Islami Bank Fixed Deposit

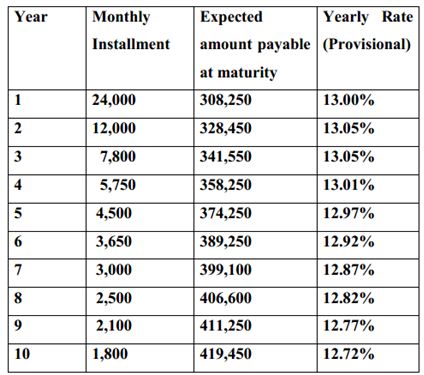

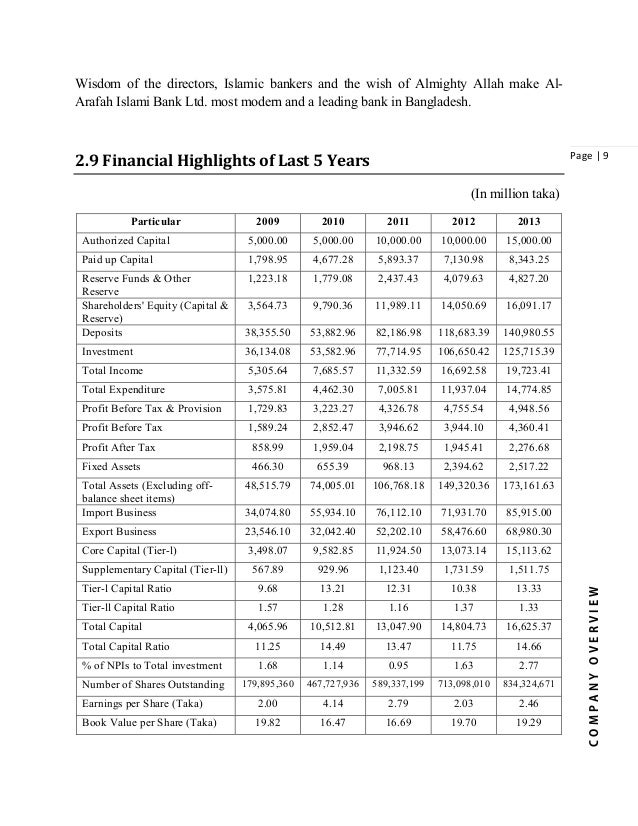

Islami bank bangladesh limited mobilizes deposits through different types of accounts.

Islami bank fixed deposit. Al wadeah accounts islami bank bangladesh limited operates al wadeah current account on the principles of al wadeah. Here is a list of all available schemes provided by islami bank and are listed alphabetically by account names. Islamic term deposits based on the shariah concept of commodity murabahah cost plus sale where a specific asset as deemed fit by the bank is identified and used as the underlying asset for the sale and purchase transaction between bank and customer. For more information on pidm click here.

With this account you get. With this account you get. Compare islamic term deposits study the fine print find the investment product that matches your principles. Islamic term deposits based on the shariah concept of commodity murabahah cost plus sale where a specific asset as deemed fit by the bank is identified and used as the underlying asset for the sale and purchase transaction between bank and customer.

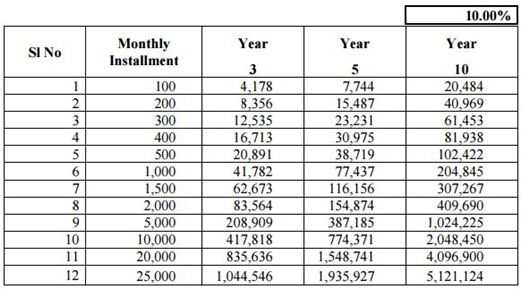

Islami bank bangladesh limited provides various types of deposit schemes for their different types of clients for helping to make their life easy and simple. Best islamic fixed deposits in malaysia 2020 predetermined profit sharing and murabahah cost sale may allow you to enjoy the benefit of investing in a fixed deposit account without compromise. Read the latest fixed deposit news in malaysia here. Minimum investment amount as low as pak rs 100 000 or usd 2000 available in tenors of 1 3 6 months or 1 2 3 5 and 7 years.

To make sure your deposits are protected keep an eye out for the pidm sign to ascertain that your bank is indeed a pidm member bank. Features of the fixed deposit account. What s more when you make a premature withdrawal of your fixed deposit before maturity date you will no longer receive any profit payments effective from january 2019. The bank commits to refund money deposited in these accounts on the demand of customers.

Alternatively you can also place your money into an islamic account or a joint name account with the same bank as they are insured separately. Student mudaraba saving account. Al wadeah accounts mudaraba accounts. Even though bank islam does not penalize you for making premature withdrawal however you are required to pay 50 of the total brokerage fee to the bank.

An islamic fixed deposit account. Free access to dubai islamic internet banking gives you the convenience to easily monitor your fixed deposits. Pidm insures you against the loss of your deposits for a maximum of rm250 000 per depositor per bank.