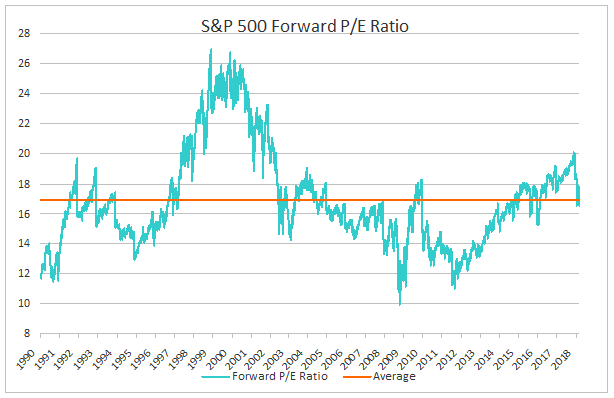

S P 500 Forward Pe Ratio History

This is a change of 5 62 from last quarter and 38 43 from one year ago.

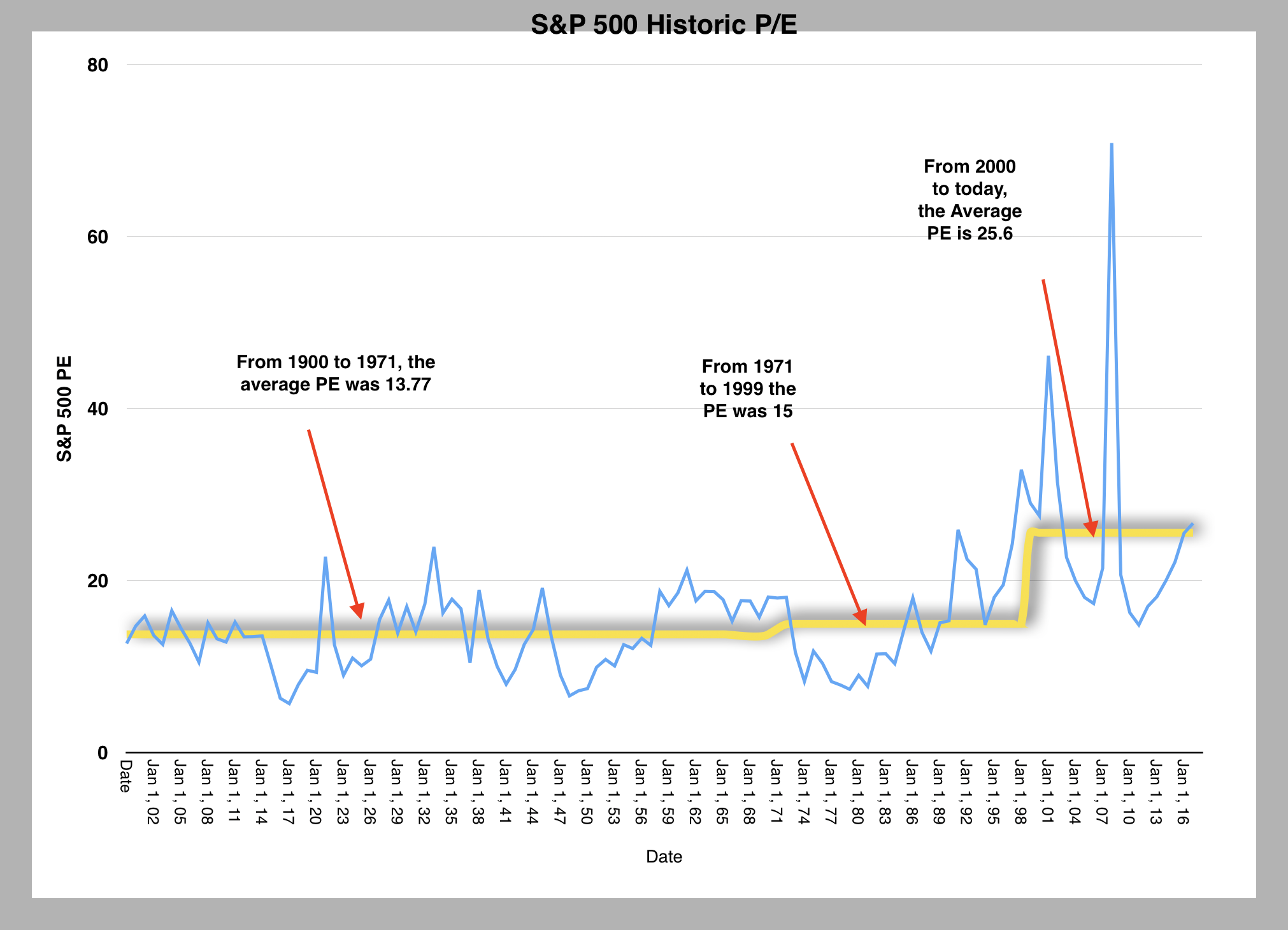

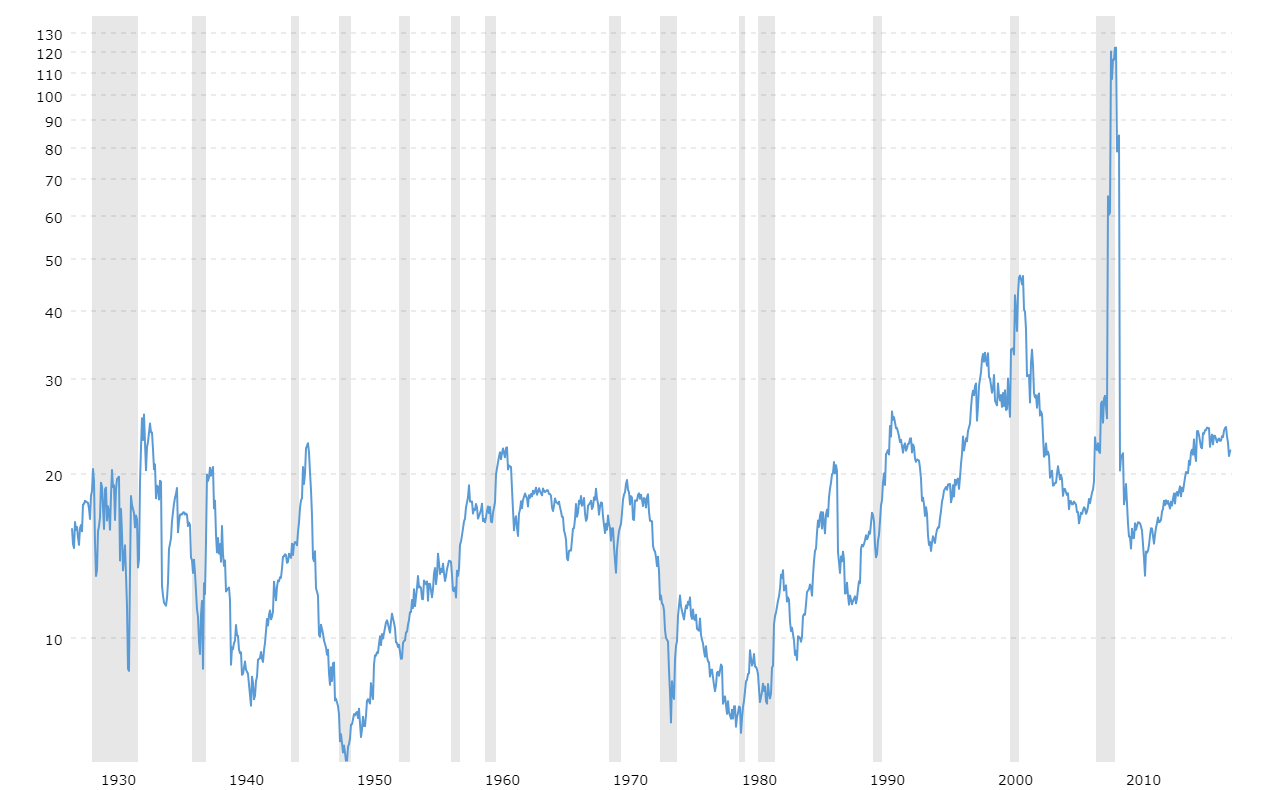

