Islami Bank Fixed Deposit System

Student mudaraba saving account.

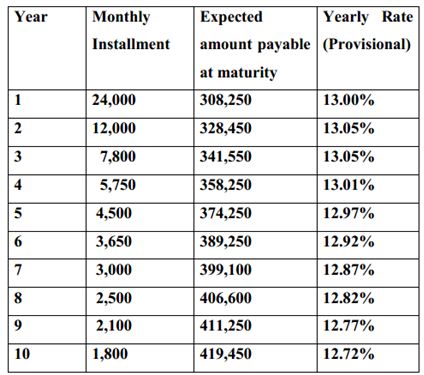

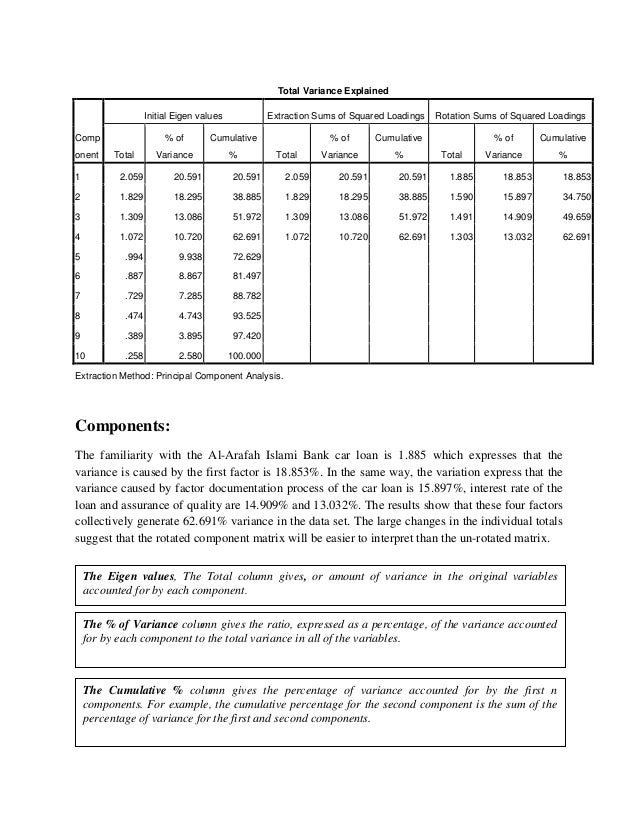

Islami bank fixed deposit system. Islamic term deposits based on the shariah concept of commodity murabahah cost plus sale where a specific asset as deemed fit by the bank is identified and used as the underlying asset for the sale and purchase transaction between bank and customer. Al wadeah accounts mudaraba accounts. An islamic term deposit based on the contract of commodity murabahah. The bank commits to refund money deposited in these accounts on the demand of customers.

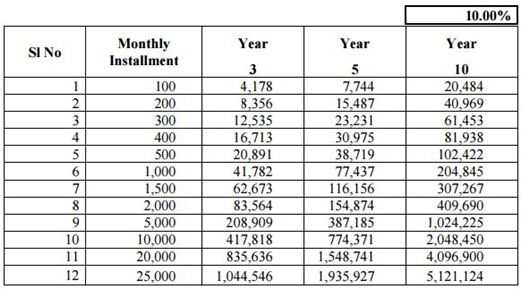

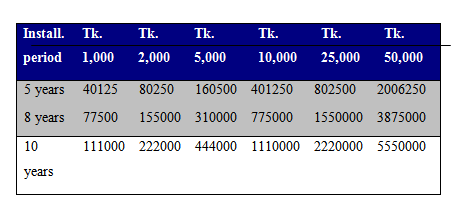

Even though bank islam does not penalize you for making premature withdrawal however you are required to pay 50 of the total brokerage fee to the bank. Islamic deposits may be based on mudarabah and wakalah structures. It can be observed that total money expansion is 125 with a money multiplier equal to 1 25 and 1000 with money multiplier equal to 10 in islamic and conventional system respectively 1 if the savings rate is 10 percent of gdp and reserve requirement is 5 percent of deposits then total deposits become 111 and 2 000 under an islamic and conventional banking system respectively. Islami bank bangladesh limited mobilizes deposits through different types of accounts.

What s more when you make a premature withdrawal of your fixed deposit before maturity date you will no longer receive any profit payments effective from january 2019. Al wadeah accounts islami bank bangladesh limited operates al wadeah current account on the principles of al wadeah. Best islamic fixed deposits in malaysia 2020 predetermined profit sharing and murabahah cost sale may allow you to enjoy the benefit of investing in a fixed deposit account without compromise. It merely sets the ratio in which profits and losses may be distributed between the parties of the contract.

Here is a list of all available schemes provided by islami bank and are listed alphabetically by account names. Major approaches for islamic banking deposit accounts. Deposit accounts name. In conventional banking as we know it the relationship between a bank and a customer is that of a debtor and a creditor namely.

The bank earns profit by charging interest to borrowers of funds and using money it earns to pay back to depositors of funds as interest. With this account you get.