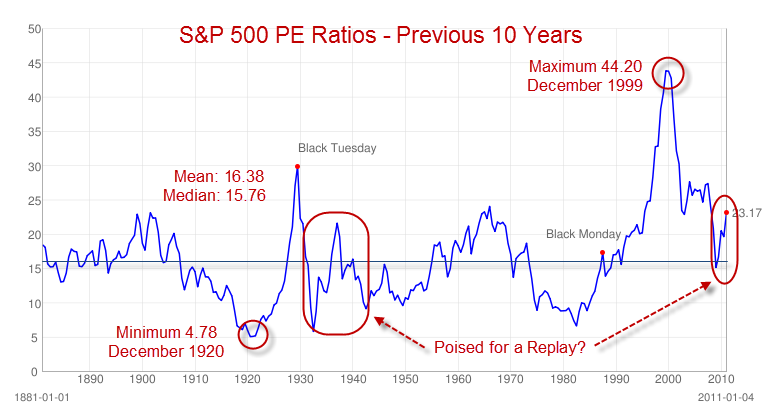

S P 500 Pe Ratio Chart

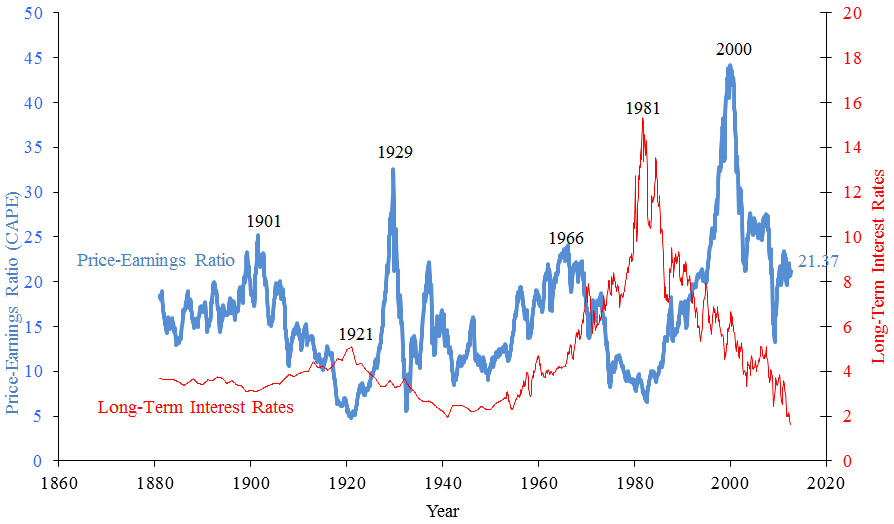

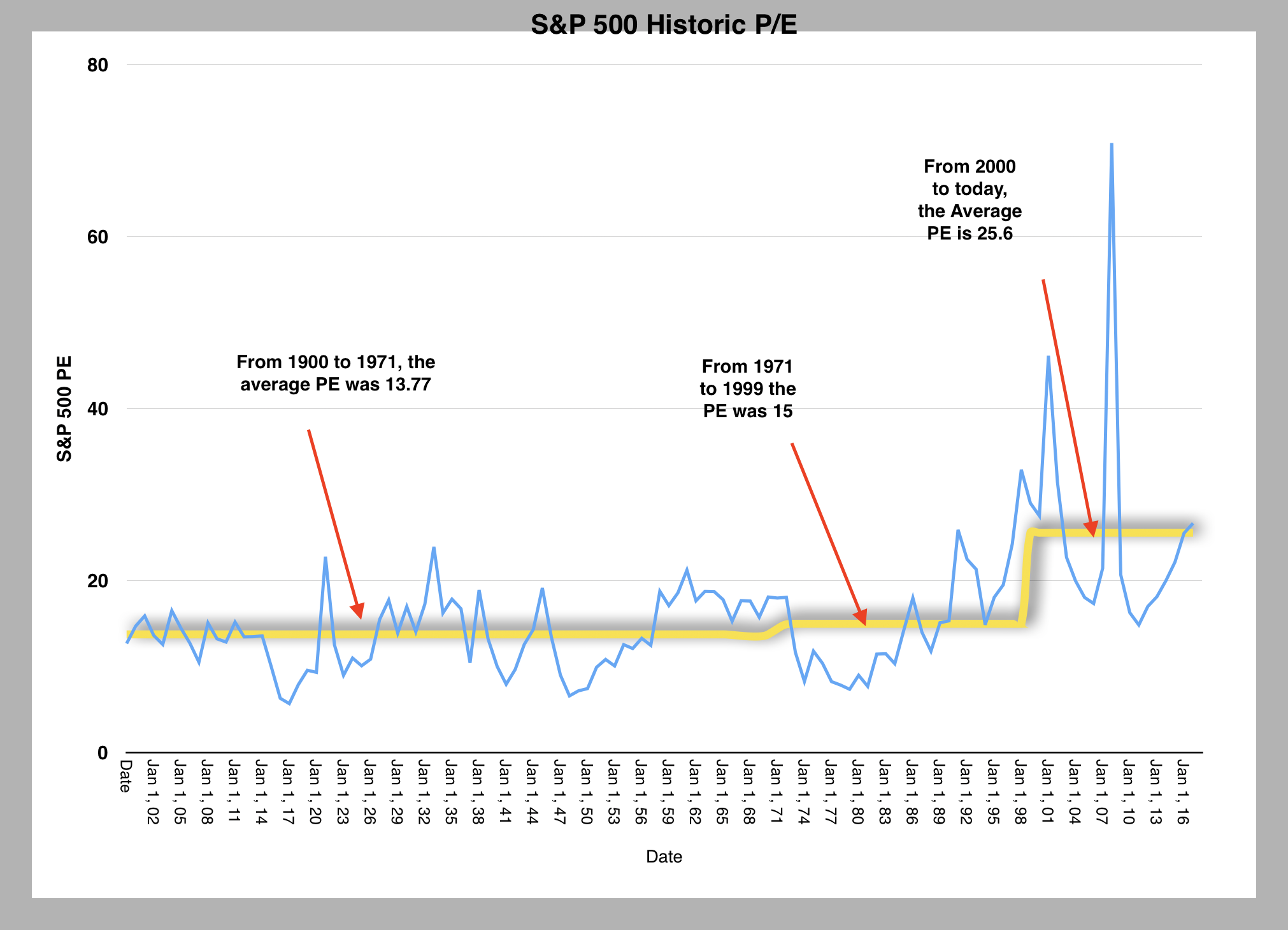