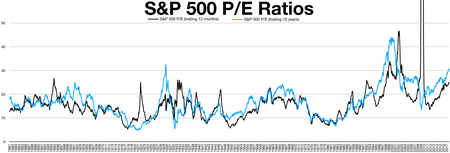

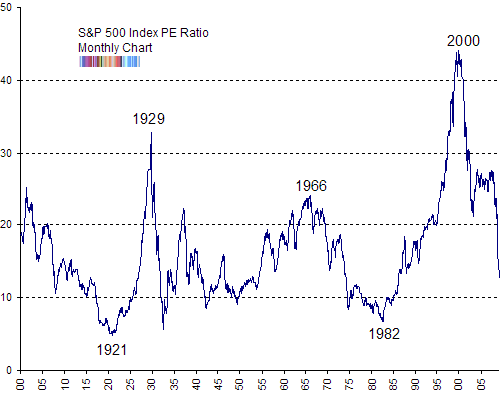

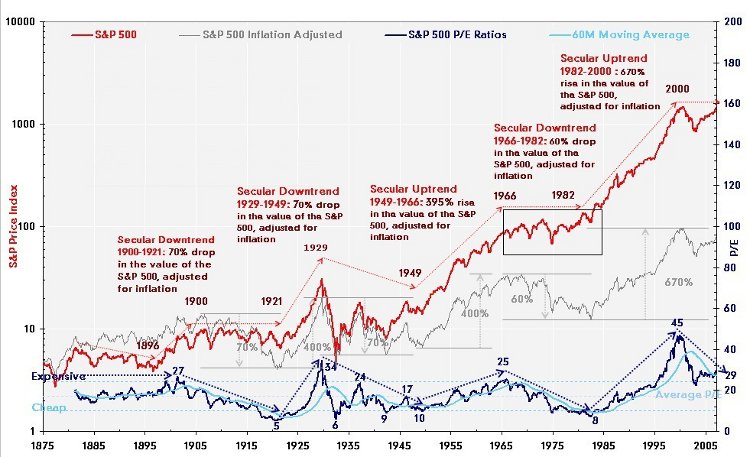

S p 500 forward pe ratio history. Stock market as a whole is currently 31 90 oct 14th 2020. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926. The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months. It is interesting to note that analysts are projecting record high eps of 177 41 for the s p 500 for cy 2020.

