P E Ratio S P 500

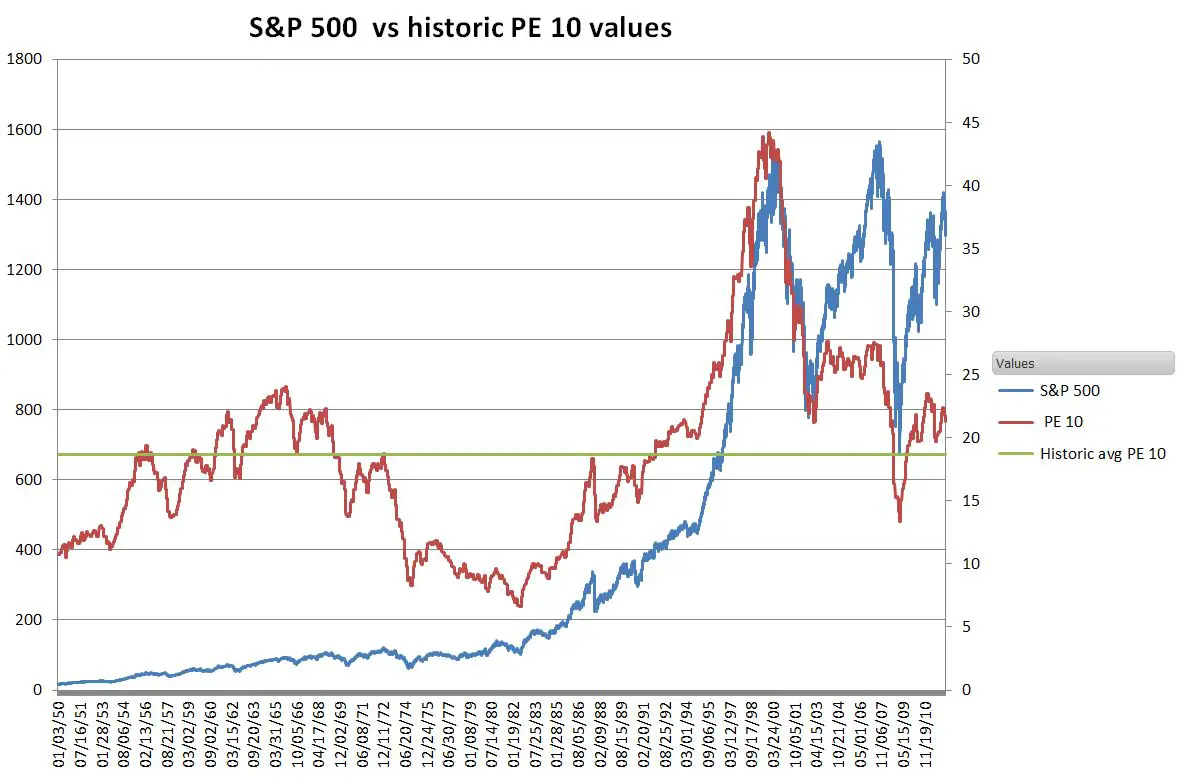

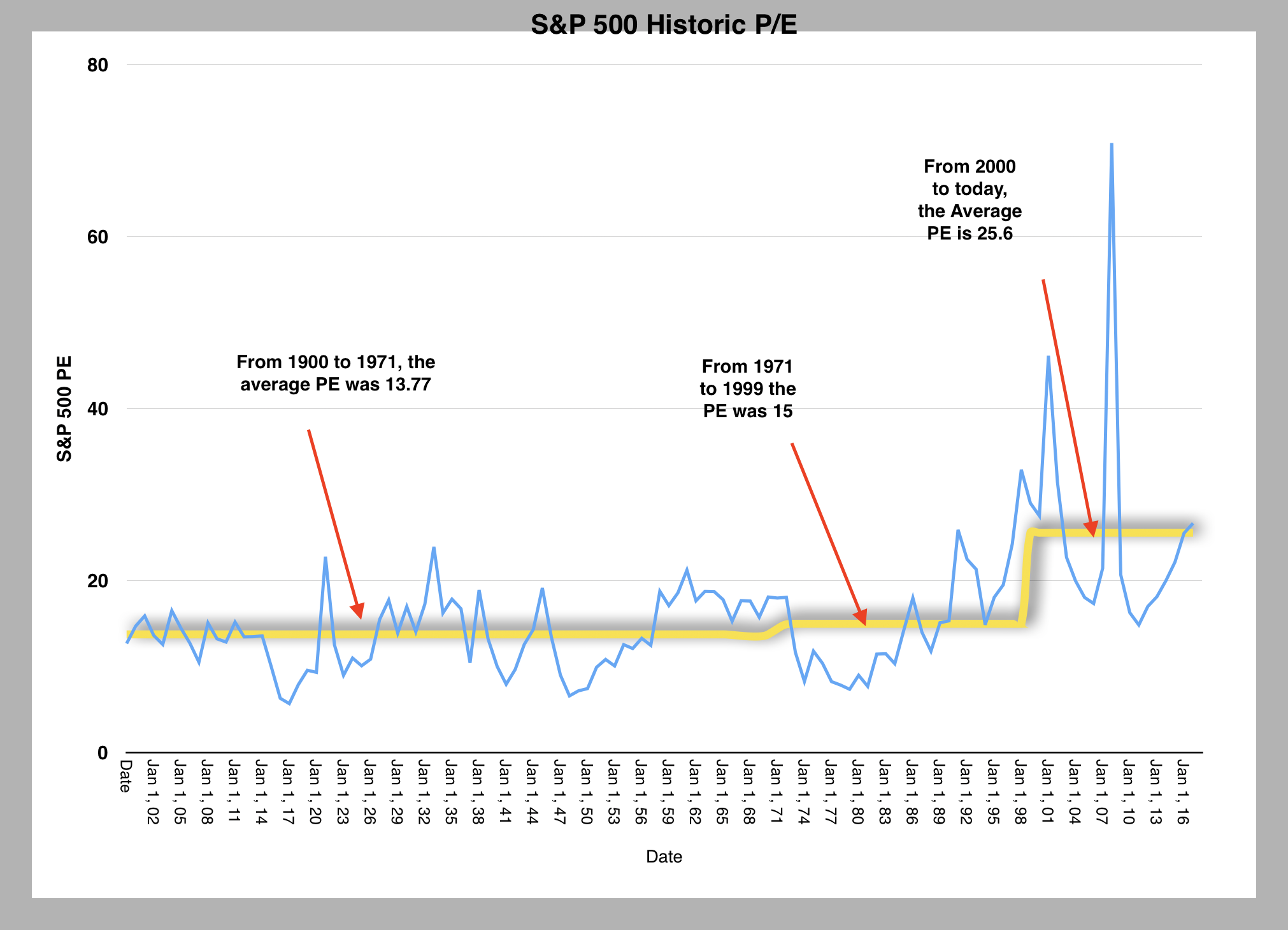

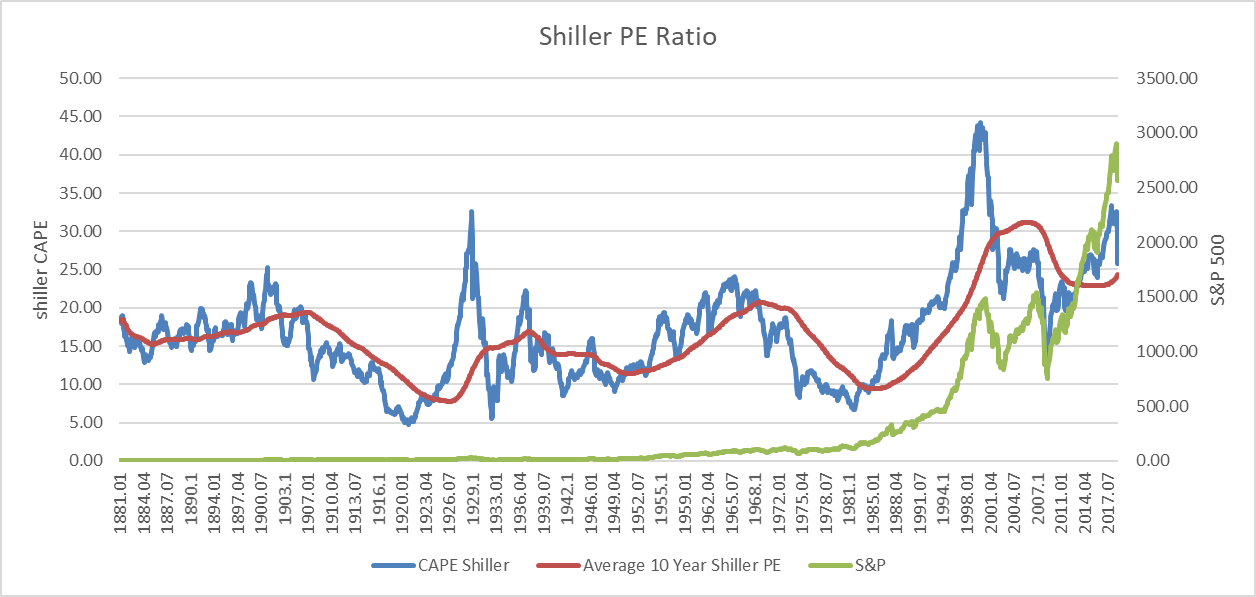

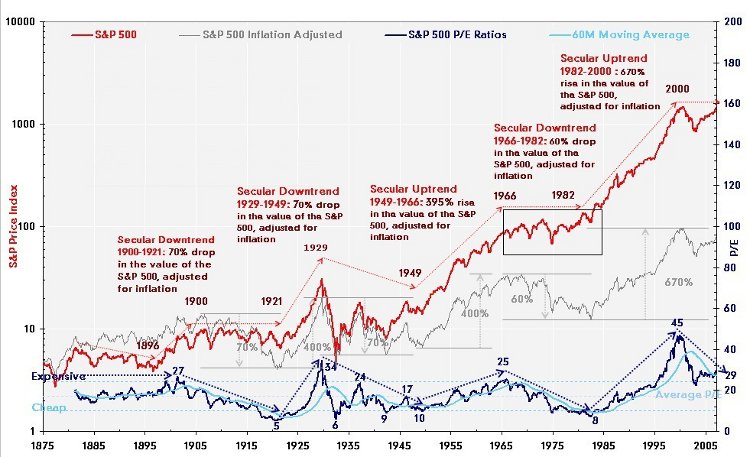

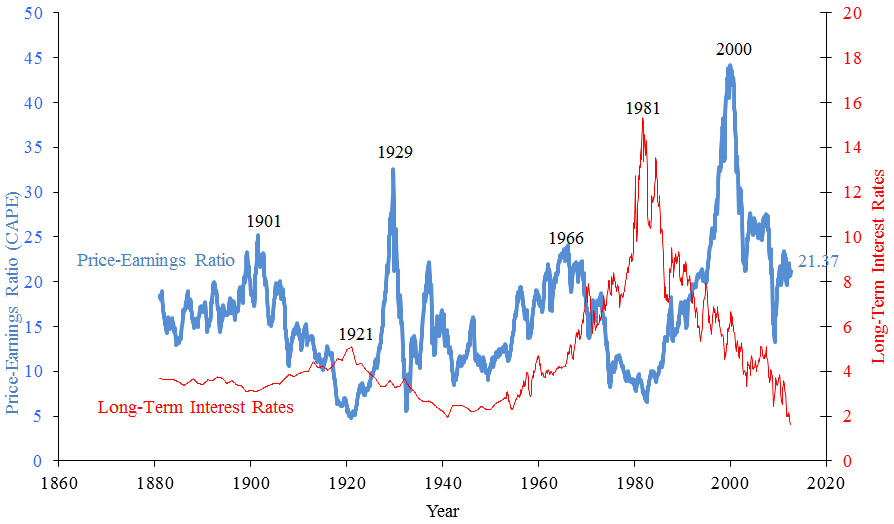

A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years.

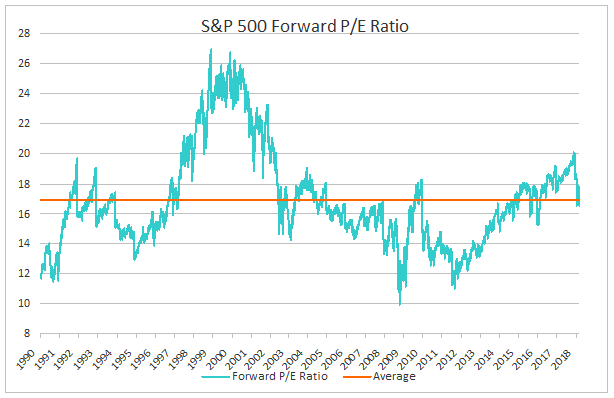

P e ratio s p 500. In 2009 when earnings fell close to zero the ratio got out of whack. Many financial websites have p es for individual companies but not for indexes like the dow or s p 500. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. The s p 500 pe ratio is the price to earnings ratio of the constituents of the s p 500.

