P S Ratio Formula

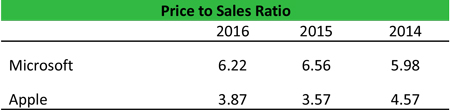

The current p s ratio is shown on all financial websites as 0 96 generally indicating an undervalued company but based on the actual commissions received by the company the p s ratio would be 3 64.

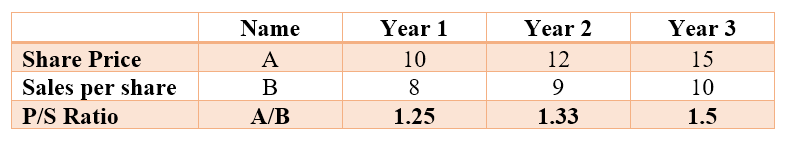

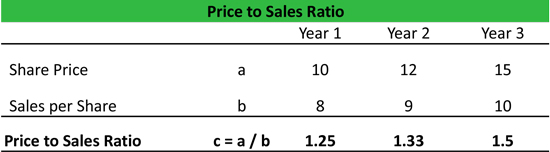

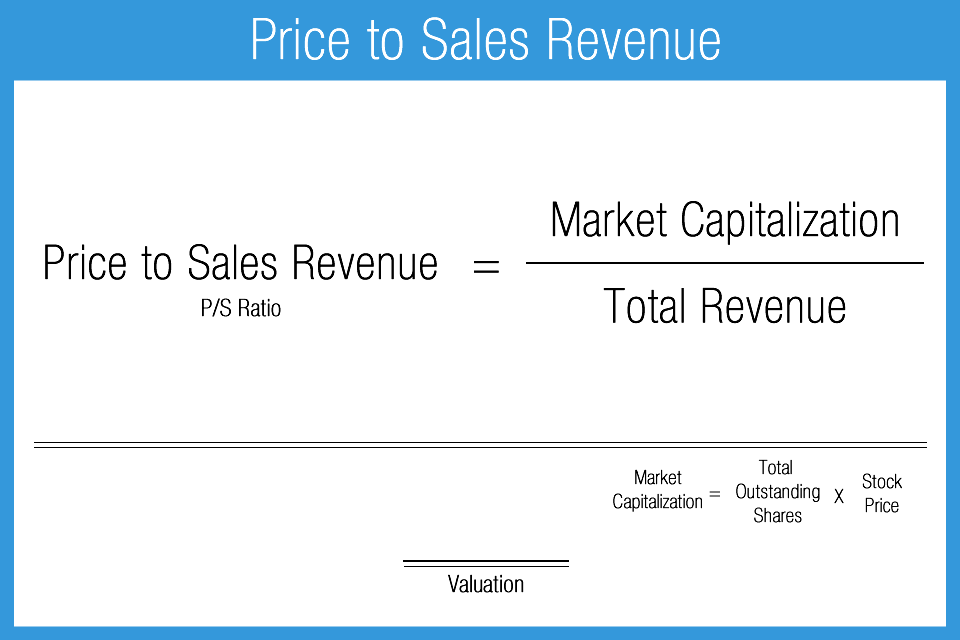

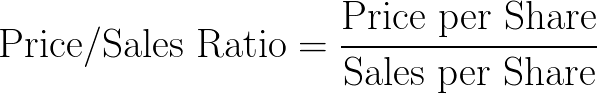

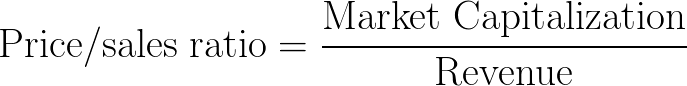

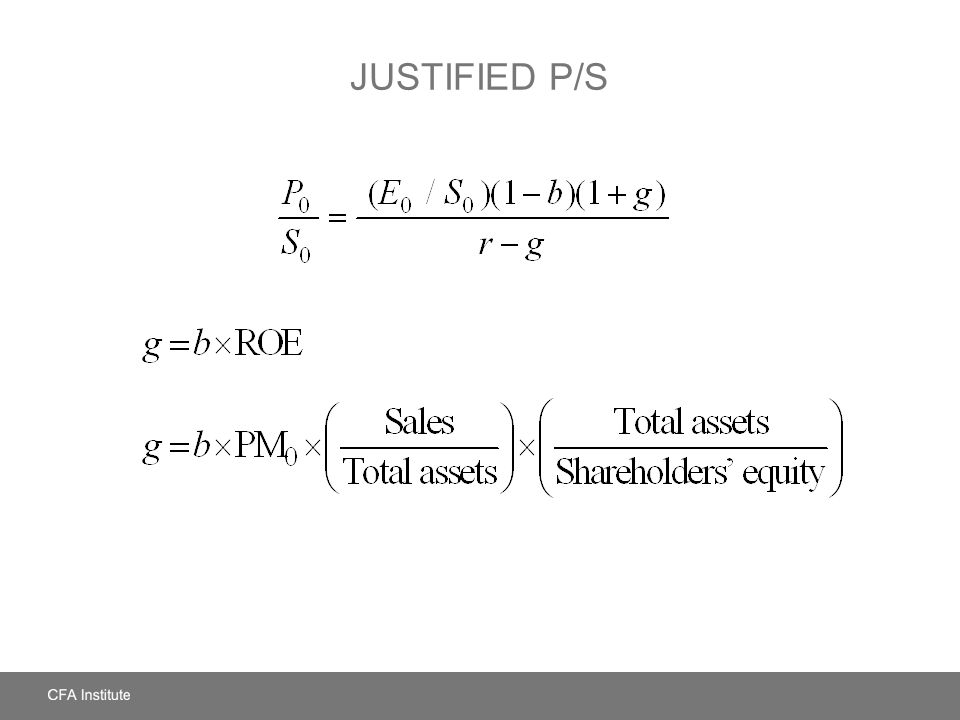

P s ratio formula. The island corporation stock is currently trading at 50 a share and its earnings per share for the year is 5 dollars. The formula for price to sales ratio sometimes referenced as the p s ratio is the perceived value of a stock by the market compared to the revenues of the company. So to sum everything up here s what the pe ratio formula can tell us. The price to sales ratio also known as the p s ratio is a formula used to measure the total value that investors place on the company in comparison to the total revenue revenue revenue is the value of all sales of goods and services recognized by a company in a period.

Investors are expecting higher earnings growth in the future. In the above example for every rs. Let s assume company xyz reports net sales of 5 000 000 and it currently has 500 000 shares outstanding. Price to sales ratio psr.

P s ratio price per share annual net sales per share. The formula to calculate the p s ratio is. The price earnings ratio p e ratio is the ratio for valuing a company that measures its current share price relative to its per share earnings. 100 sales contribution of rs.

Higher the p v ratio more will be the profit and lower the p v ratio lesser will be the profit. Revenue also referred to as sales or income forms the beginning of a company s income. The price to sales ratio often called the p s ratio or simply price sales is a financial metric that measures the value investors put on a company for each dollar of revenue generated by the firm by comparing the stock price with total revenue. A high p e ratio can indicate that.

What is the price to sales ratio. The price to sales ratio is an indicator of the value placed on. The price to sales ratio is calculated by dividing the stock price by sales per share. As you can see the island s ratio is 10 times.

Island s p e ratio would be calculated like this. 25 is made towards meeting the fixed expenses and then the profit comparison for p v ratios can be made to find out which product department or process is more profitable. How does a price to sales ratio p s work. The stock is currently trading at 20.

To give you some idea of where to start the historical pe ratio of the median stock in the s p 500 index is approximately equal to 15.