Hong Leong Loan Documents

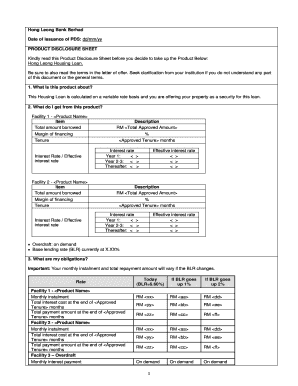

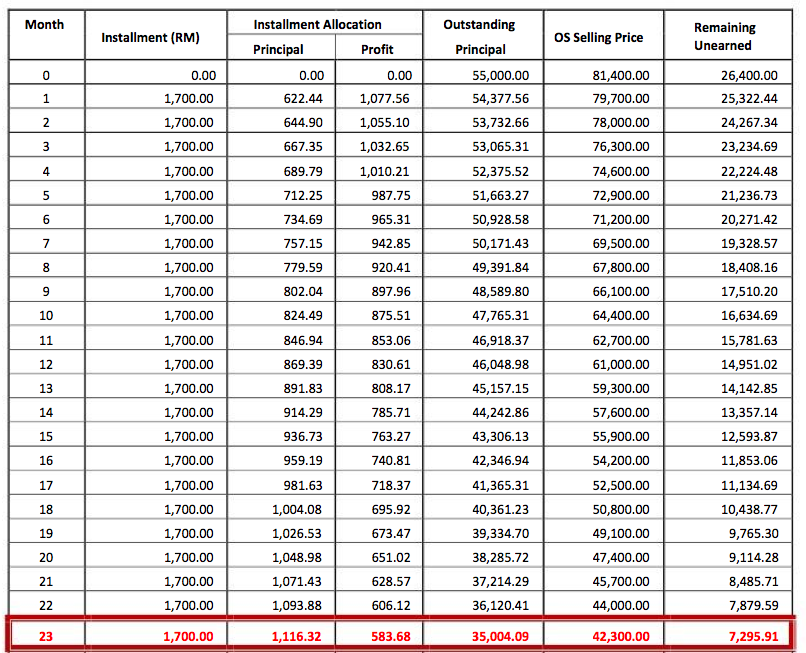

For this conventional personal loan you will have a fixed interest rate of 12 00 per annum.

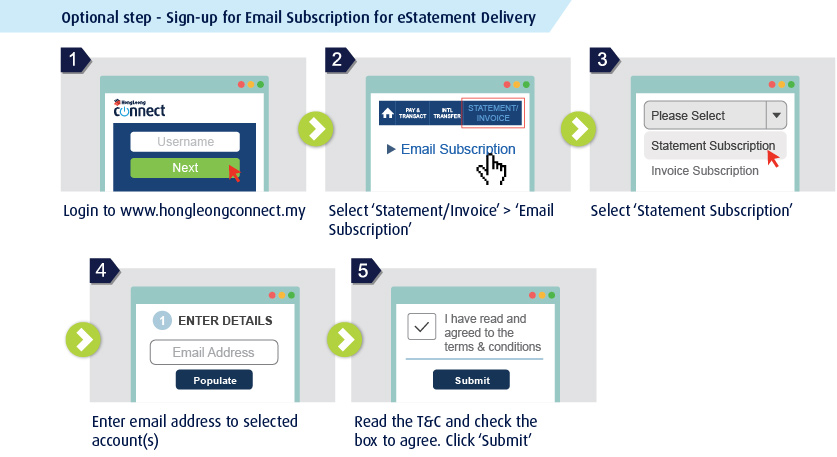

Hong leong loan documents. Hl bank singapore offers a host of personal financing products and services ranging from loans savings current accounts online banking mobile banking and more. Eoncap islamic bank berhad to hong leong islamic bank berhad g. Revised specimens for facilities agreement and solicitors guide for hong leong cm flexi property financing i with effect from 1 july 2016. Password combination and format to open letter of instruction.