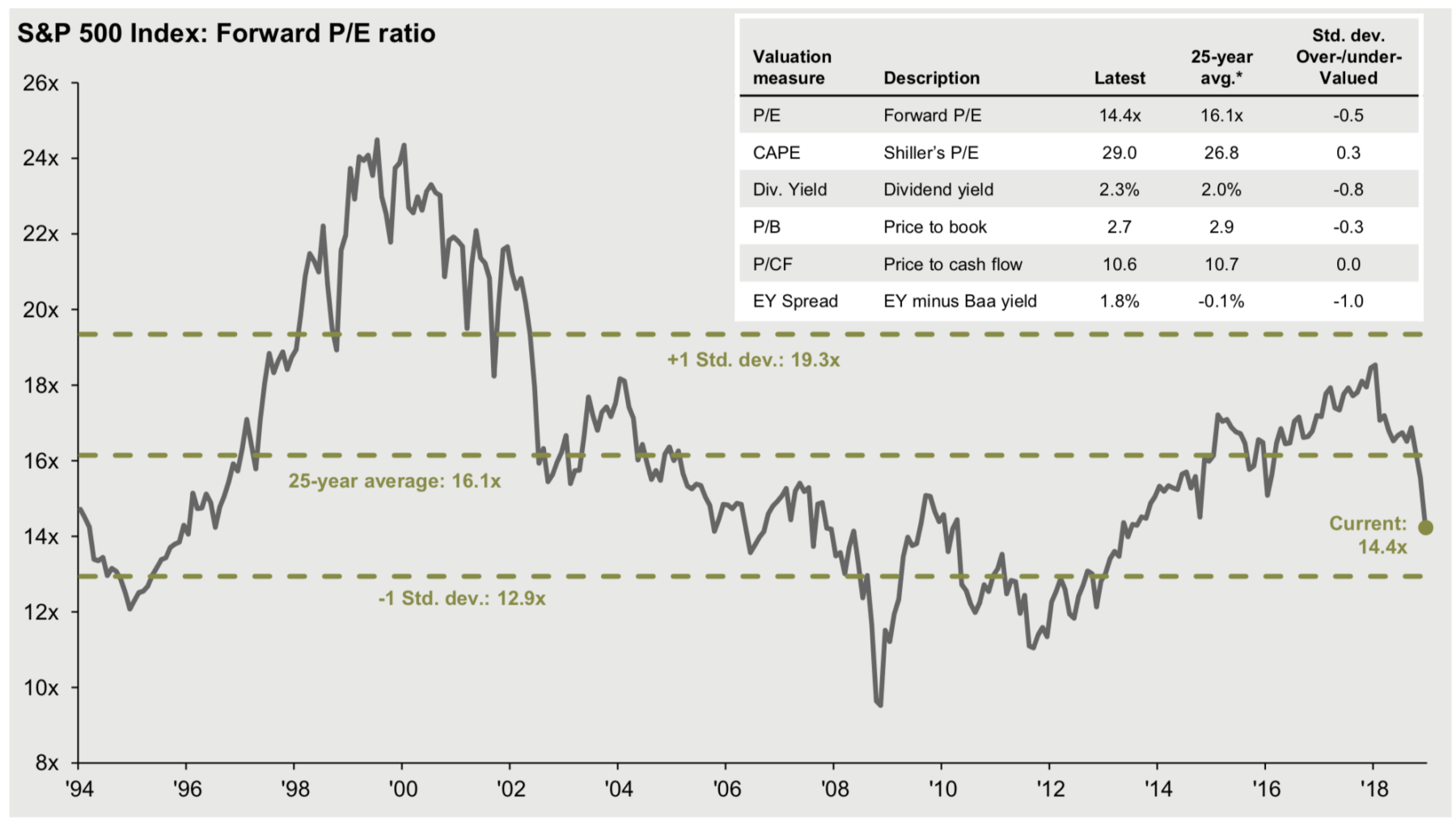

S p 500 p e ratio and dow jones p e ratio. The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months. Equities and serves as the foundation for a wide range of investment products. The top 25 lowest pe ratios of the s p 500.

