Current S P 500 Pe Ratio

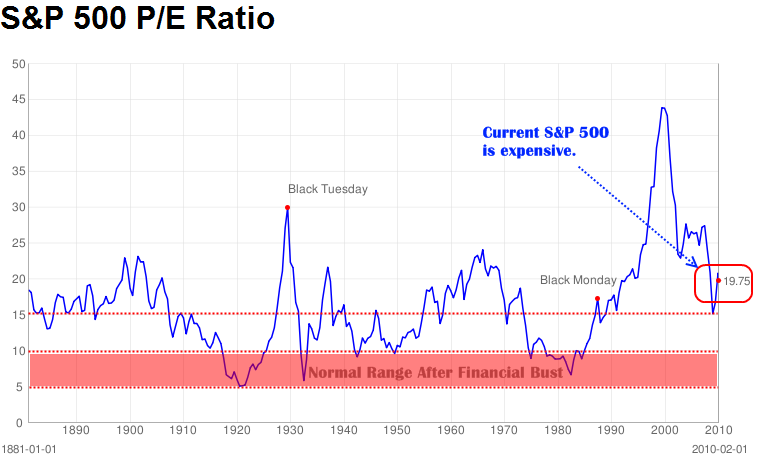

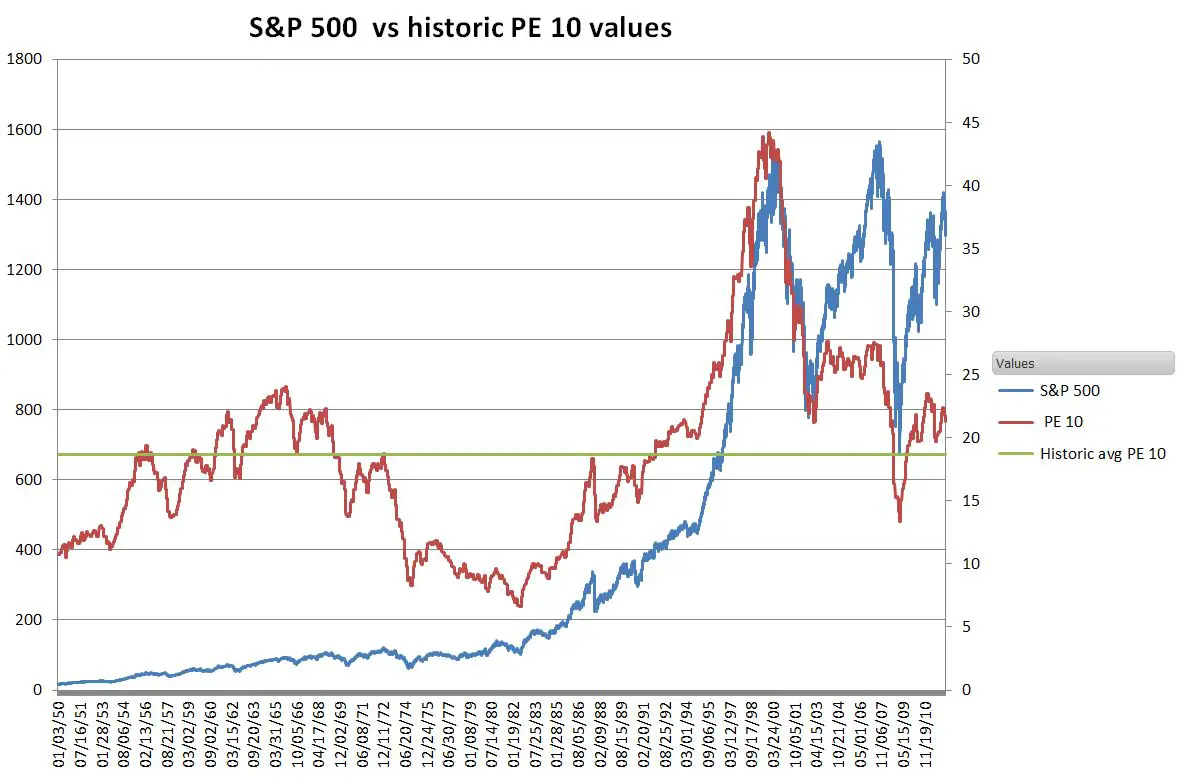