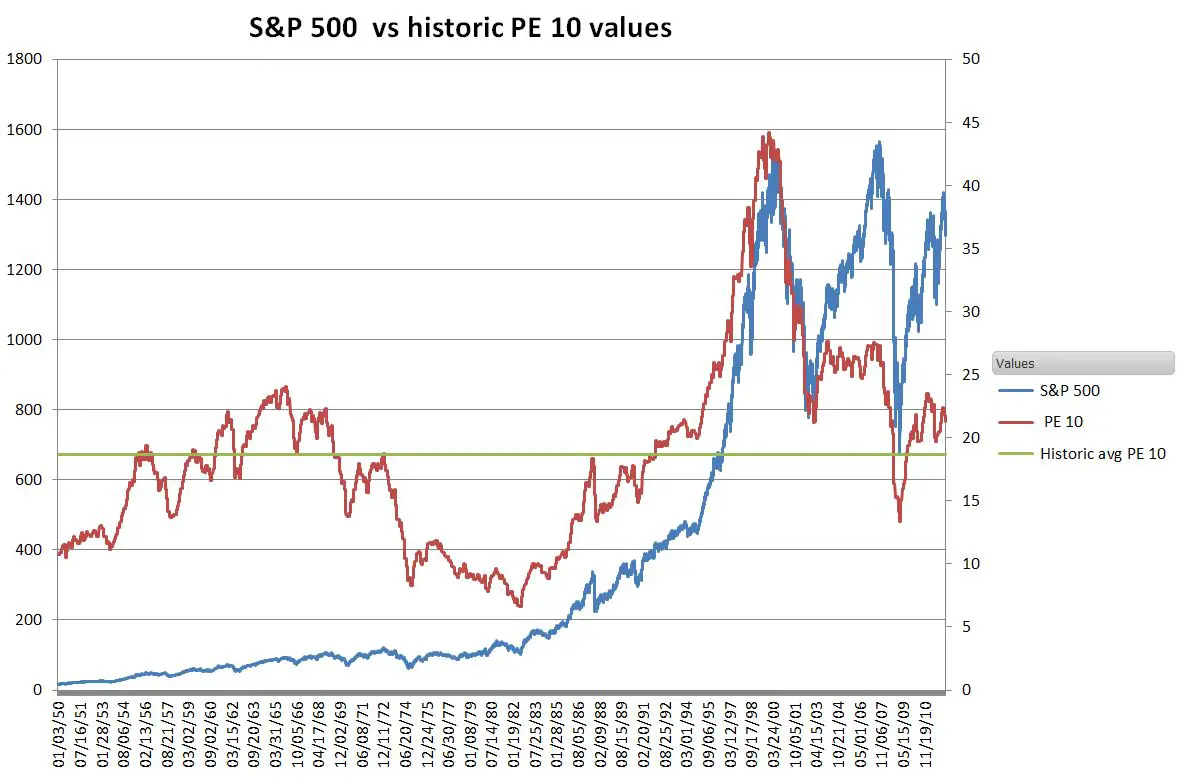

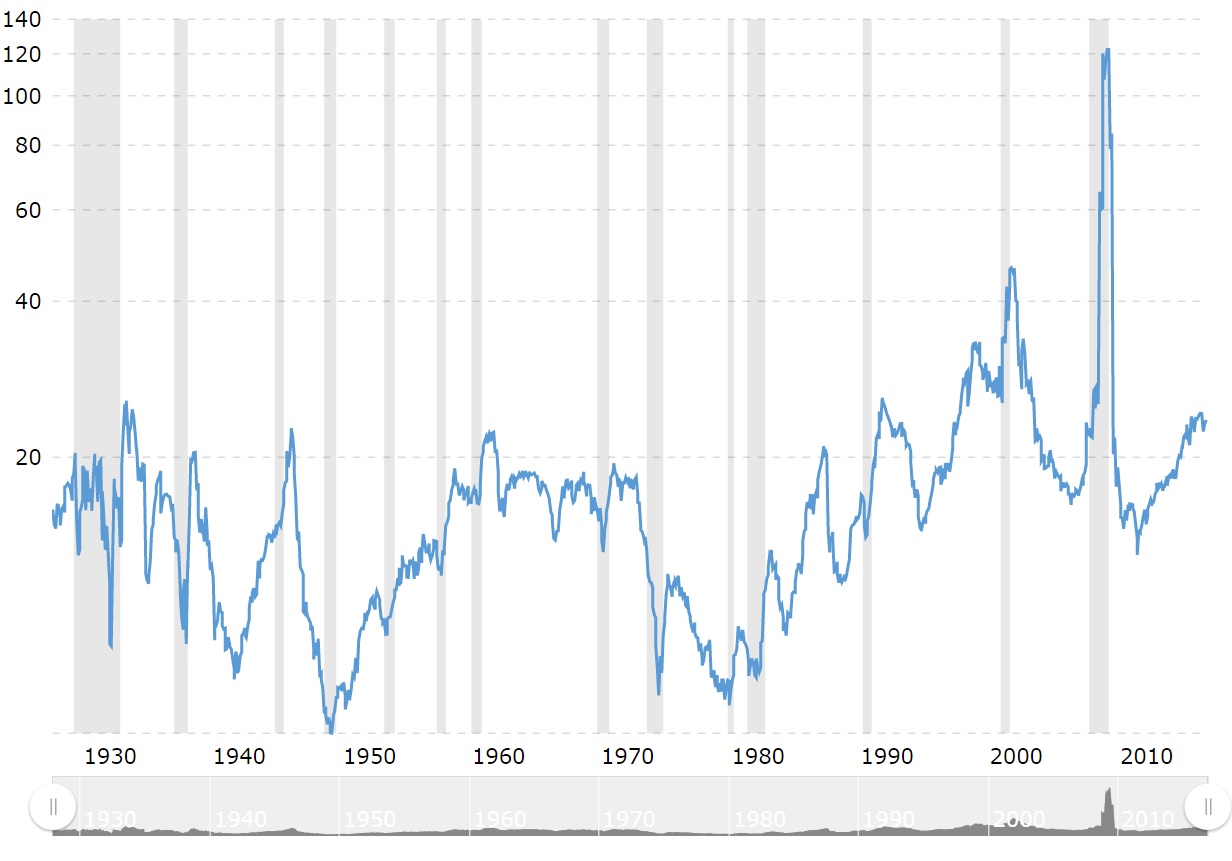

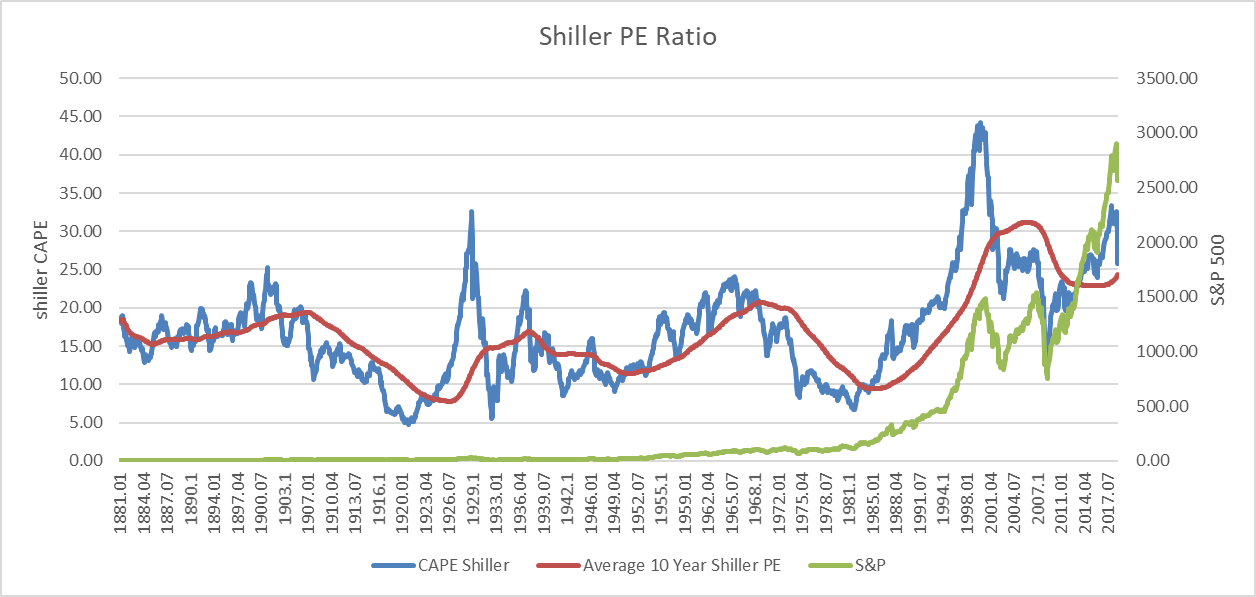

Instead of dividing by the earnings of one year see chart above this ratio divides the price of the s p 500 index by the average inflation adjusted earnings of the previous 10 years.

