S P 500 Forward Pe Ratio By Month

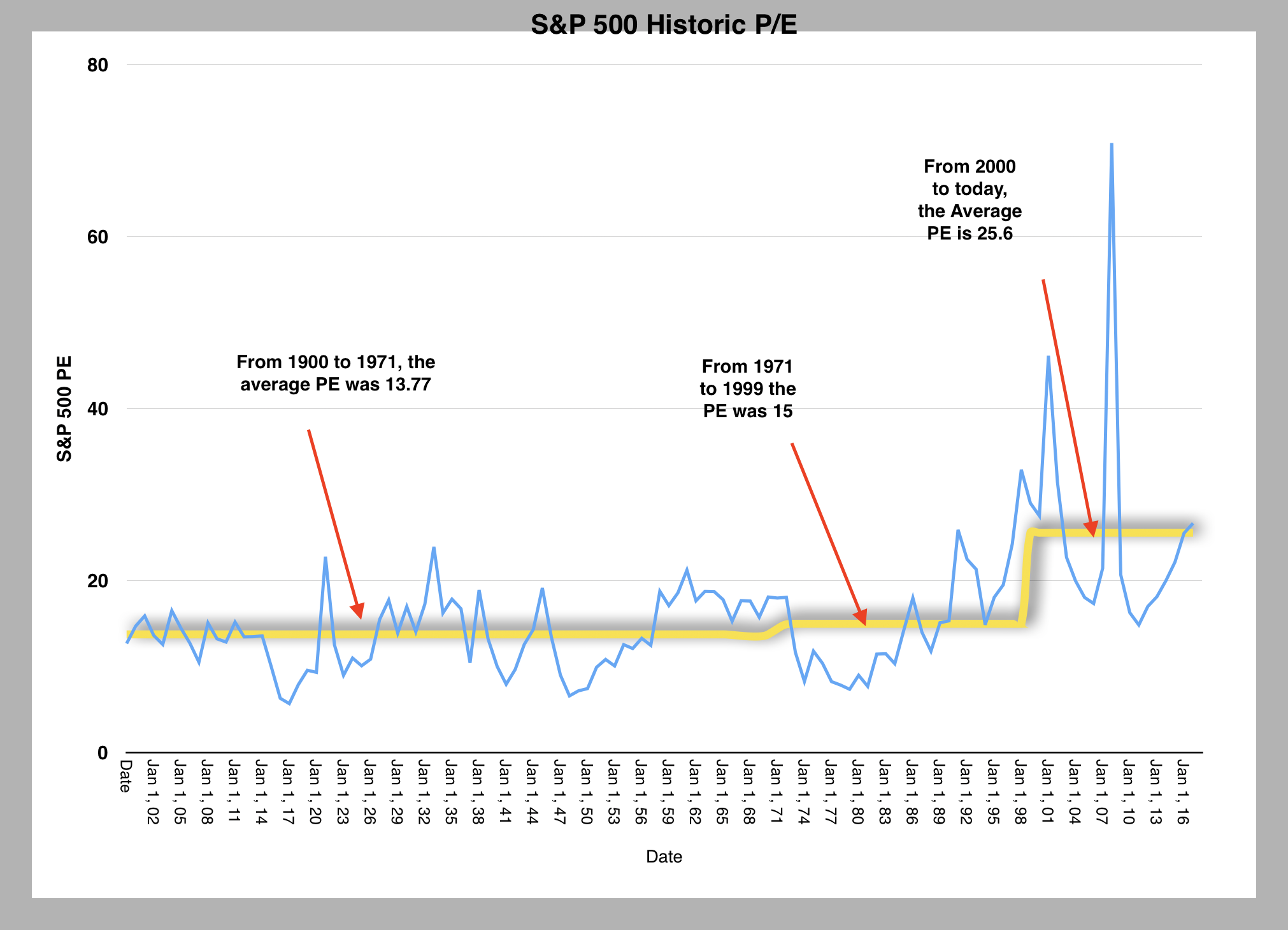

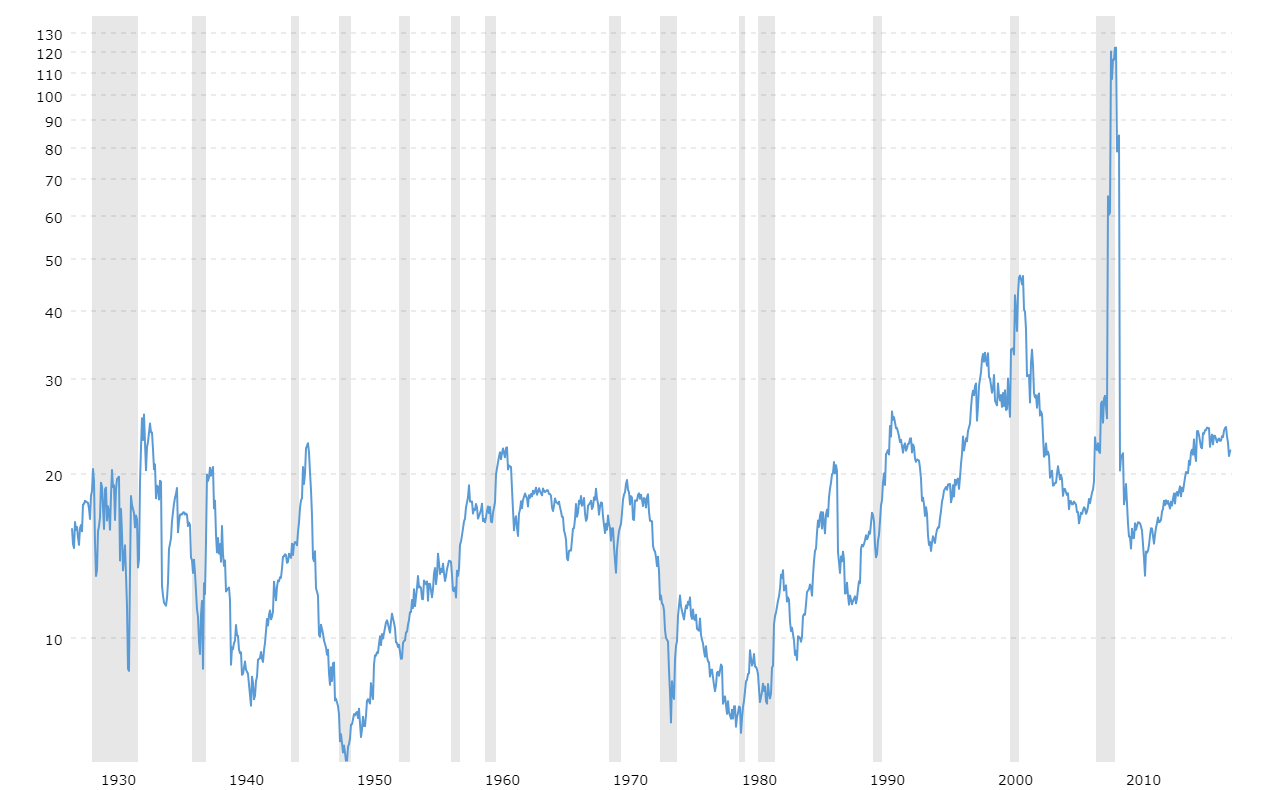

If not the forward 12 month p e ratio would be even higher than the current 18 6.