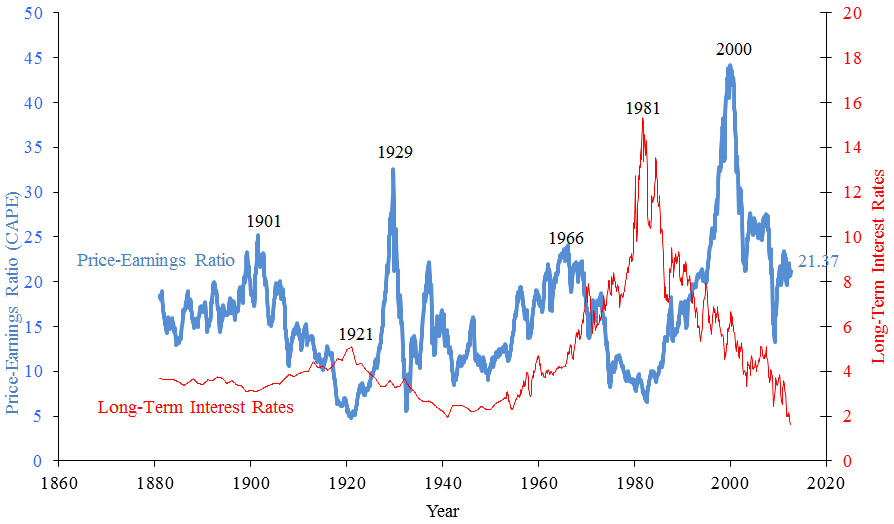

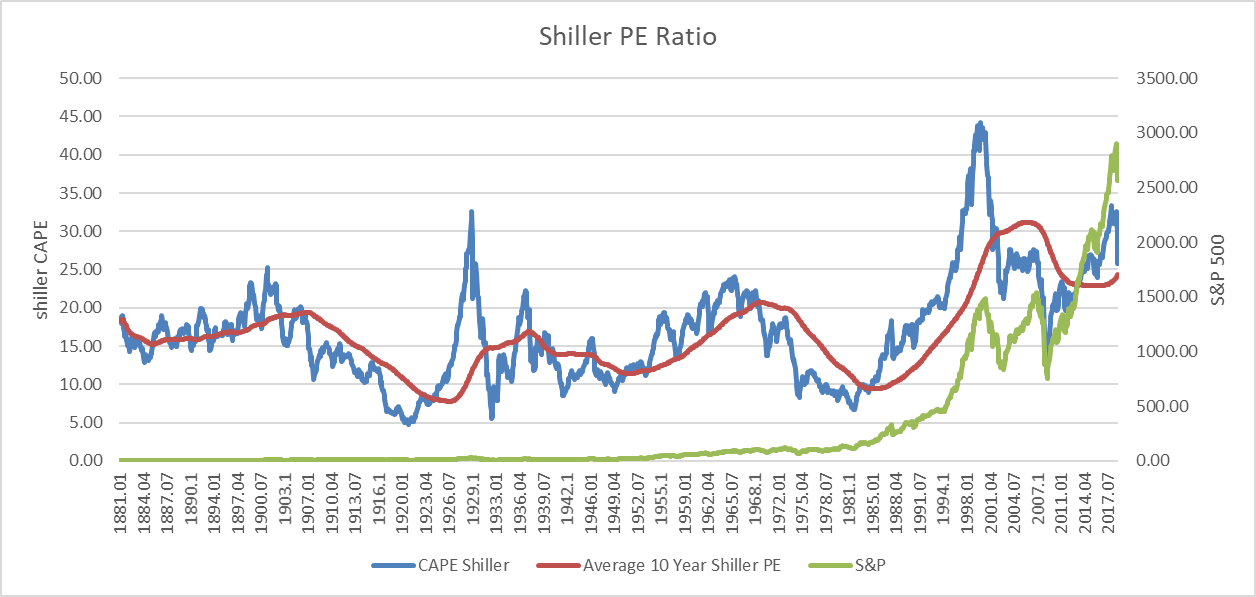

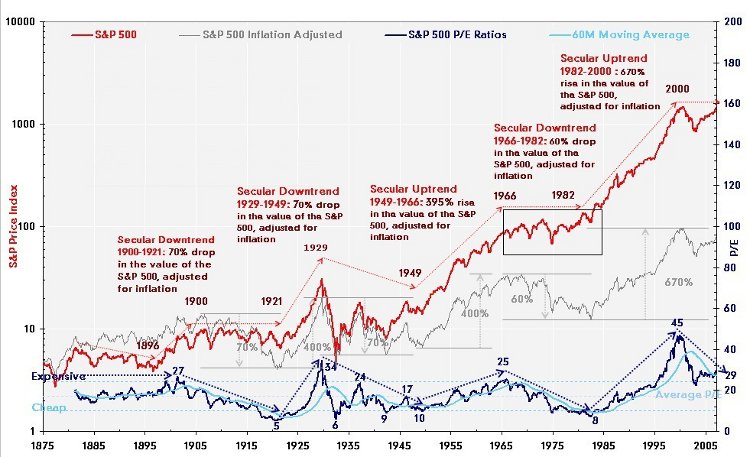