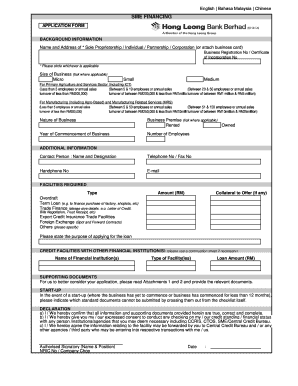

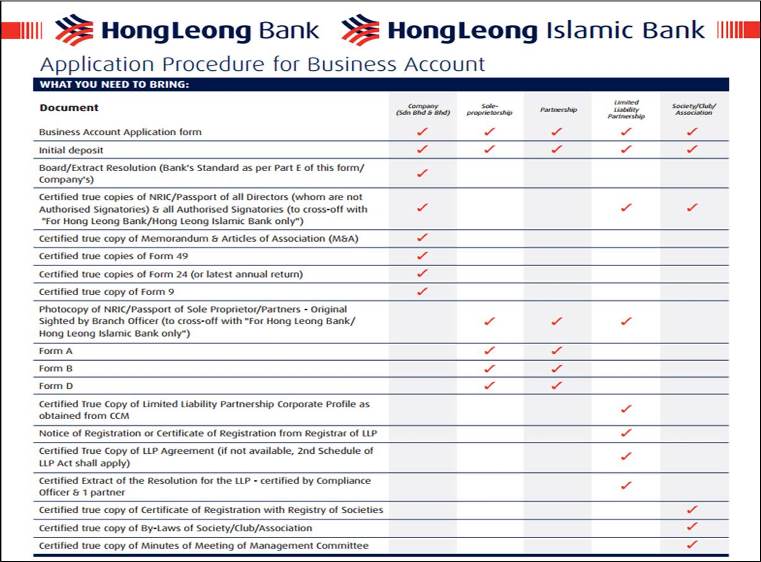

As the name suggests this hong leong mortgage loans allow you to pay more than your fixed monthly payment. Temporary bridging loan hong leong finance provides both smes and non smes that are impacted by covid 19 outbreak. These sectors are eligible to apply for the temporary bridging loan programme. Bring along relevant documents stated in the application form to meet a branch manager for a discussion at any of the 28 hong leong finance branches produce relevant documents for loan application declaration.

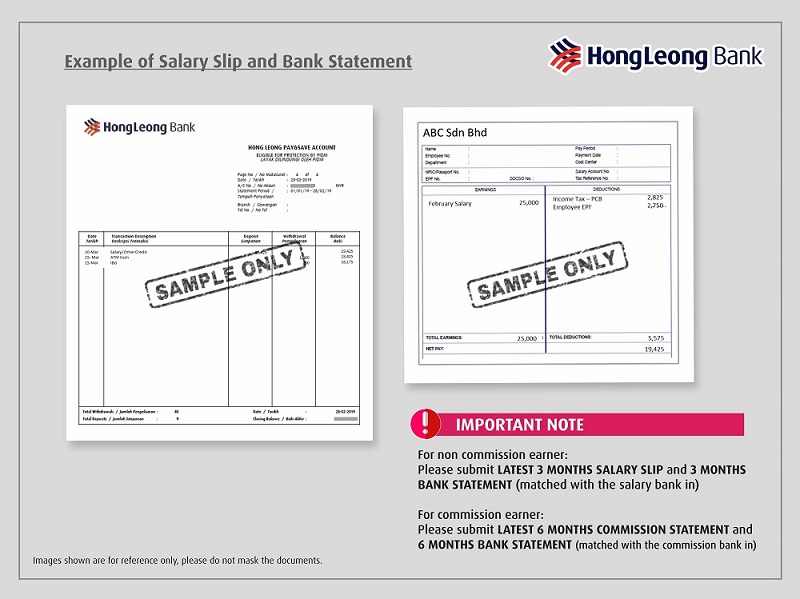

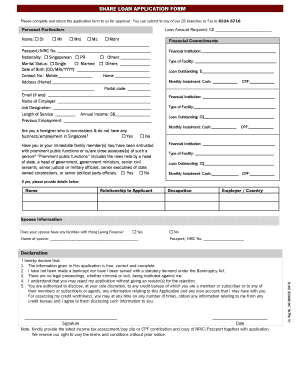

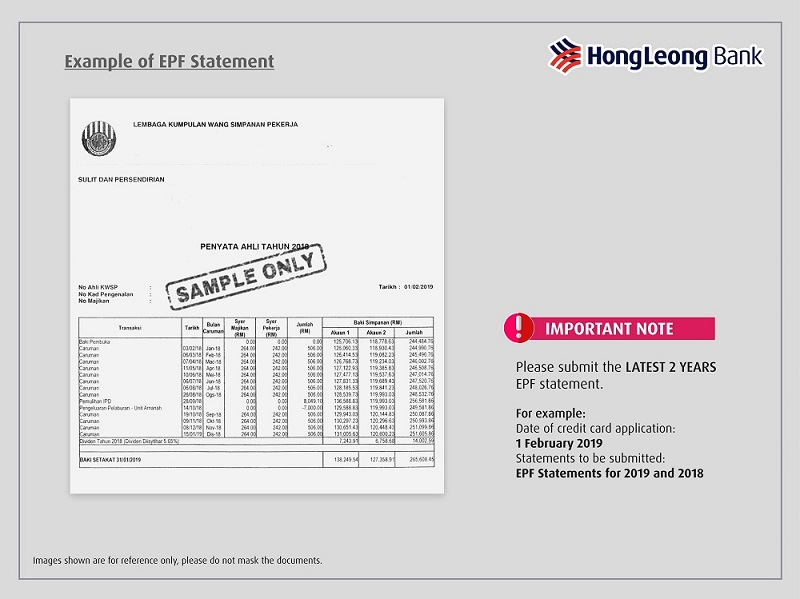

You could get your personal loan application approved within 48 hours once you have submitted the application form and all relevant documents. Anyone 18 years of age or older can apply this hong leong mortgage package. Currency unit selling tt buying tt. Hlisb certificate of incorporation on change of name of company form 13 kwong lee bank limited to kwong lee bank berhad.

We offer affordable interest rates package to help the businesses tide through this period. The minimum loan amount required in order to be able to enjoy the benefits of hong leong personal loan is rm5 000 and up to rm100 000. Hong leong bank ensures a fast turnaround time for this personal loan. You can access to your money via a bank account maintained with hong leong bank or other banks of your choice.

You are also entitled to enjoy this fantastic personal loan minimum tenure of 2 years up to 7 years. There is another type of hong leong mortgage loans namely hong leong housing loan with the option of a term loan with overdraft facility. Based on loan of up to 90 residential 85 non residential of property value.