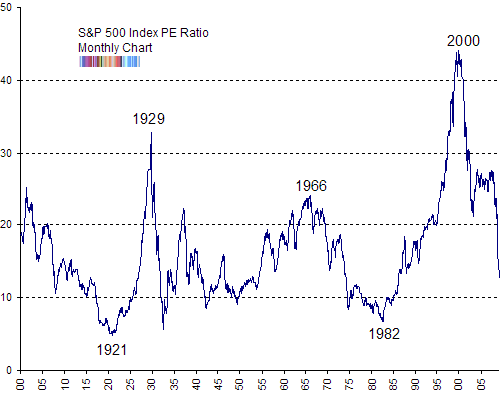

S P 500 Pe Ratio History Chart

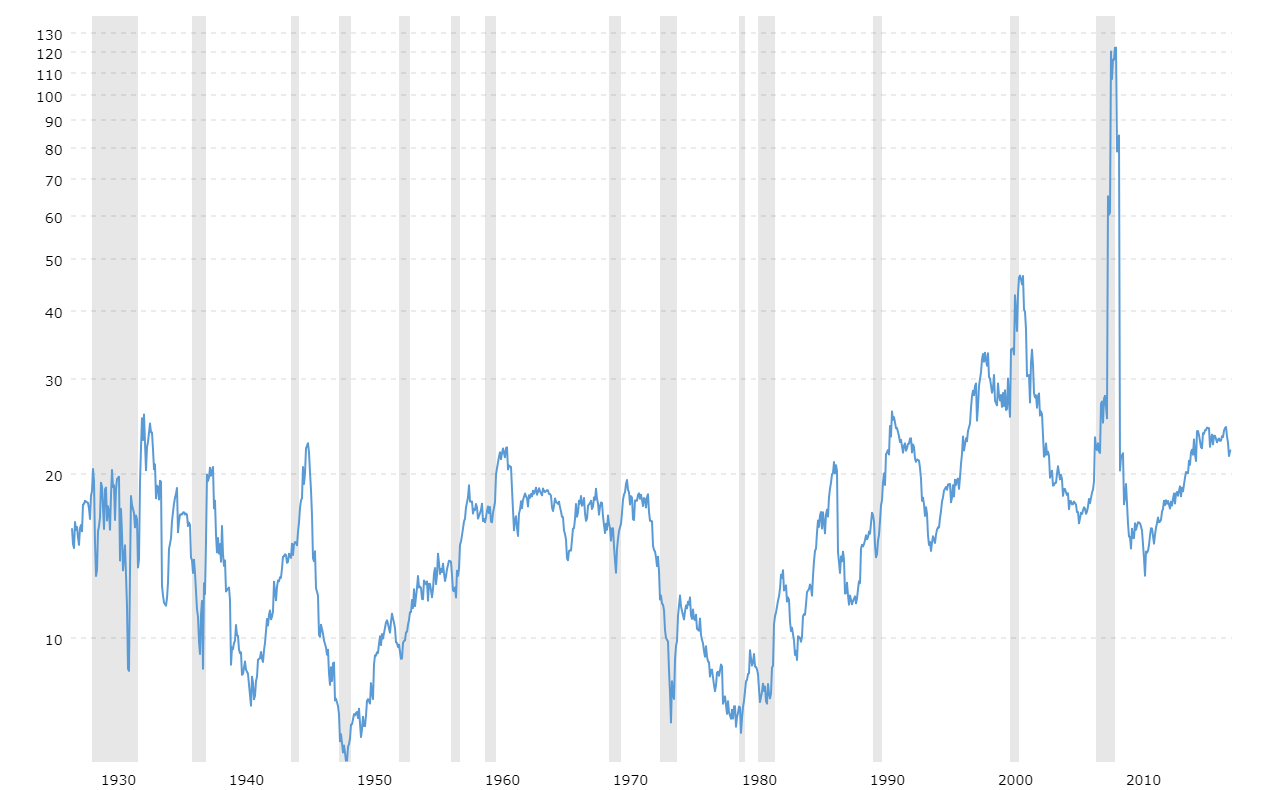

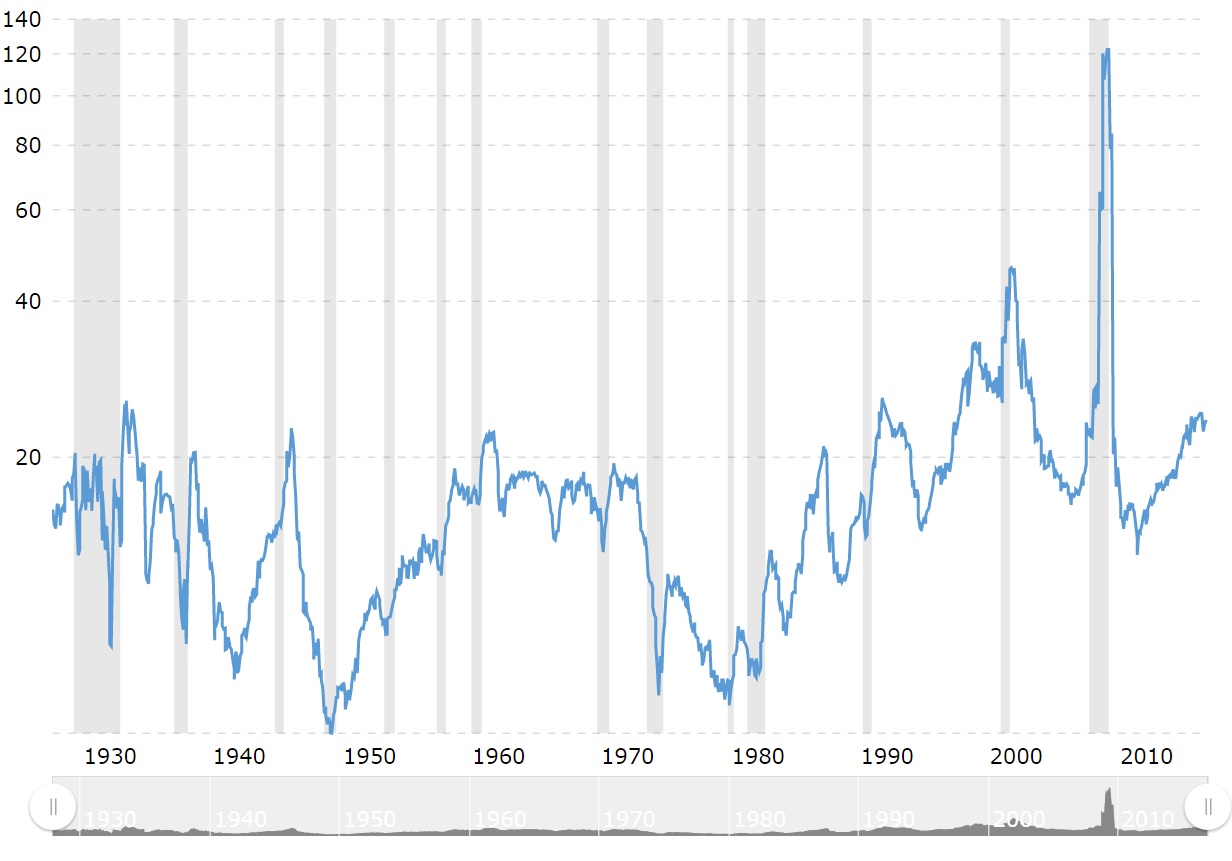

Historically the s p 500 pe ratio peaked above 120 during the financial crisis in 2009 and was at its lowest in 1988.

S p 500 pe ratio history chart. Pe ttm of s p 500 index historical data charts stats and more. S p 500 p e ratio is at a current level of 31 24 up from 22 22 last. This is a change of 5 62 from last quarter and 38 43 from one year ago. Interactive chart of the s p 500 stock market index since 1927.