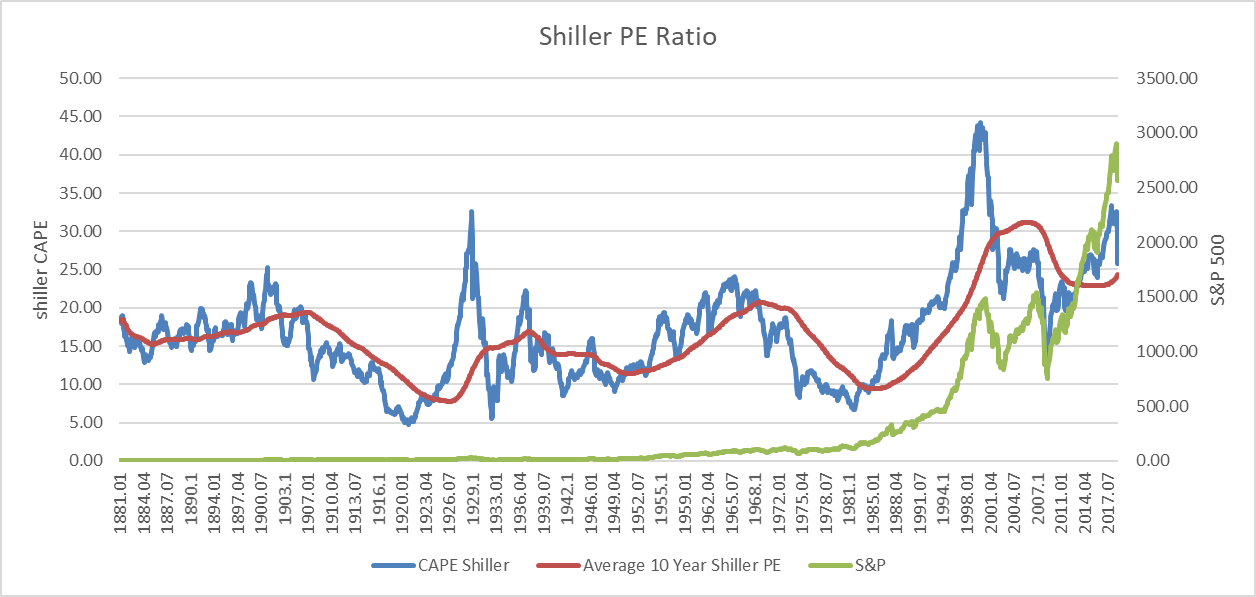

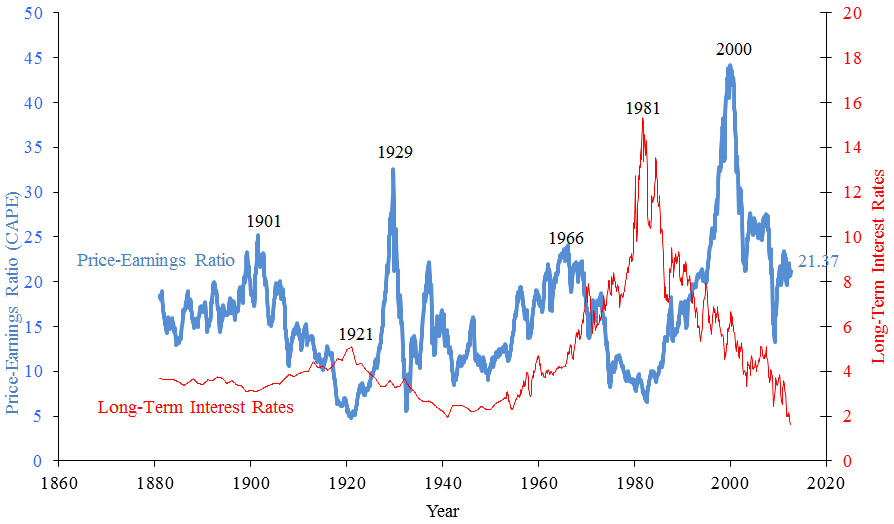

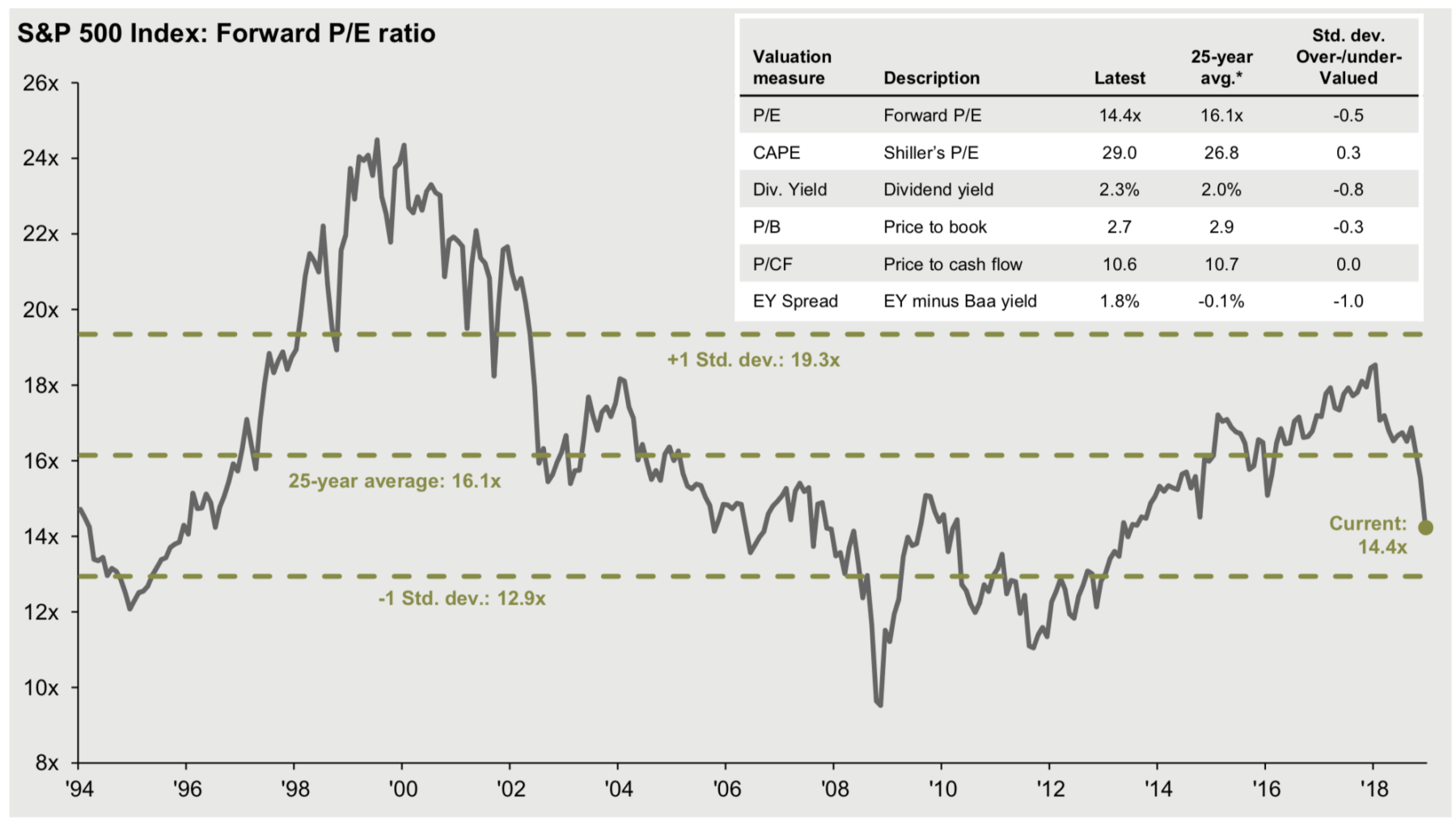

S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago. The table below lists the current historical cape ratios by sector calculated using the 500 largest public u s. This ratio is in the 84 th percentile of the historical distribution and was only exceeded during the early 2000s and the 2008 2009 recession. The s p 500 p e ratio as of june 1 2017 was 25 7x which is 32 47 higher than the historical average of 19 4x.

S p 500 pe ratio table by year historic and current data. S p 500 pe ratio chart historic and current data. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. Companies if the shiller pe ratio of a sector is lower than its historical average this might indicate that the sector is currently undervalued and vice versa.

