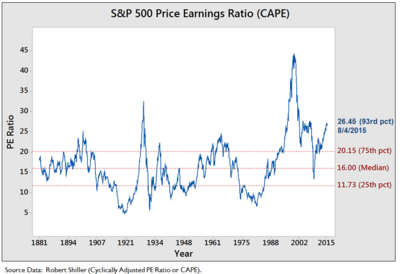

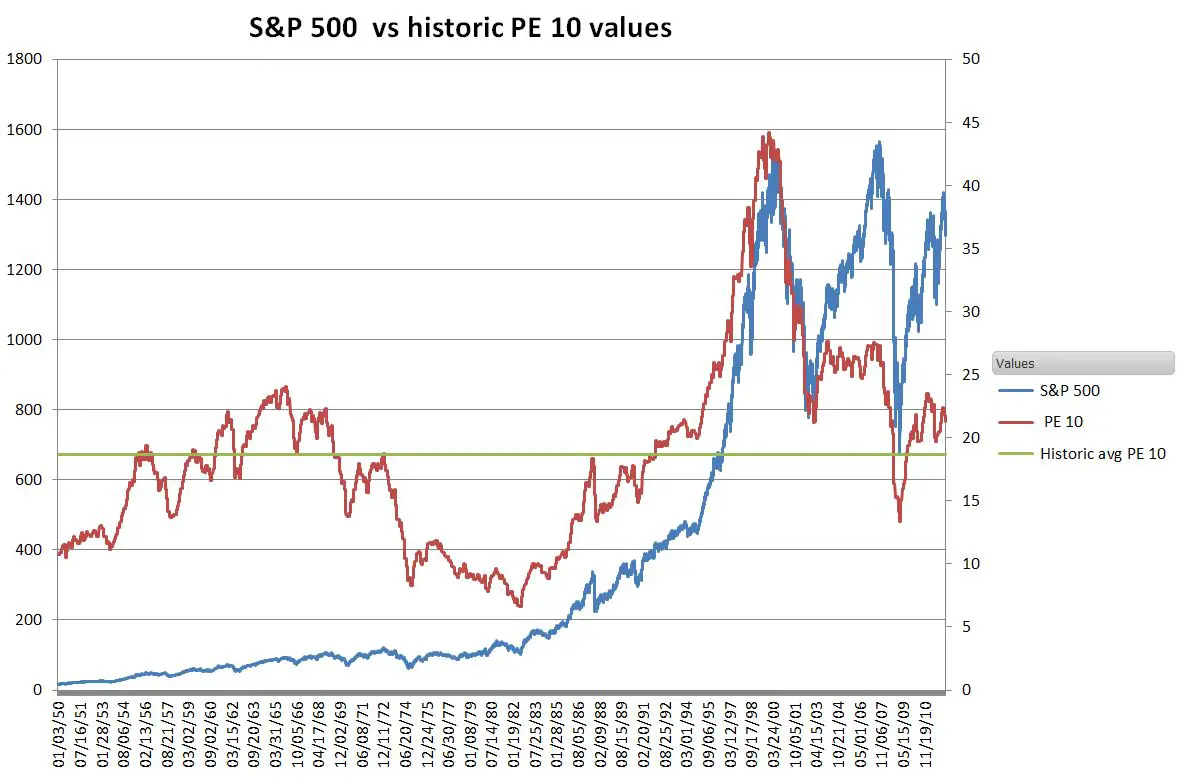

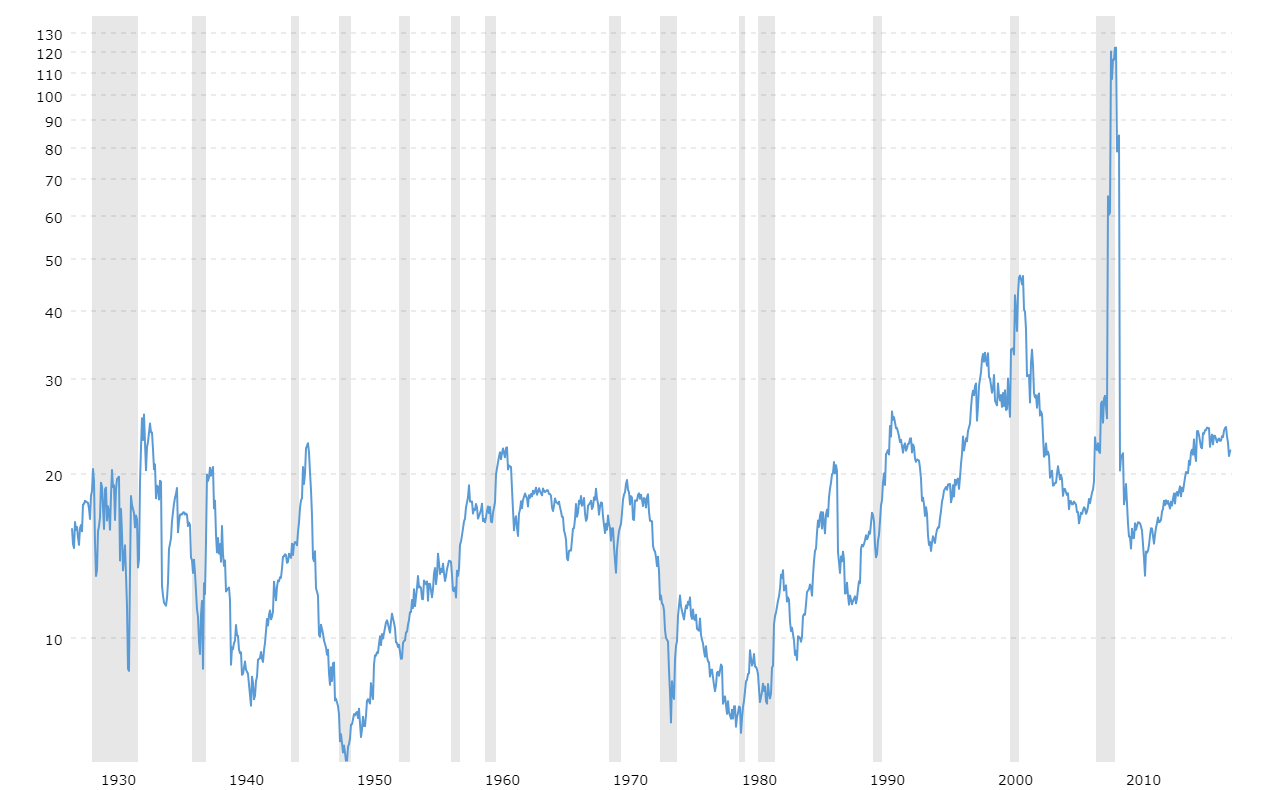

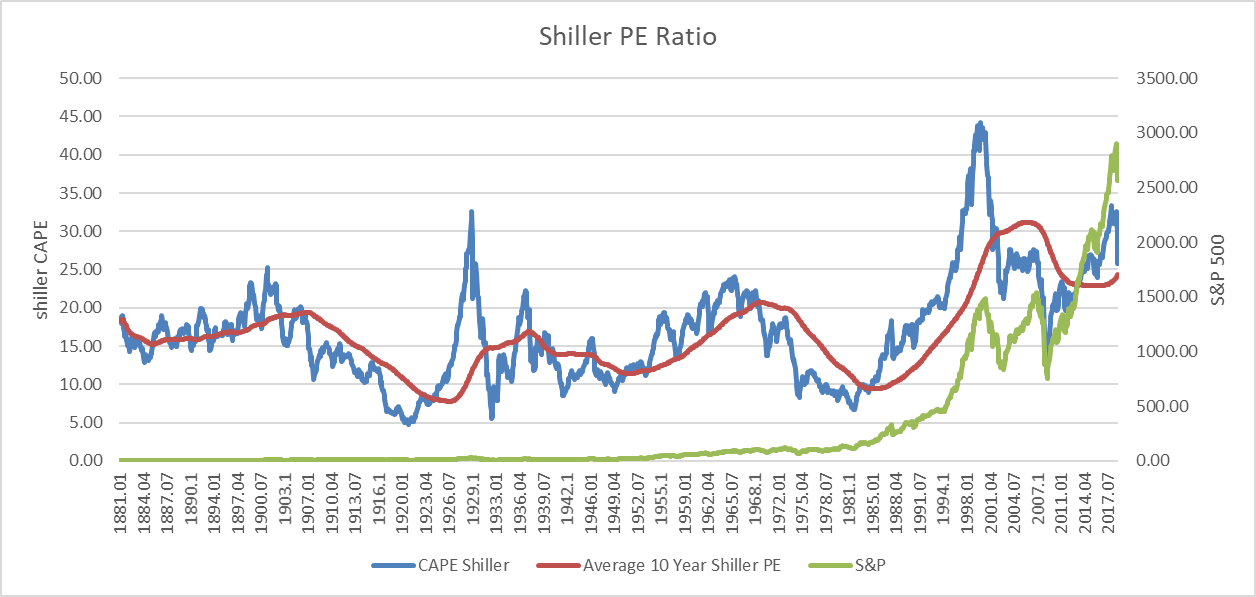

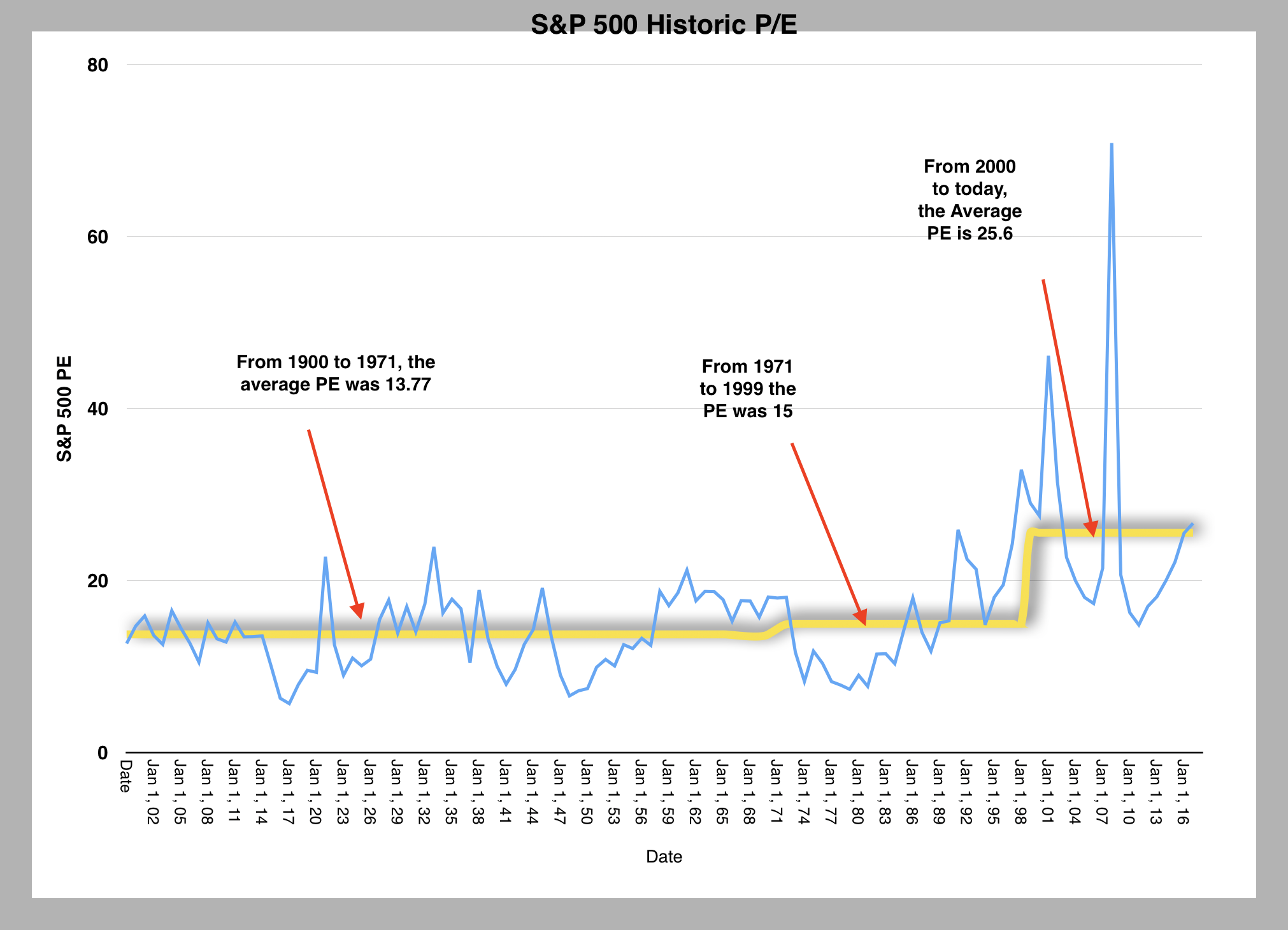

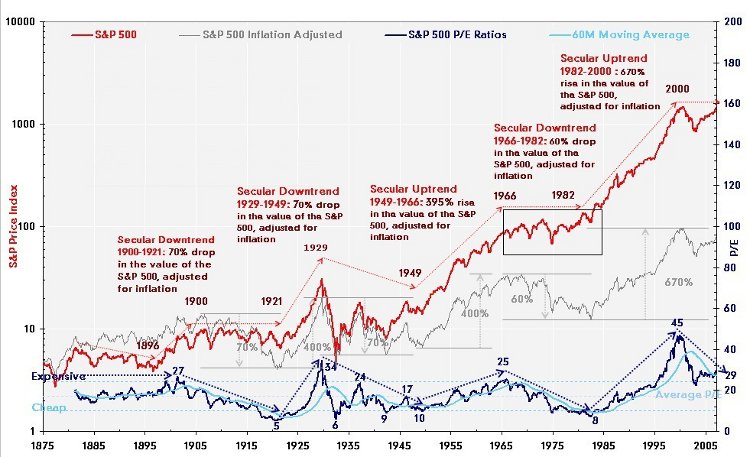

Current s p 500 pe ratio 2020. A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years. 17 8 march 13 2020 average s p 500 pe ratio. One of the stats followed by investors is the p e ratio. