P E Ratio S P 500 Current

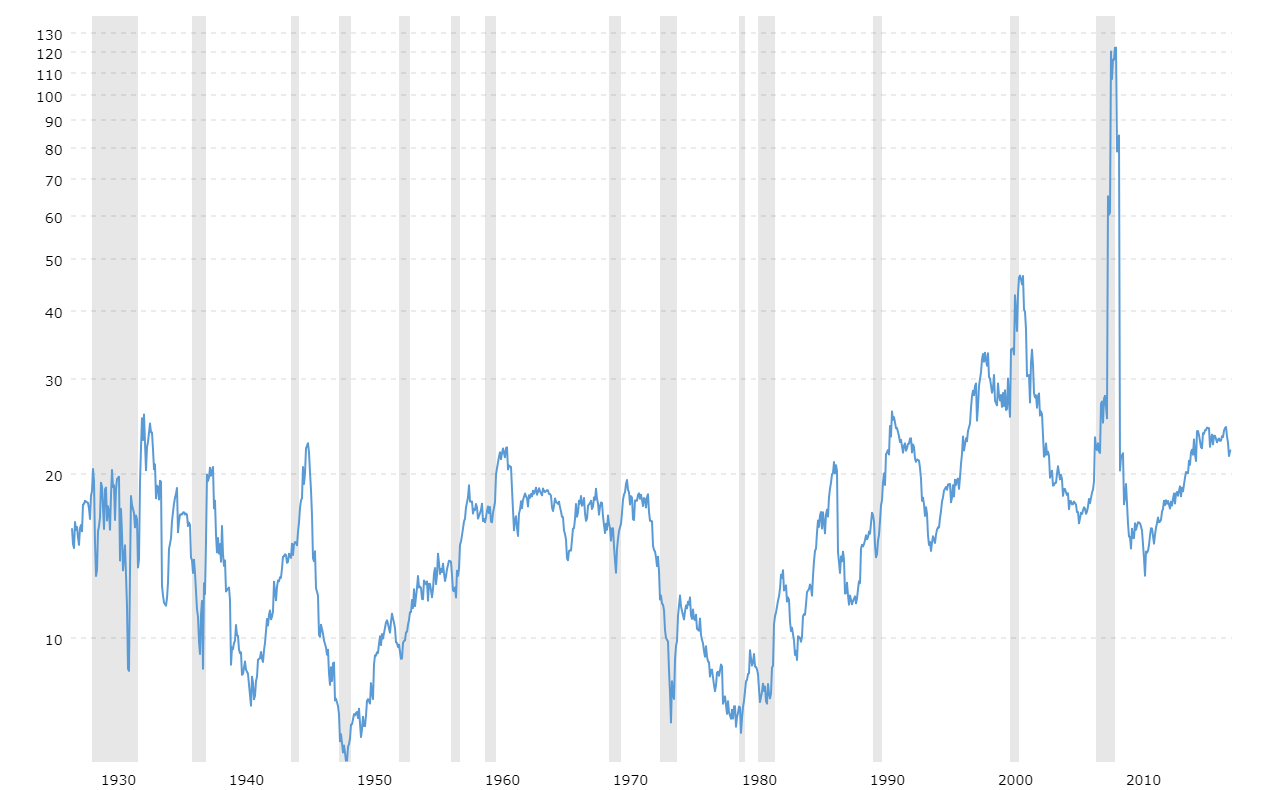

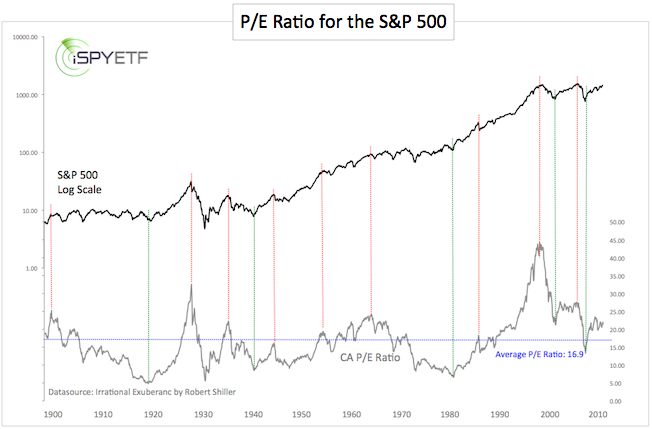

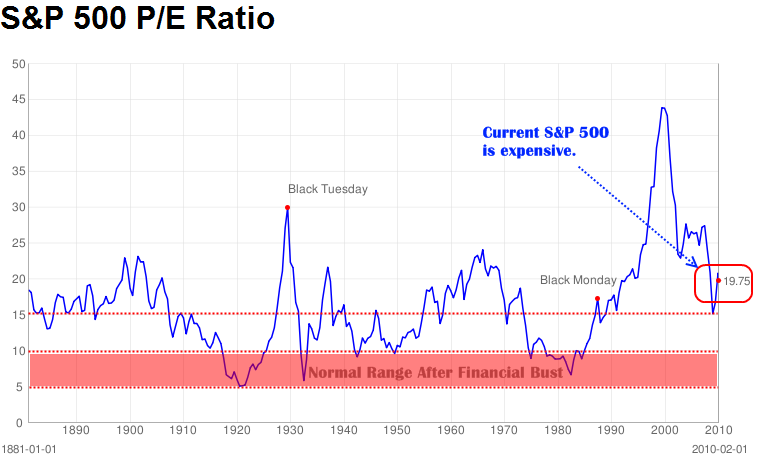

This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

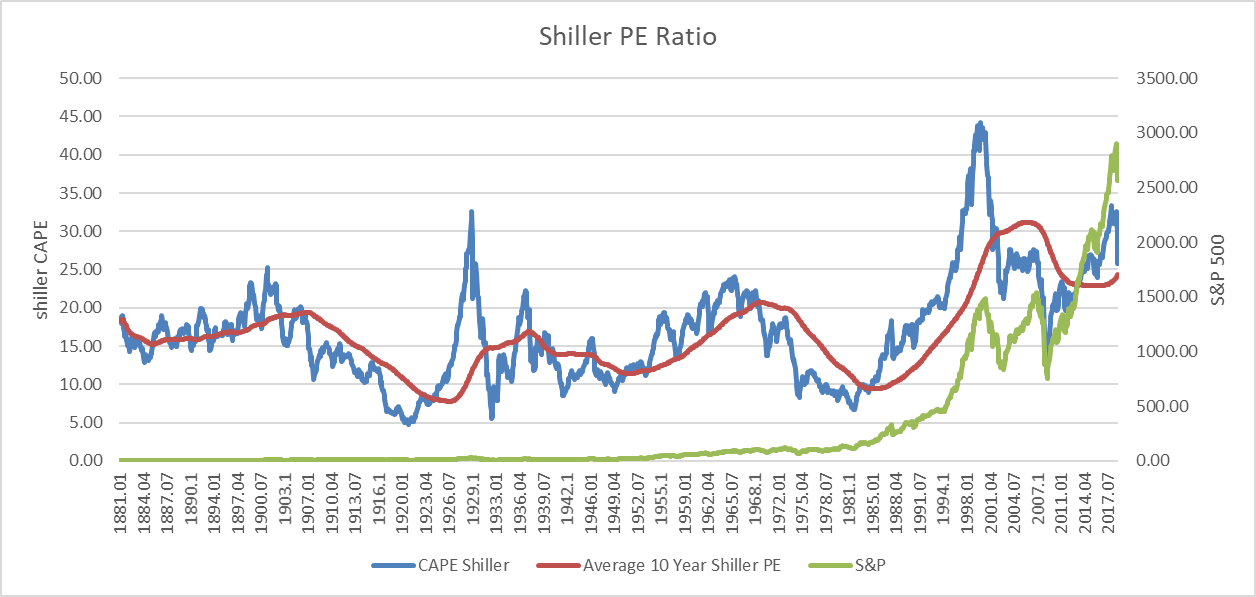

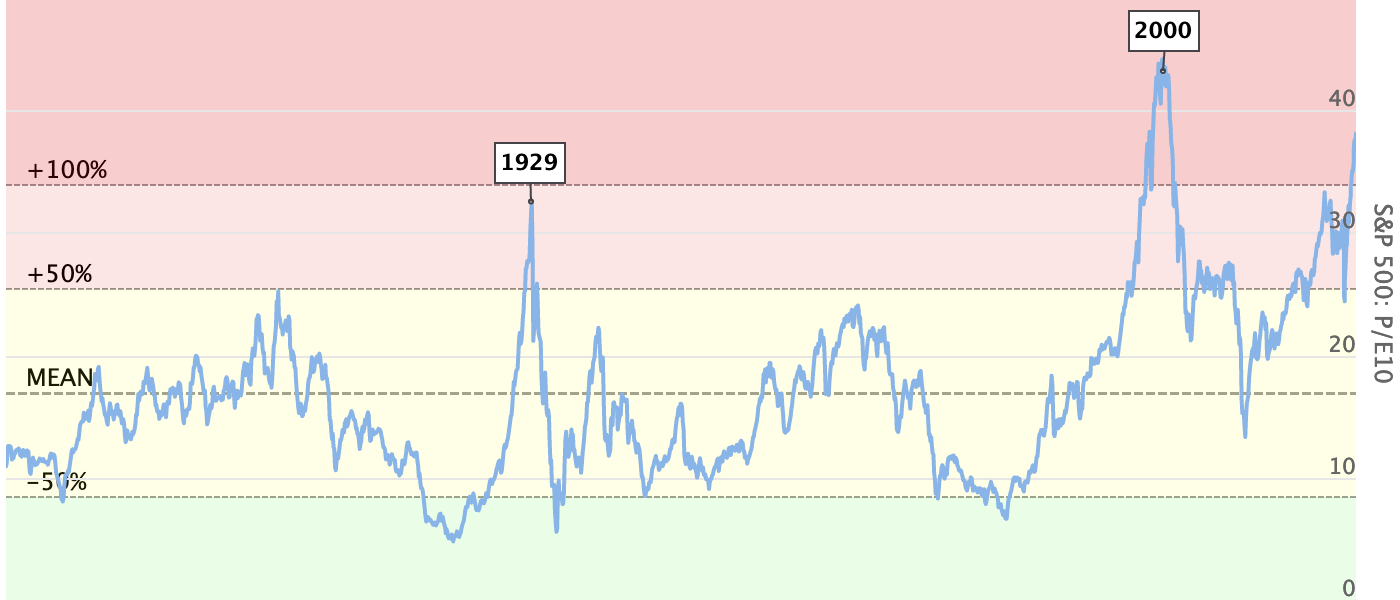

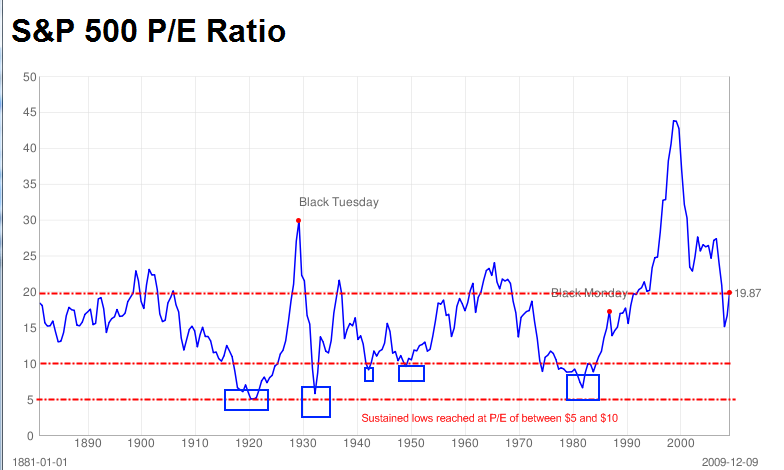

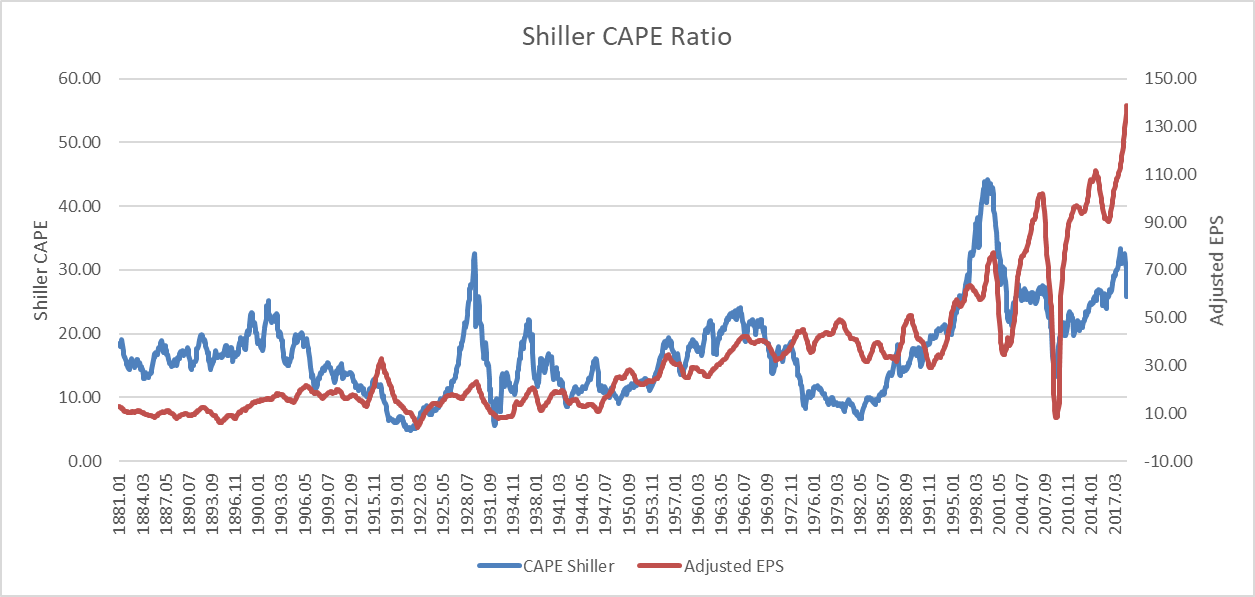

