Director Fees Taxation Malaysia

Inland revenue board of malaysia director s liability public ruling no.

Director fees taxation malaysia. The company conducts agm within six 6 months from the company s financial year end. A public ruling as provided for under section 138a of the income tax act 1967 is issued for the purpose of providing guidance for the public and officers of the inland revenue board malaysia. 2 2019 date of publication. Would director s fees declared to a non resident director by a malaysia incorporated company but not remitted to the director subject to withholding tax.

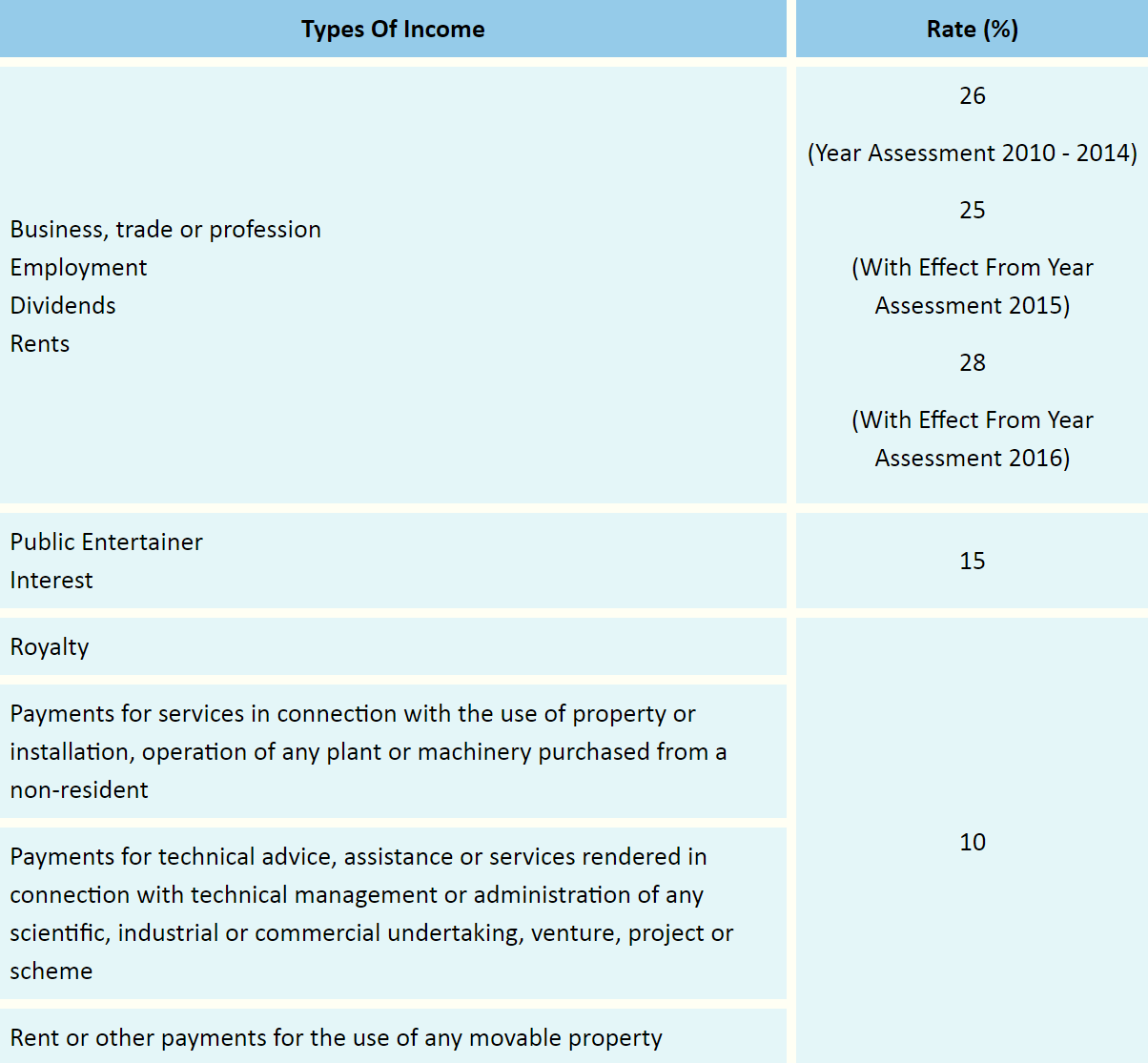

Tax deduction for secretarial and tax filing fees. We carefully watch the payment of salary and wage to working director before year end. That is because we want to make sure the company satisfies its super pagy w obligations etc at the same time make sure the company sits in its best tax position. Director fee or any remuneration received by a statutory director from a company resident in malaysia in respect of their directorship is liable to malaysian tax.

You need to give numbers for people advise accurately. The earliest date which the director can receive his fees is the date on which his fee is approved by the board of directors bod at the company s annual general meeting agm. Currently expenses incurred on secretarial and tax filing fees are given a tax deduction of up to rm5 000 and rm10 000 respectively for each year of assessment ya under the income tax deduction for expenses in relation to secretarial fee and tax filing fee rules 2014 p u. Yes where director fees are received.

Director s remuneration and tax planning evidence from malaysia. Try fully utilize sdn bhd lower band tax of 19. Director salary bonus have to combo with kwsp which is good in a way that kwsp is tax exempted. Director s remuneration and tax planning evidence from malaysia.

For a working director directors fee is a planning tool. A will the taxation be triggered irrespective of whether or not the board member is physically present at the board meetings in malaysia. No director s fees are assessed in the year that a director received the payments. By smdk thursday.

Director s remuneration and tax planning evidence from malaysia. Director fee is like a project basis fee. Since you have secure your income you need to start to have proper tax planning. It sets out the interpretation of the director general of inland revenue in respect of the particular tax law and the policy and proced ure that.