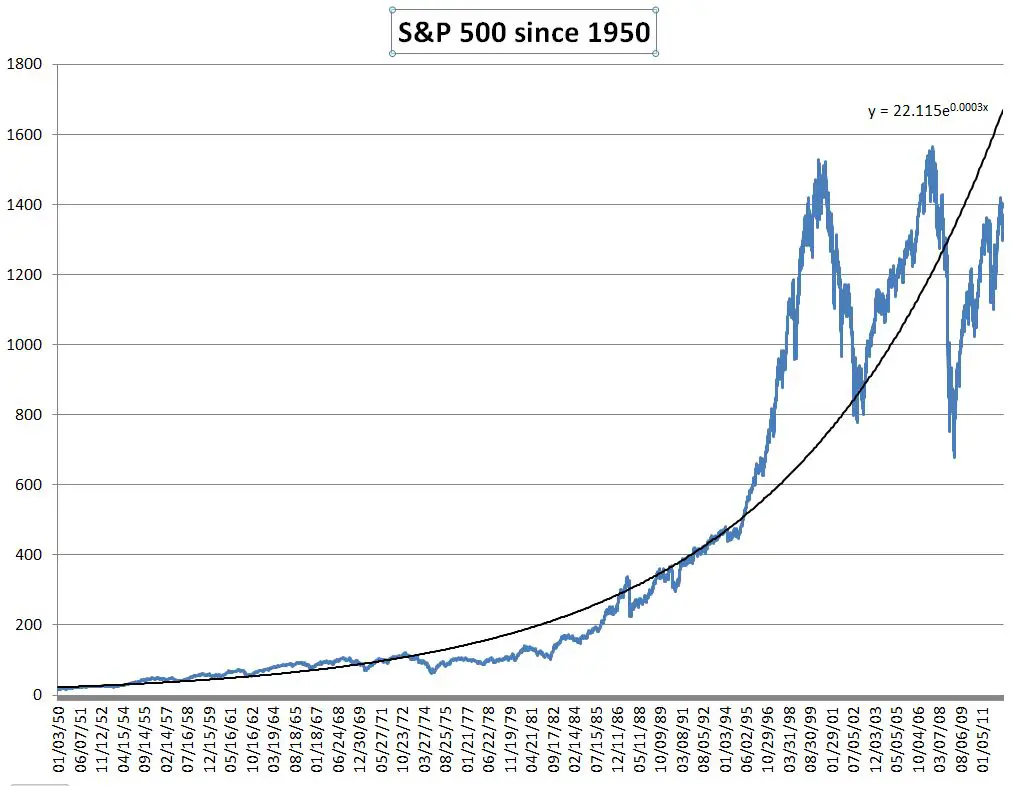

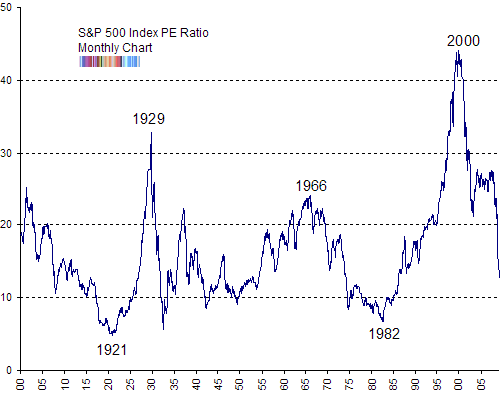

S p 500 pe ratio chart. The s p 500 shiller cape ratio also known as the cyclically adjusted price earnings ratio is defined as the ratio the the s p 500 s current price divided by the 10 year moving average of inflation adjusted earnings. S p 500 pe ratio chart historic and current data. Each series begins in the month of election and runs to the election of the next president. The s p 500 includes the 500 largest companies in the united states and can be viewed as a gauge for how the united states stock market is performing.