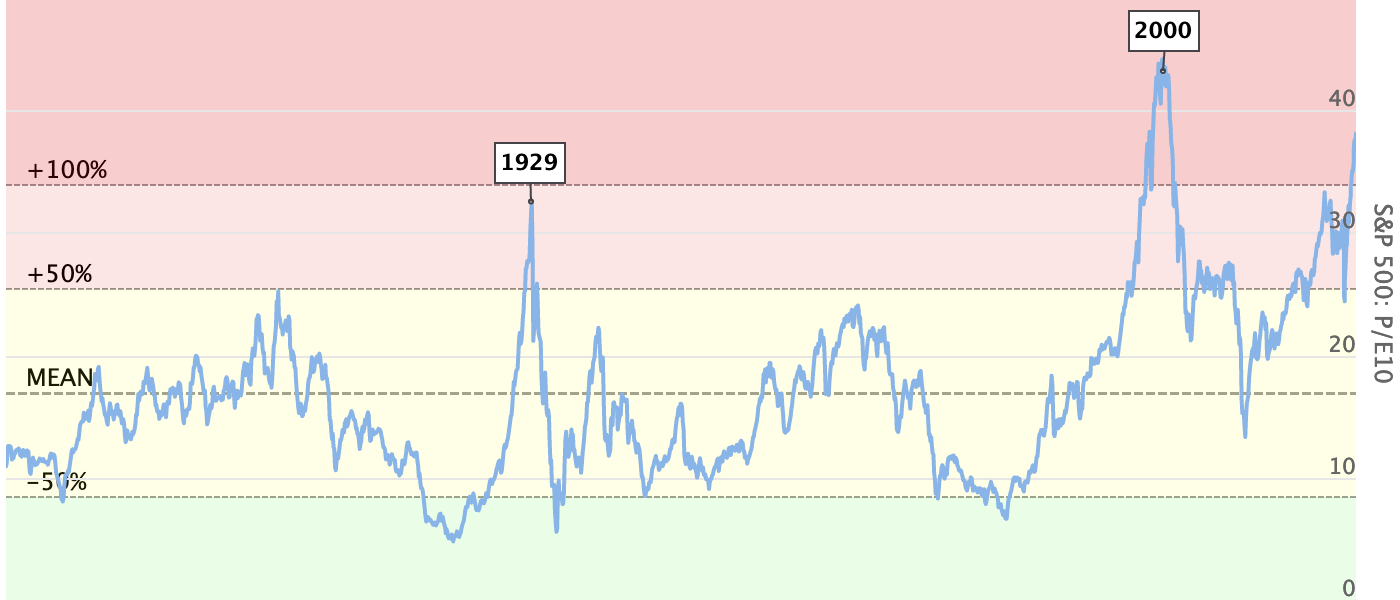

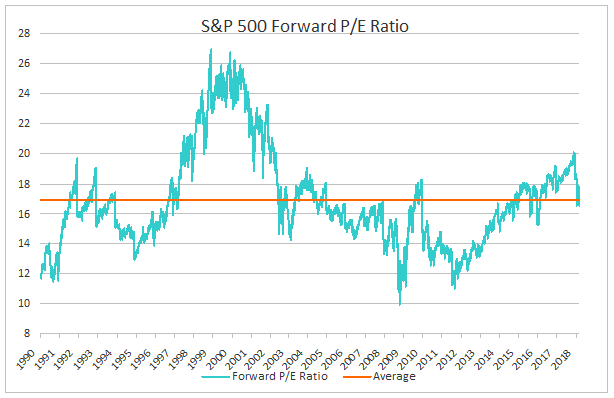

S p 500 forward pe ratio by month. This is a change of 5 62 from last quarter and 38 43 from one year ago. It is interesting to note that analysts are projecting record high eps of 177 41 for the s p 500 for cy 2020. I b e s data by refinitiv. S p 500 by president from election date s p 500 90 year historical chart.