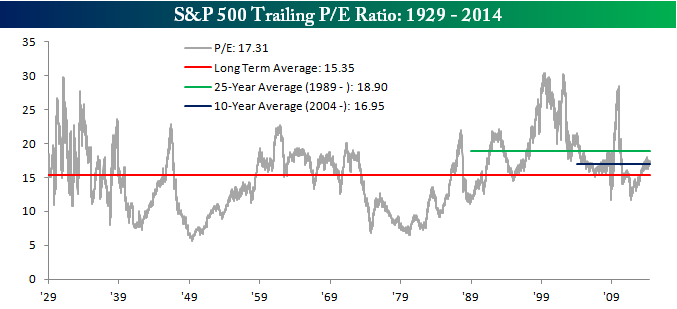

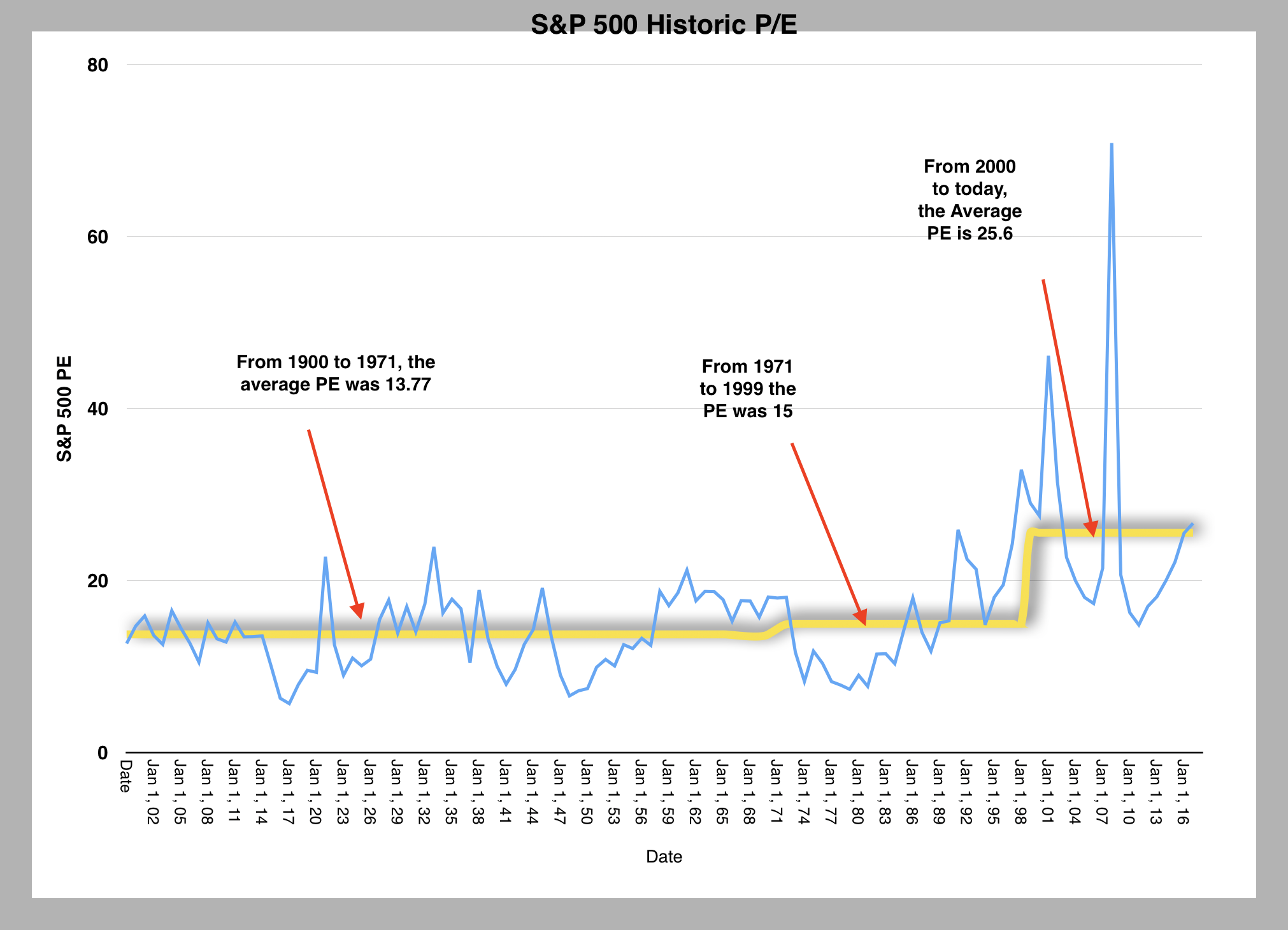

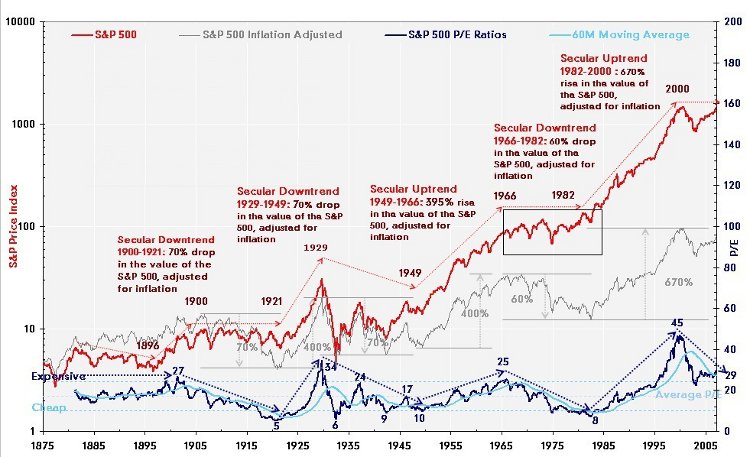

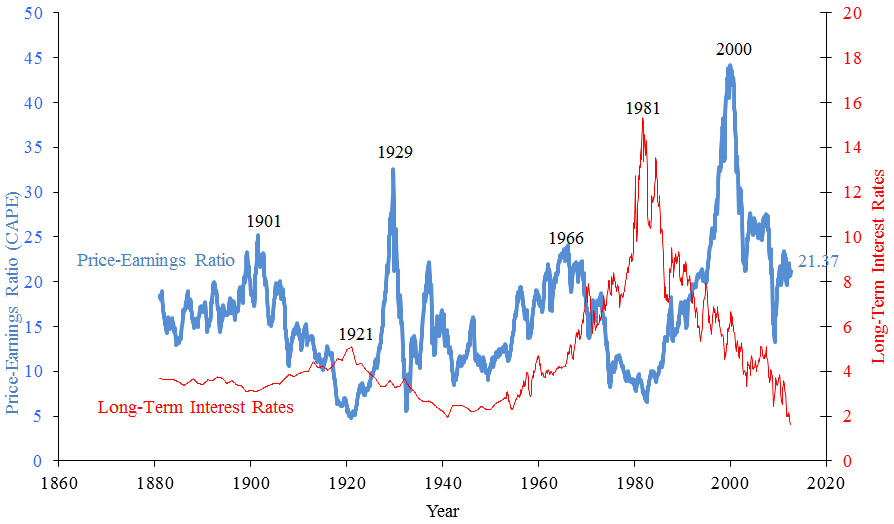

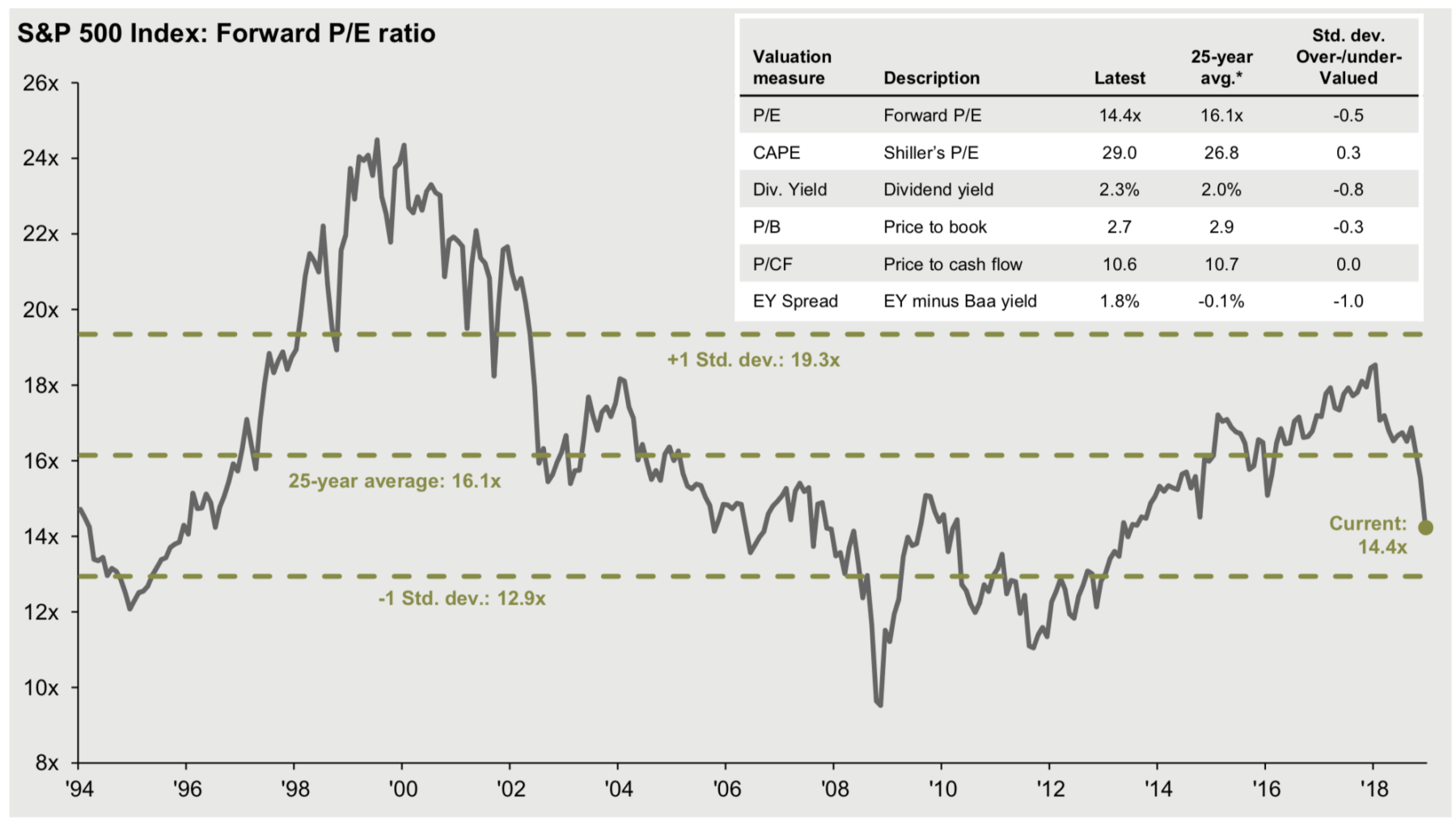

S p 500 pe ratio table by year historic and current data. S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago. S p 500 historical pe