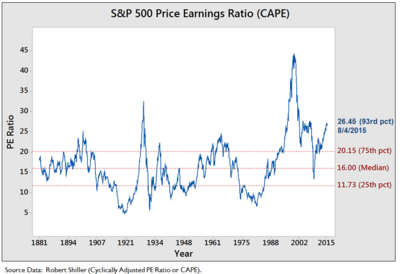

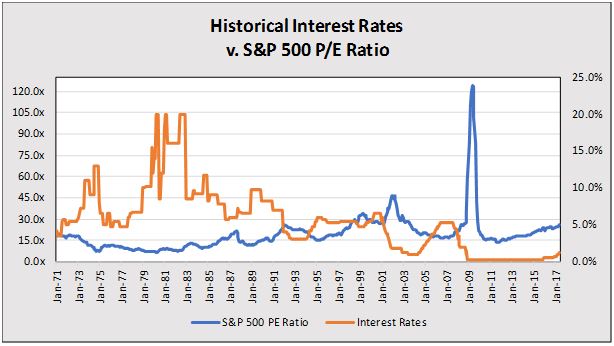

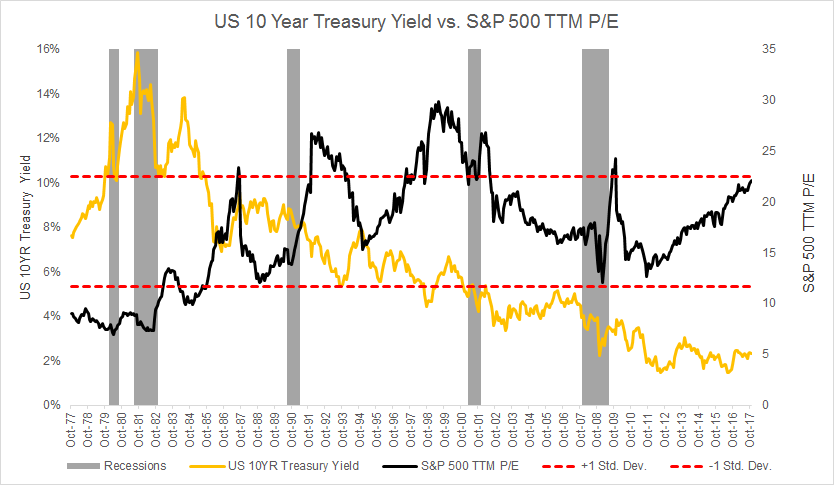

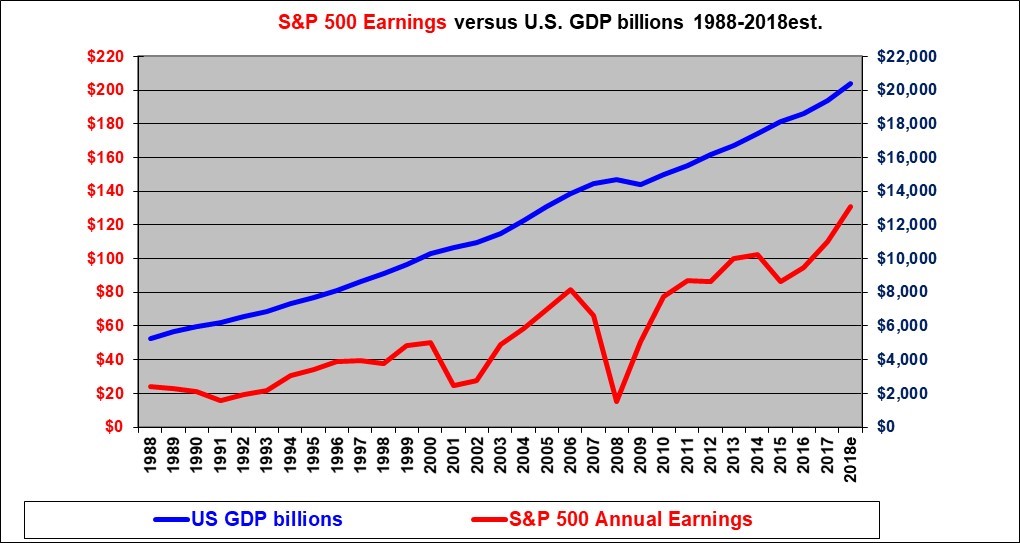

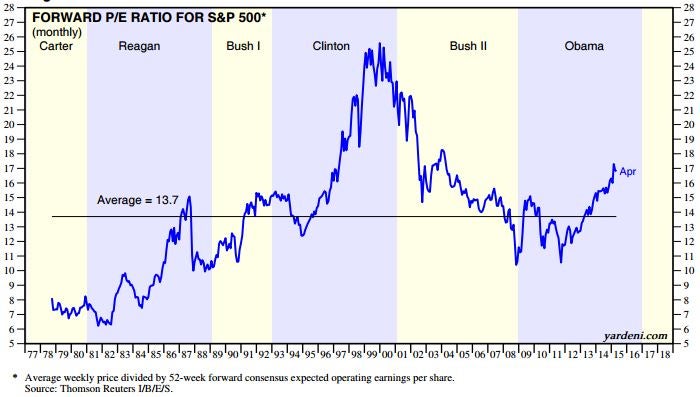

P e ratio s p 500 current. 14 7 1871 2018 maximum s p 500 pe ratio. 17 8 march 13 2020 average s p 500 pe ratio. Historically the s p 500 pe ratio peaked