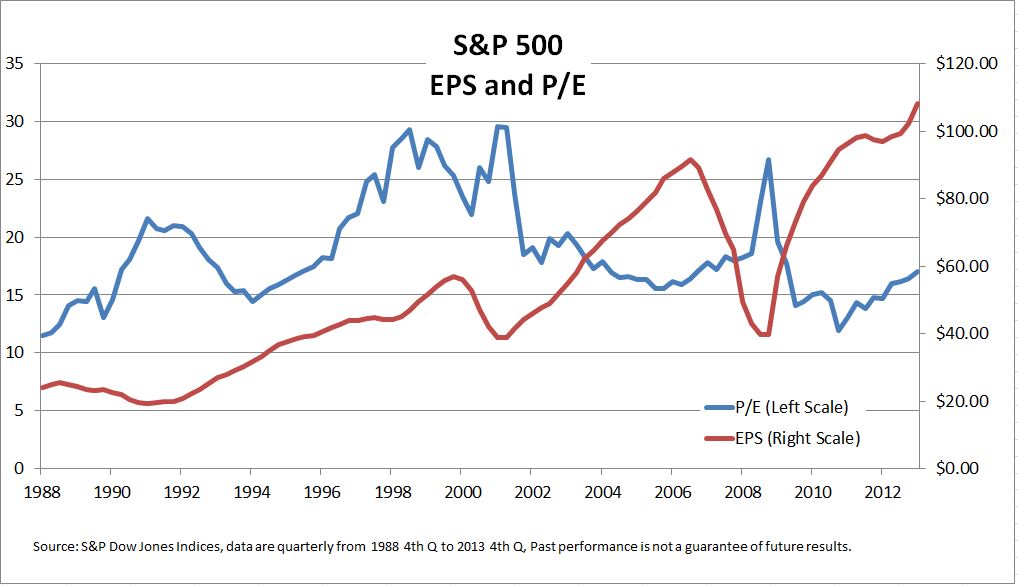

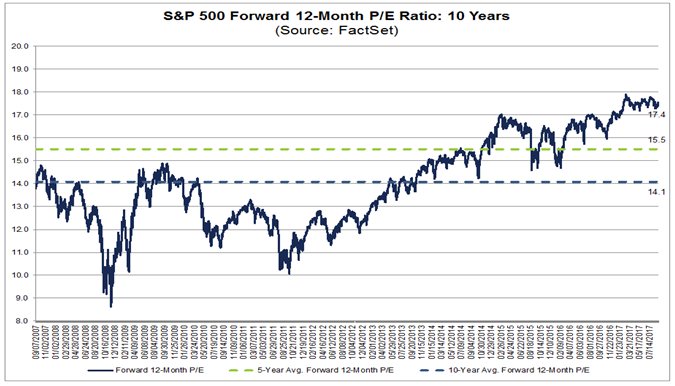

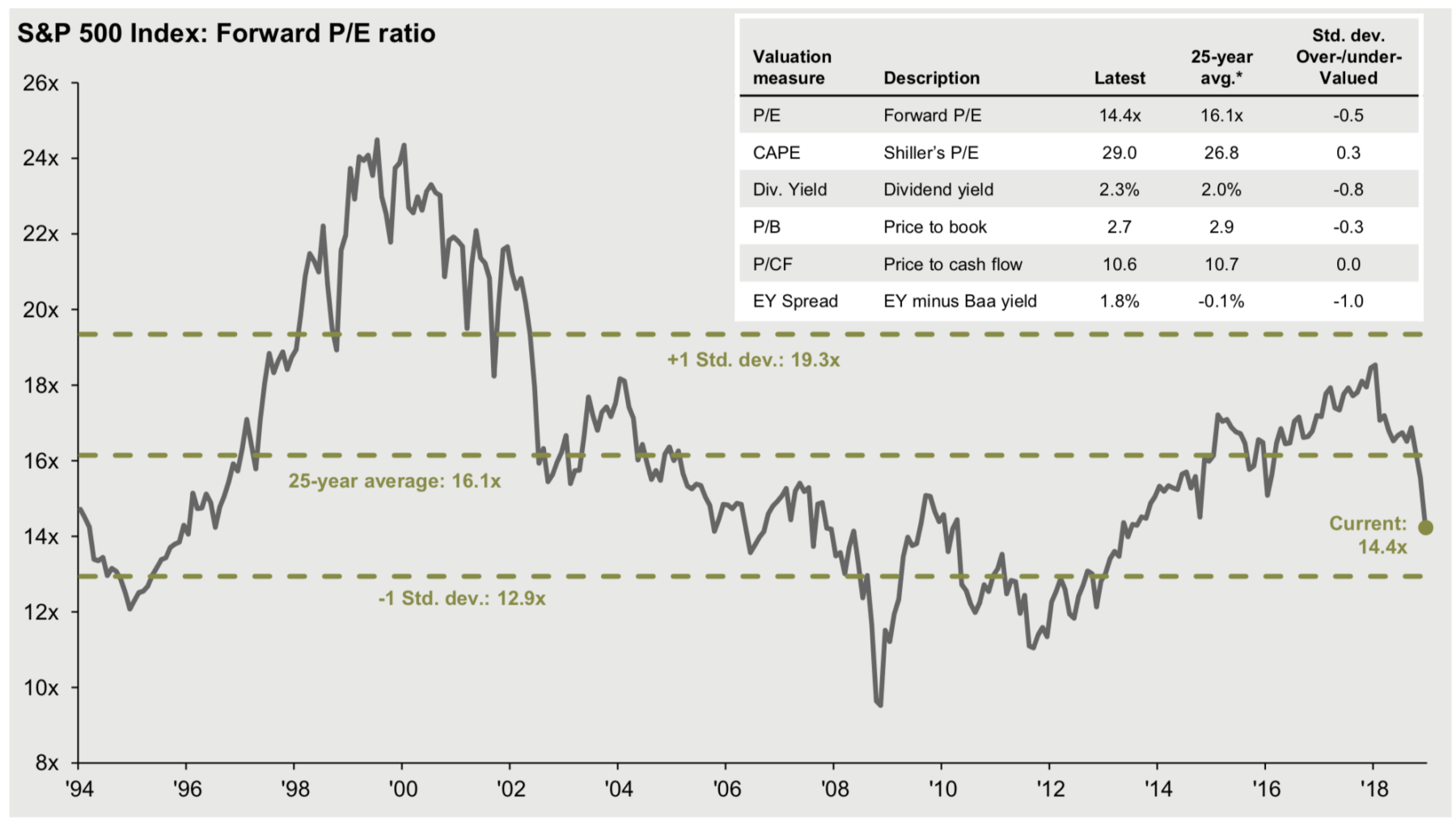

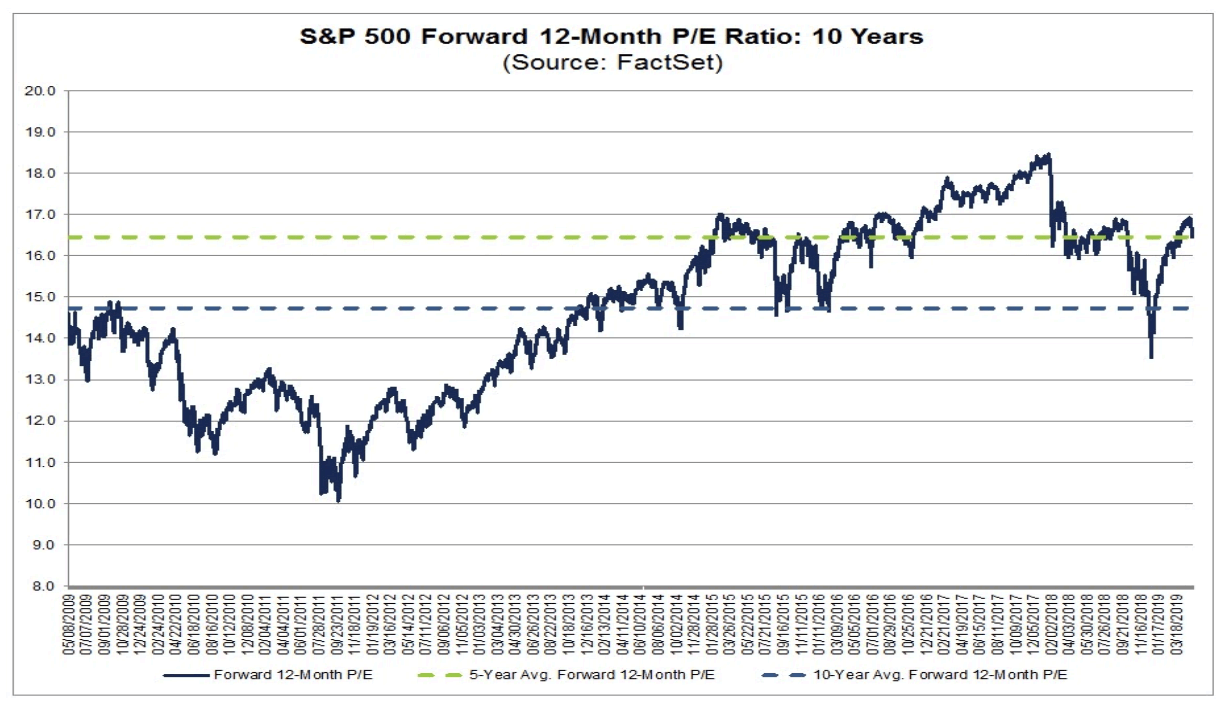

The forward 12 month p e ratio for the s p 500 is 21 7x in comparison to a 10 year. Thus the increase in the p has been the main driver of the increase in the p e ratio to 17 6 today from 16 9 at the start of the first quarter. S p 500 by president. However prior to january 16 the last time the forward 12 month p e ratio was equal to 18 6 was may 31 2002.