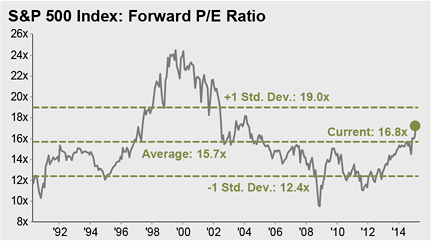

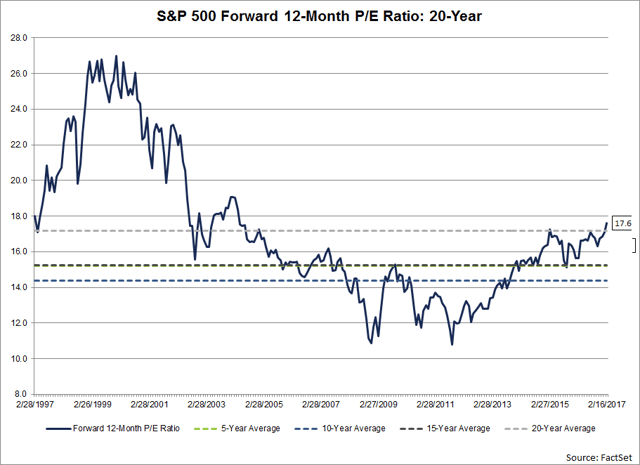

In 2009 when earnings fell close to zero the ratio got out of whack. If not the forward 12 month p e ratio would be even higher than the current 18 6. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close. However prior to january 16 the last time the forward 12 month p e ratio was equal to 18 6 was may 31 2002.

Metrics and data to guide value investing. The overall cape of the u s. Forward p e ratio january 3 2019 6 00am by barry ritholtz one good thing we can say about market volatility is that the 20 percent sell off in stock prices since q4 began have returned valuations to more reasonable levels.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)