How To Calculate Epf Dividend Malaysia

Epf s dividend calculation is not that straight forward.

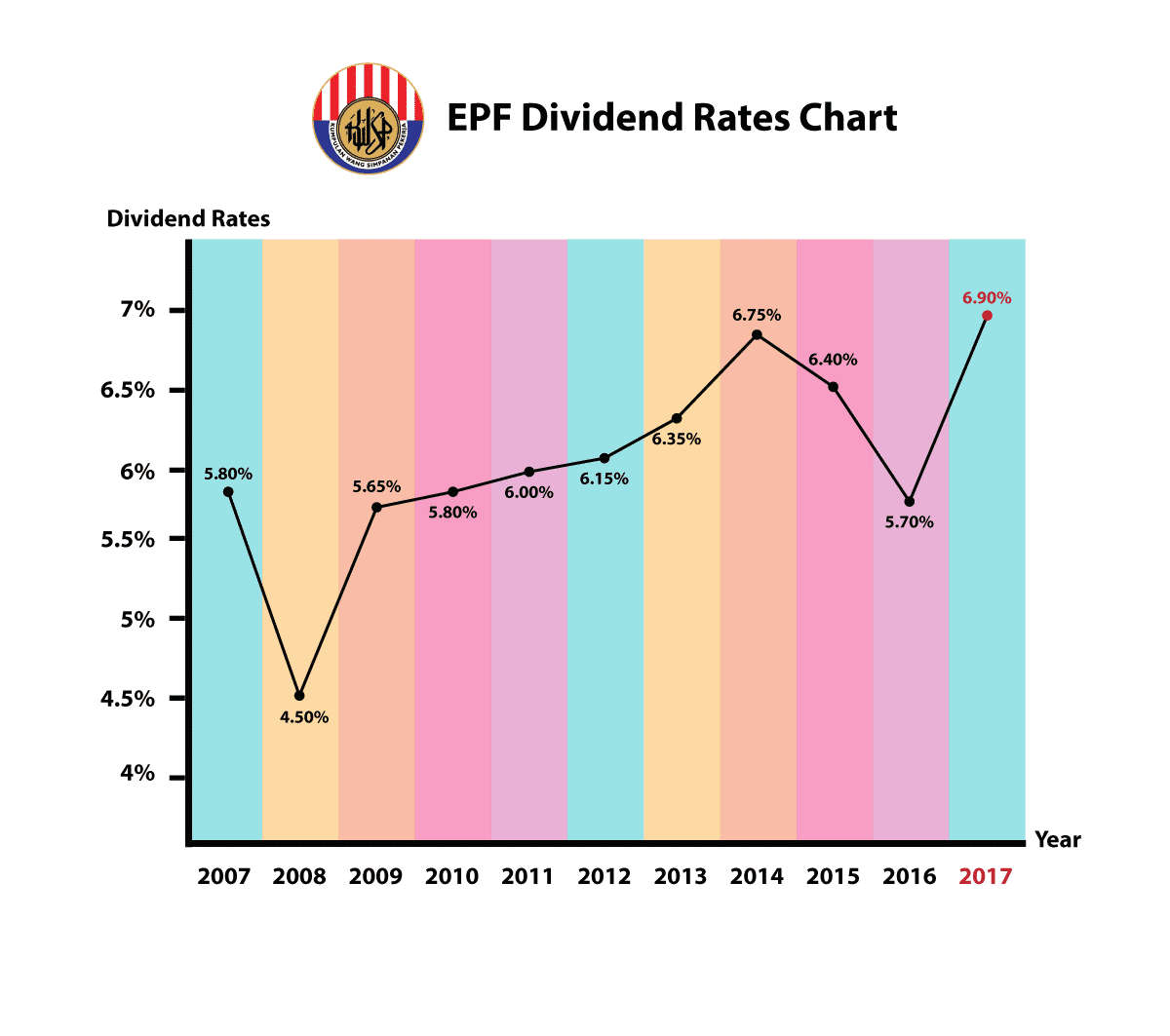

How to calculate epf dividend malaysia. Your estimated epf fund is 622763 upon reaching age 55. For example in 2014 the dividend rate was 6 75. Calculate your epf dividend every month. Total yearly dividend sum of daily dividends.

Rm500 billion in debt is the malaysian government bankrupt. The epf declares its annual dividend payout based on its net realised income. Your epf contributions are deducted from your income tax up to a maximum of rm6 000 per annum. It manages the retirement savings plan for malaysia s private and non pensionable public sector employees.

The epf had 12 7 million members as of the end of 2010. Calculators try out our calculators for all your needs. Forever for unlimited employees. Check eligibility check your eligibility.

Alternatively you may want to use online epf dividend calculator the formula to calculate epf dividend is as follow daily dividend daily balance x yearly dividend no of days in a year. You only have 20 years to save. As everybody known the employees provident fund epf declared 5 65 of dividend for the financial year 2009. How to open trading and cds account for trading in bursa malaysia.

Based on epf dividend of 4 5 per annum. Take example on the following scenario epf declared 5 65 dividend for year 2009. This calculator helps you to estimate your total savings in epf when you retire. If you need more flexible and better payroll calculation such as generating ea form automatically or adding allowance that does not contribute to pcb epf or socso you may want to check out hr my free malaysian payroll and hr software which is absolutely free.

Asb unitholders get up to 7 00 sen dividend bonus for 2018. Btw payroll my pcb calculator 2020 is powered by hr my s payroll calculator. Epf s dividend payouts are derived from total gross realised income for the year after deducting the net impairment on financial assets realized losses on listed equity undistributable unrealised gains or losses investment expenses operating expenditures statutory charges as well as dividend on withdrawals. How to calculate your epf dividend.

The epf by law has a minimum dividend rate of 2 5 but historically has had a much higher rate.