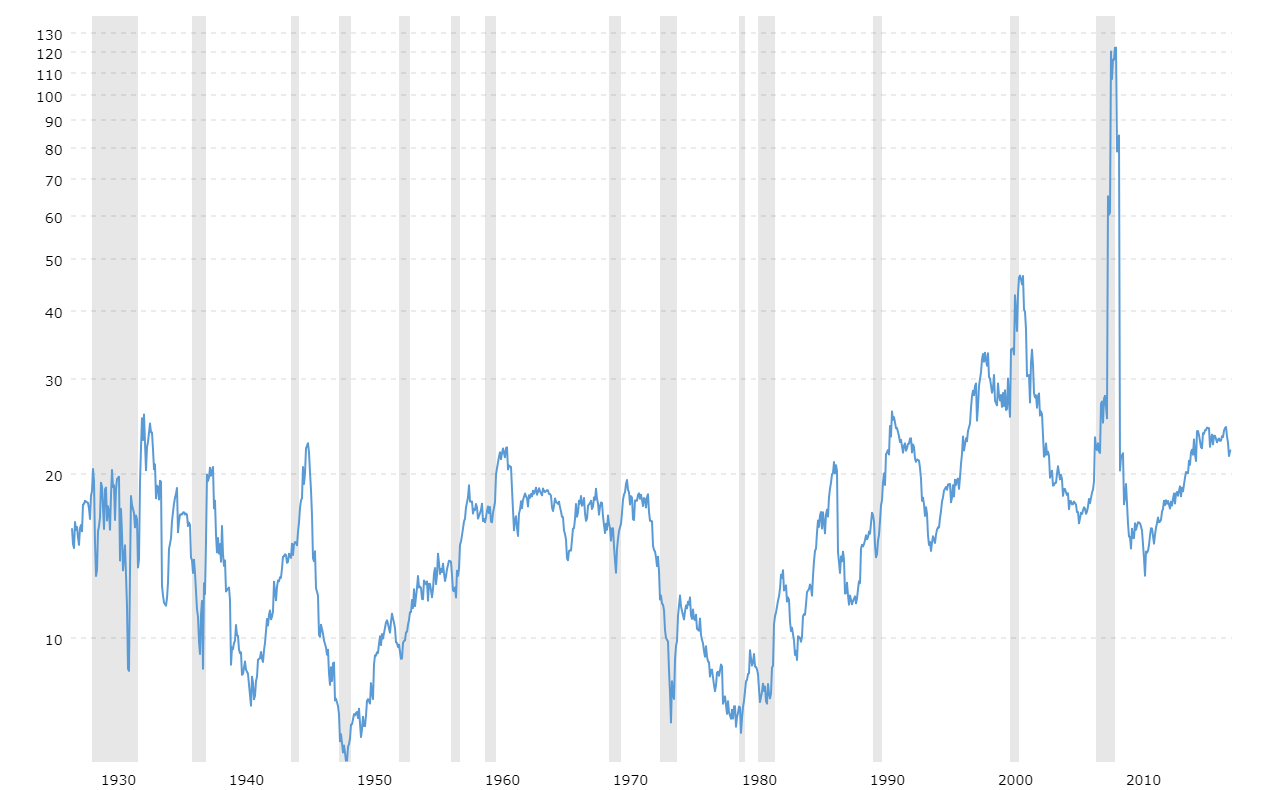

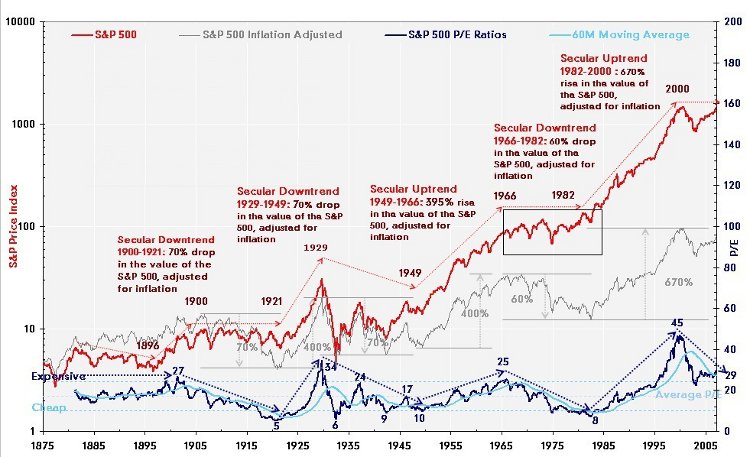

S p 500 pe ratio 90 year historical chart. Sp spx trade ideas forecasts and market news are at your disposal as well. View live s p 500 index chart to track latest price changes. The s p 500 pe ratio is the price to earnings ratio of the constituents of the s p 500.

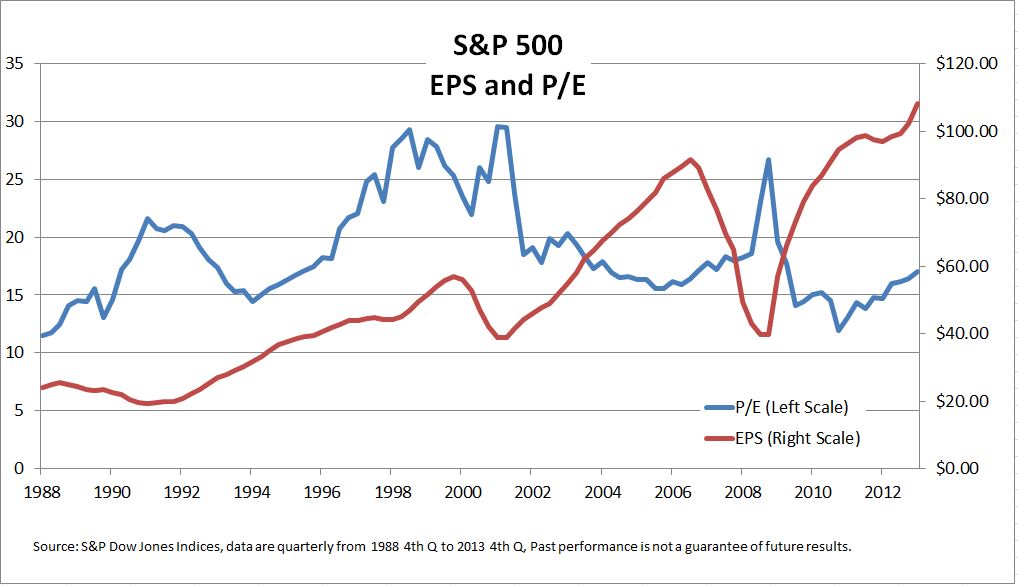

The forward 12 month p e ratio for the s p 500 is 21 7x in comparison to a 10 year. Equities and serves as the foundation for a wide range of investment products. The y axis shows the total percentage increase or decrease in the s p 500 and the x axis shows the term length in months. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

Only presidents who were elected as opposed to vps who stepped in are shown. About s p 500 index the s p 500 is widely regarded as the best single gauge of large cap u s. The ratio is also known as the cyclically adjusted pe ratio cape ratio the shiller pe ratio or the p e10. S p 500 pe ratio table by year historic and current data.