S p 500 forward p e ratios s p 500 index 21 7 consumer discretionary 34 0 information technology 26 3 price divided by 12 month forward consensus expected operating earnings per share. S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close. S p 500 pe ratio table by month historic and current data.

Since this date the price of the s p 500 has increased by 4 8 to 2349 45 from 2238 83 while the forward 12 month eps estimate has increased by 0 5 to 133 49 from 132 84. S p 500 ytd performance. S p 500 pe ratio chart historic and current data. Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close.

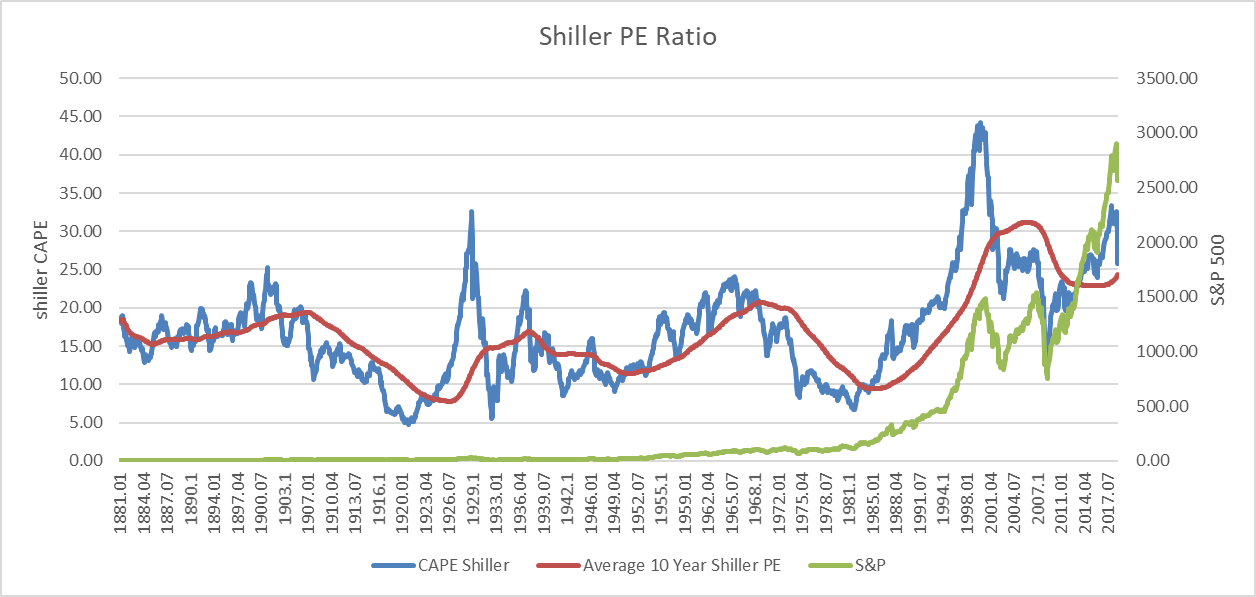

If we look at how expensive stocks are on a forward 12 month basis we also arrive at the same conclusion. S p 500 historical annual returns. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/05.2020/05.11.2020_TOW/S%26P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png?width=912&name=S%26P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png)

Insight/2020/05.2020/05.11.2020_TOW/S%26P%20500%20Sector%20Level%20Forward%2012%20Month%20PE%20Ratios.png?width=912&name=S%26P%20500%20Sector%20Level%20Forward%2012%20Month%20PE%20Ratios.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Sector%20Level%20Forward%2012%20month%20PE%20ratios.png?width=910&name=S&P%20500%20Sector%20Level%20Forward%2012%20month%20PE%20ratios.png)