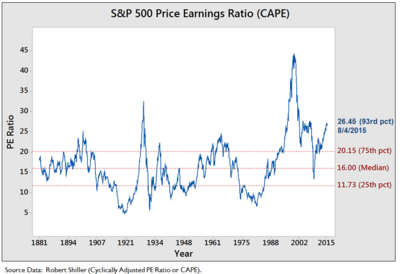

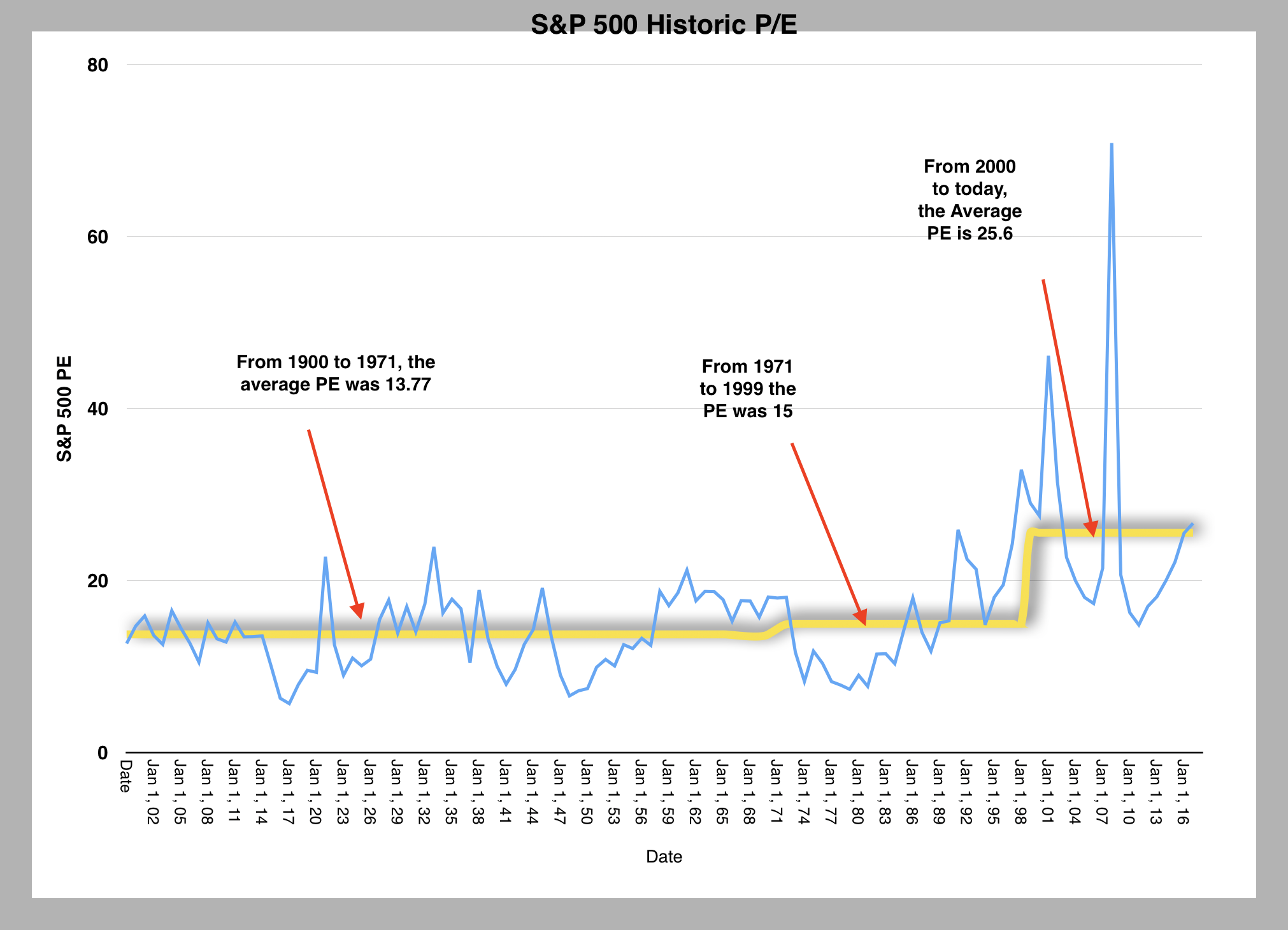

A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years.