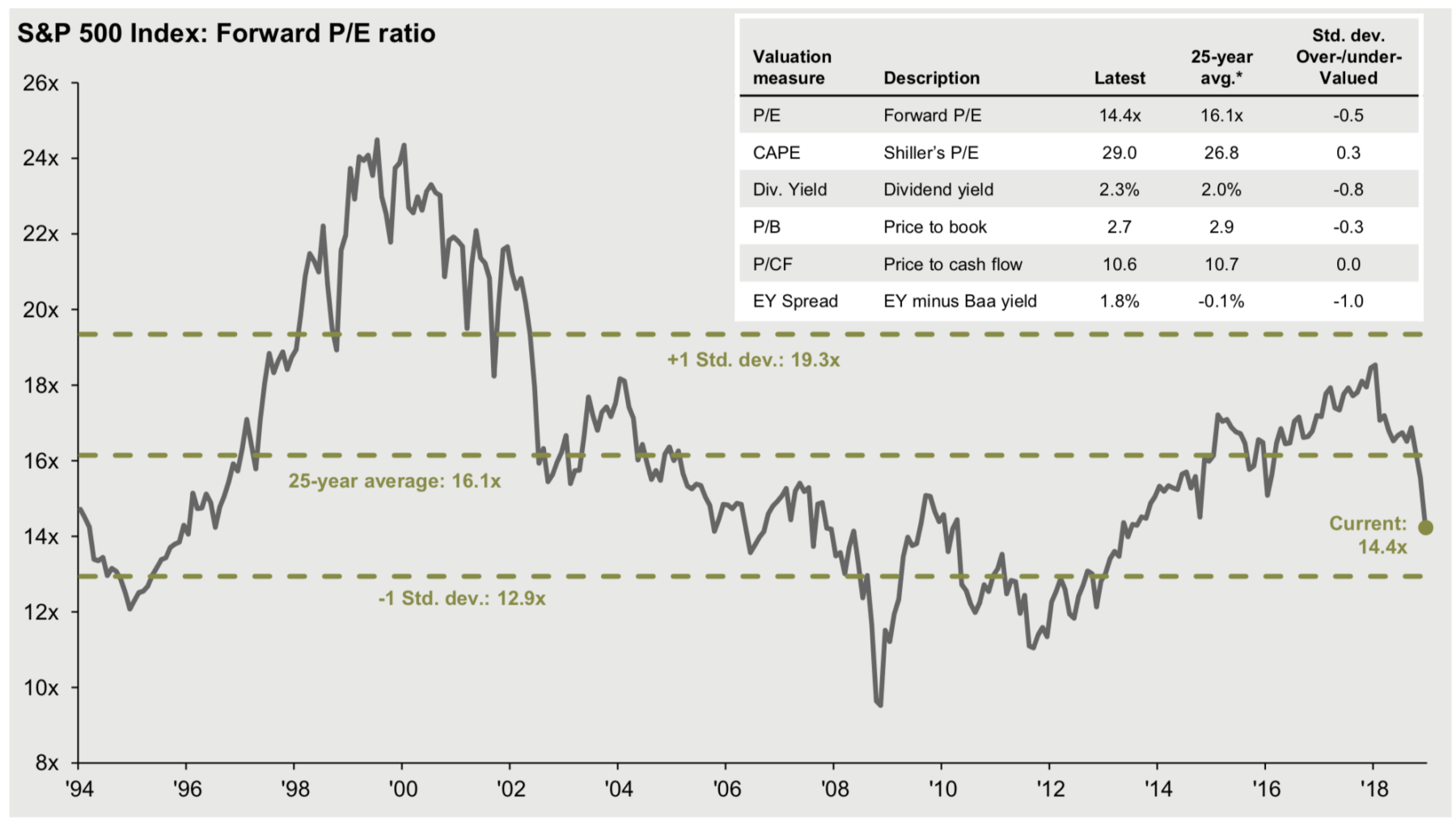

If we look at how expensive stocks are on a forward 12 month basis we also arrive at the same conclusion. This interactive chart shows the running percentage gain in the s p 500 by presidential term.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)