S p 500 pe ratio chart historic and current data. The s p 500 includes the 500 largest companies in the united states and can be viewed as a gauge for how the united states stock market is performing. A higher p e ratio suggests that investors expect higher earnings growth in the future. Metrics and data to guide value investing.

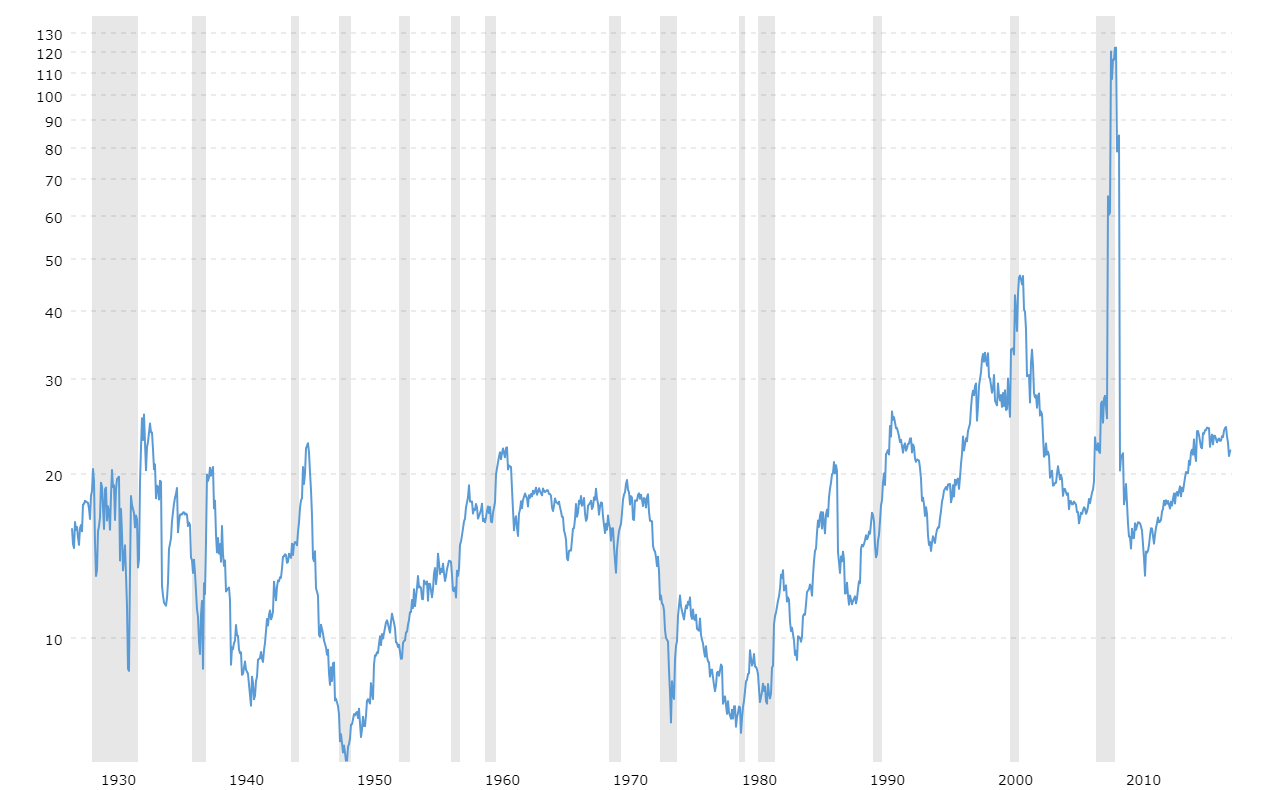

About s p 500 index the s p 500 is widely regarded as the best single gauge of large cap u s. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926. Earnings in the s p 500 are calculated using the 12 month earnings per share or current earnings. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)

:max_bytes(150000):strip_icc()/ScreenShot2020-05-14at5.58.39AM-7cb97c6836064874aa488b4d974c162c.png)