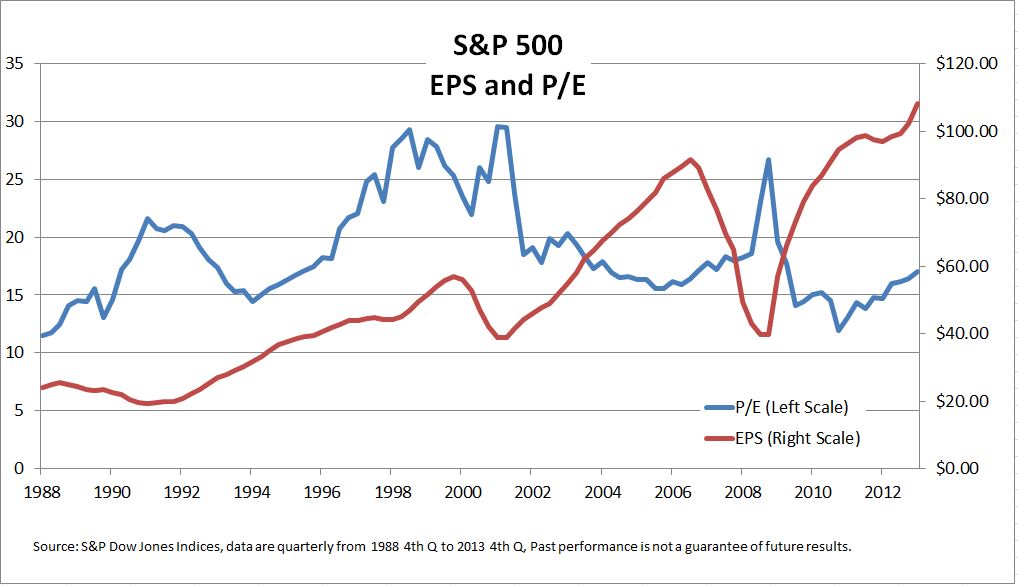

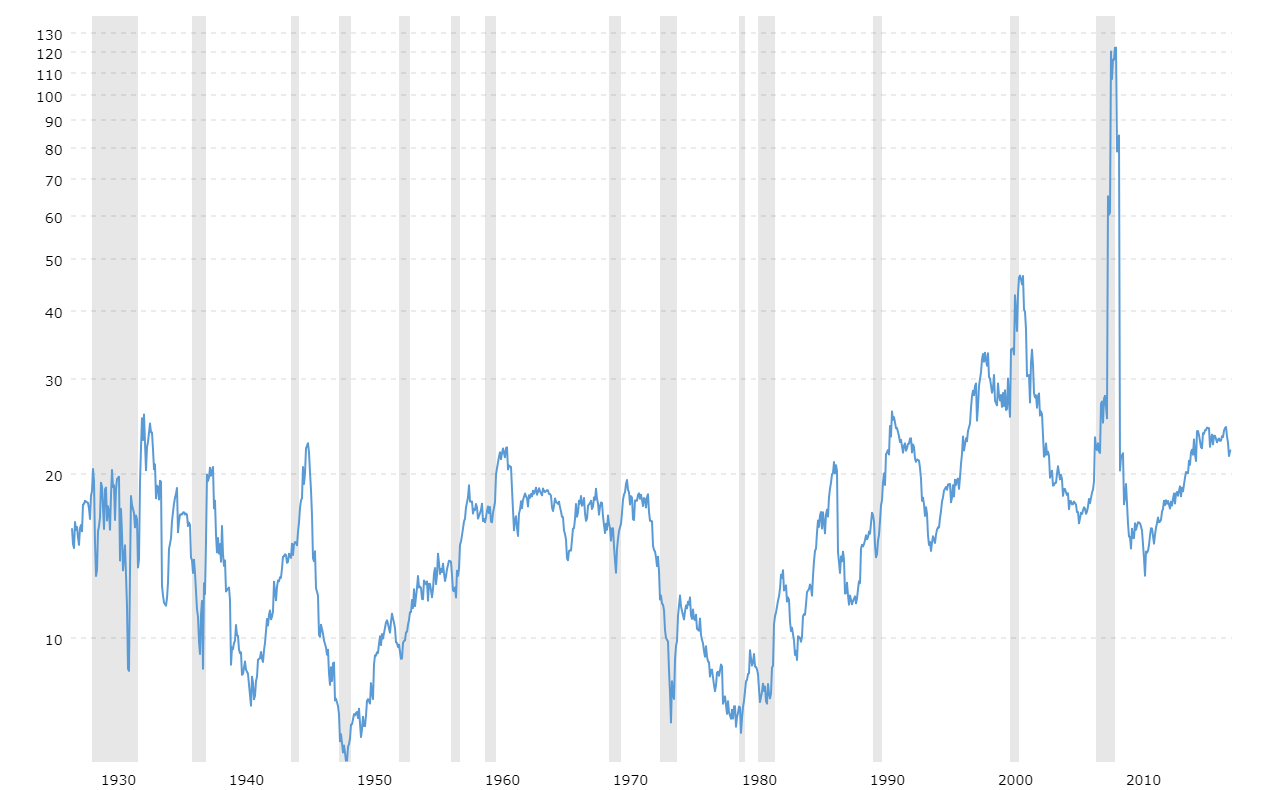

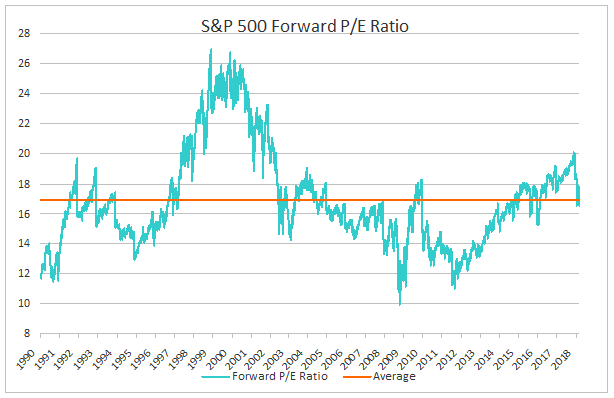

Current s p 500 pe ratio. Historically the s p 500 pe ratio peaked above 120 during the financial crisis in 2009 and was at its lowest in 1988. In 2009 when earnings fell close to zero the ratio got out of whack. Metrics and data to guide value investing. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