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close. This is a change of 5 62 from last quarter and 38 43 from one year ago. S p 500 pe ratio 90 year historical chart. S p 500 p e ratio is at a current level of 31 24 up from 22 22 last.

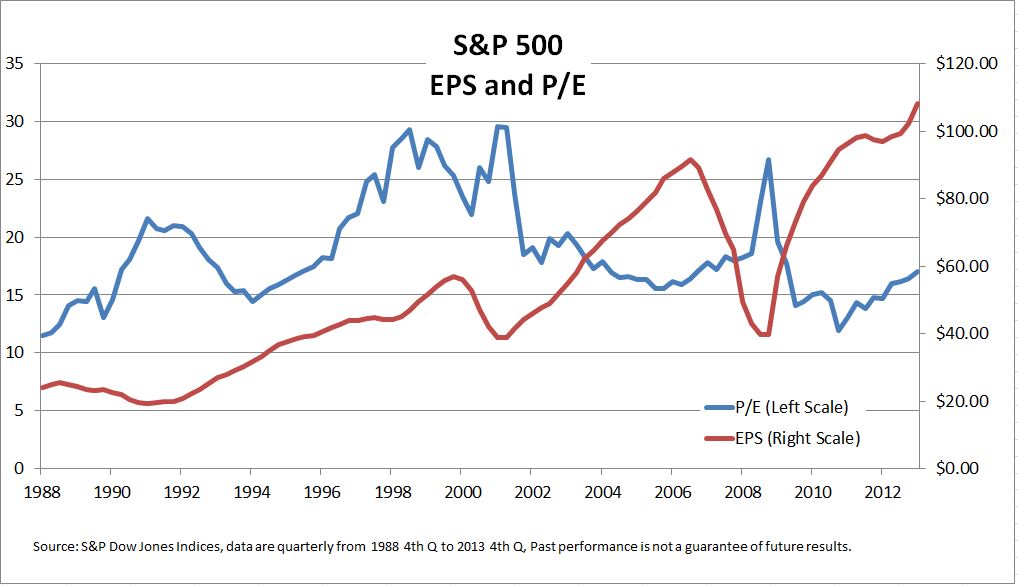

In 2009 when earnings fell close to zero the ratio got out of whack. 5 3 december 1917 the pe ratio of the most popular stock index based on trailing 12 months ttm earnings updated once a week. S p 500 pe ratio table by month historic and current data. Ten data points in 2009 are limited to 50.

The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months. S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago. Equities and serves as the foundation for a wide range of investment products. 14 7 1871 2018 maximum s p 500 pe ratio.

S p 500 pe ratio chart historic and current data. Chart data updated monthly. 123 7 may 2009 minimum s p 500 pe ratio. Historically the s p 500 pe ratio peaked above 120 during the financial crisis in 2009 and was at its lowest in 1988.

Current s p 500 pe ratio. S p 500 index sector performance as of aug 28 2020. Current s p 500 pe ratios. The price to earnings ratio is a valuation metric that gives a general idea of how a company s stock is priced in comparison to their earnings per share.

12 months prior earnings. 15 7 1871 2018 median s p 500 pe ratio. The ratio is used to determine if a company s stock price is. Historical s p 500 pe ratio.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)