above 120 during the financial crisis in 2009 and was at its lowest in 1988. Metrics and data to guide value investing.

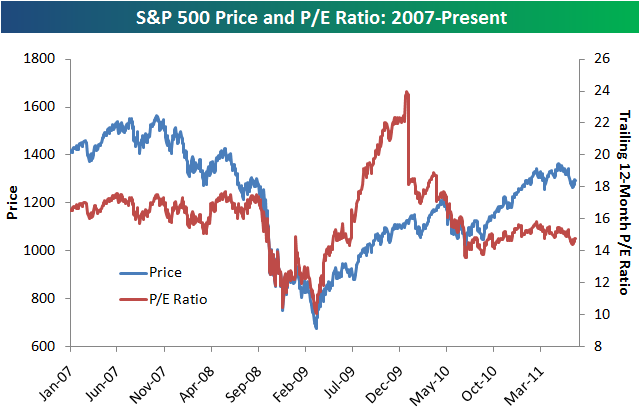

Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close. 15 7 1871 2018 median s p 500 pe ratio. Current s p 500 pe ratio. S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago.

S p 500 ytd performance. S p 500 p e ratio is at a current level of 31 24 up from 22 22 last. 123 7 may 2009 minimum s p 500 pe ratio. This is a change of 5 62 from last quarter and 38 43 from one year ago.

5 3 december 1917 the pe ratio of the most popular stock index based on trailing 12 months ttm earnings updated once a week. S p 500 pe ratio chart historic and current data. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. S p 500 by president.

S p 500 by president from election date s p 500 90 year historical chart. Updated weekly on friday. S p 500 historical annual returns. P e data based on.

The price to earnings ratio is a valuation metric that gives a general idea of how a company s stock is priced in comparison to their earnings per share.