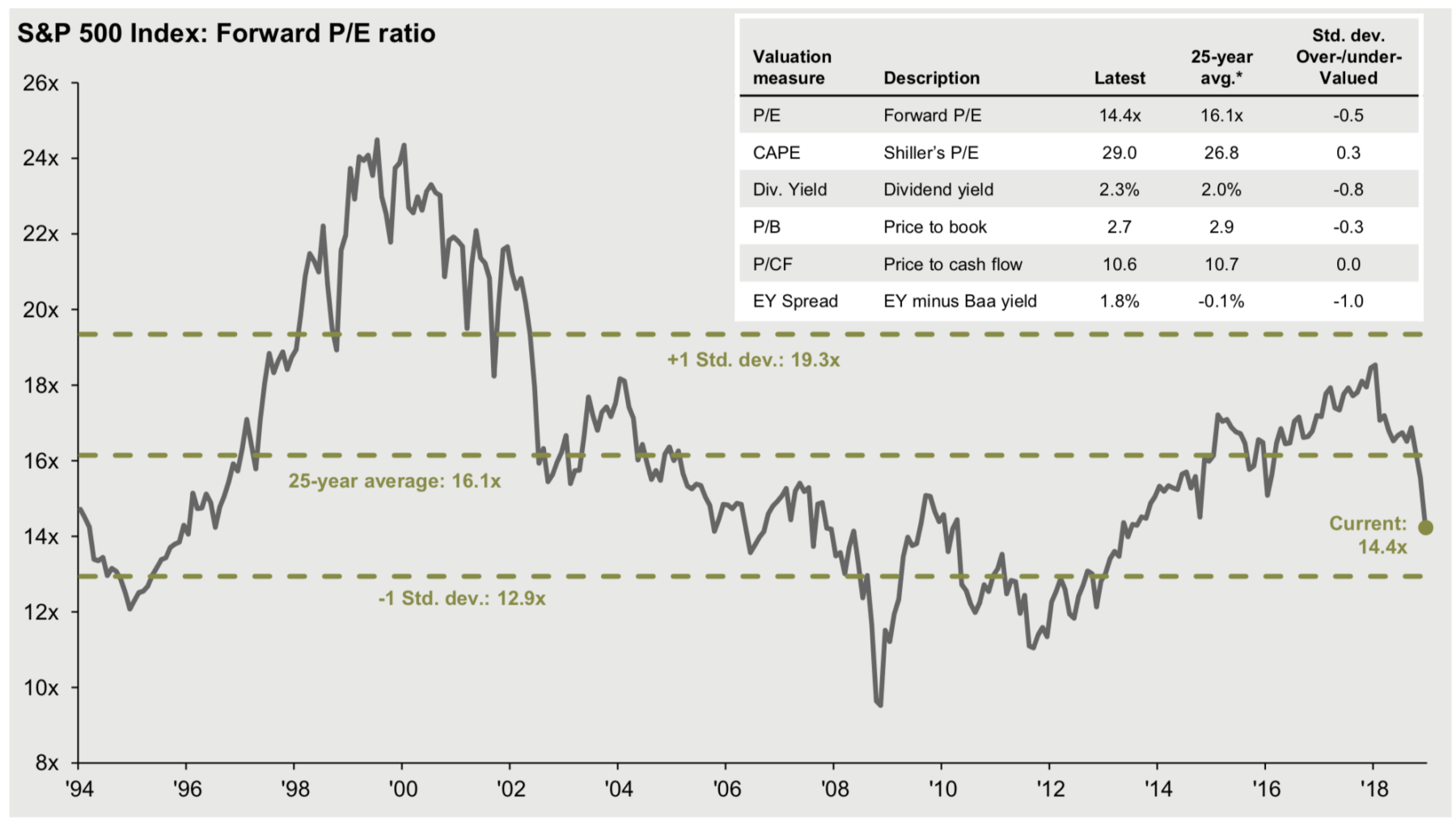

Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close. The price to earnings ratio is a valuation metric that gives a general idea of how a company s stock is priced in comparison to their earnings per share. S p 500 pe ratio chart historic and current data.

Average s p 500 pe ratio. 14 7 1871 2018 maximum s p 500 pe ratio. 123 7 may 2009 minimum s p 500 pe ratio. S p 500 pe ratio table by year historic and current data.

5 3 december 1917 the pe ratio of the most popular stock index based on trailing 12 months ttm earnings updated once a week. S p 500 historical annual returns. What is pe ratio and how it is calculated. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

The pe ratio. S p 500 p e ratio is at a current level of 31 24 up from 22 22 last. S p 500 ytd performance. S p 500 by president from election date s p 500 90 year historical chart.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)