ratio chart pe 26 27 is considered to be a strong sell but s p 500 pe once reached 40 and later it hit 65 both were abberations the first time was during the dot com rally and subsequent crash. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

The price to earnings ratio is a valuation metric that gives a general idea of how a company s stock is priced in comparison to their earnings per share. S p 500 pe ratio 90 year historical chart. S p 500 pe ratio 90 year historical chart macrotrends posted on 31 10 2020 by gegak no comments delta alpha ratio correlates with level of recovery after. Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close.

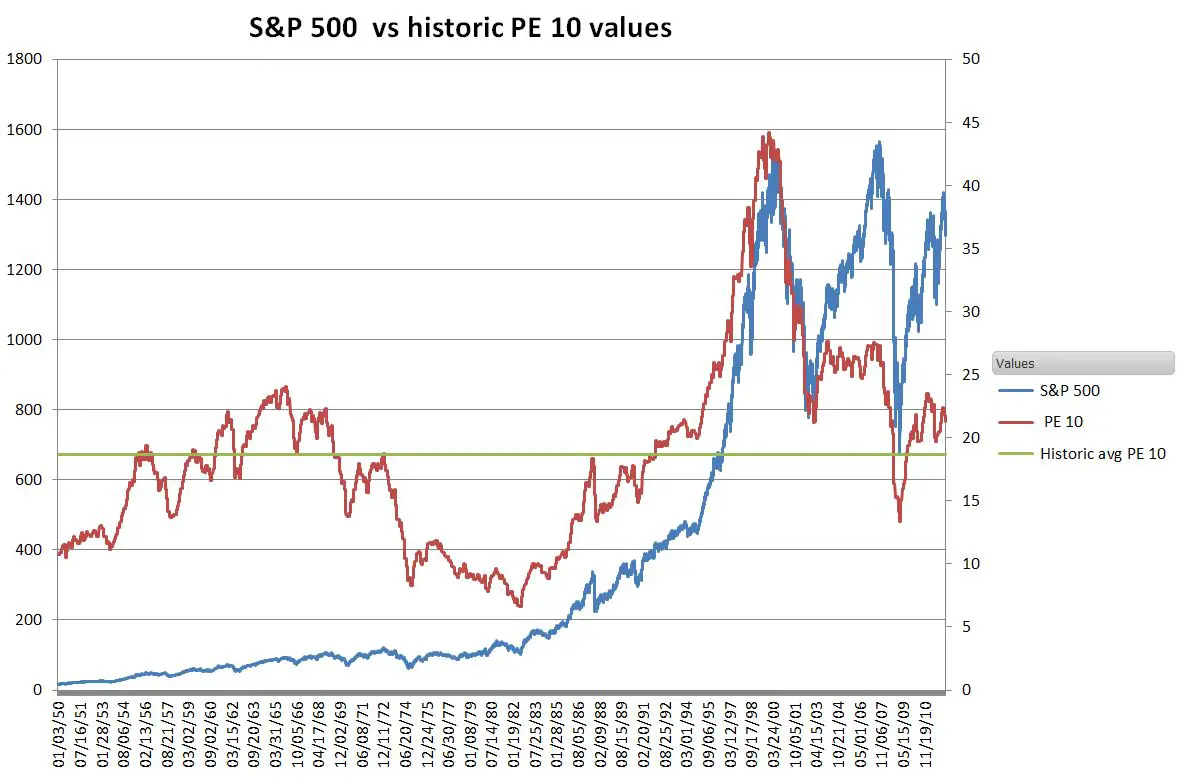

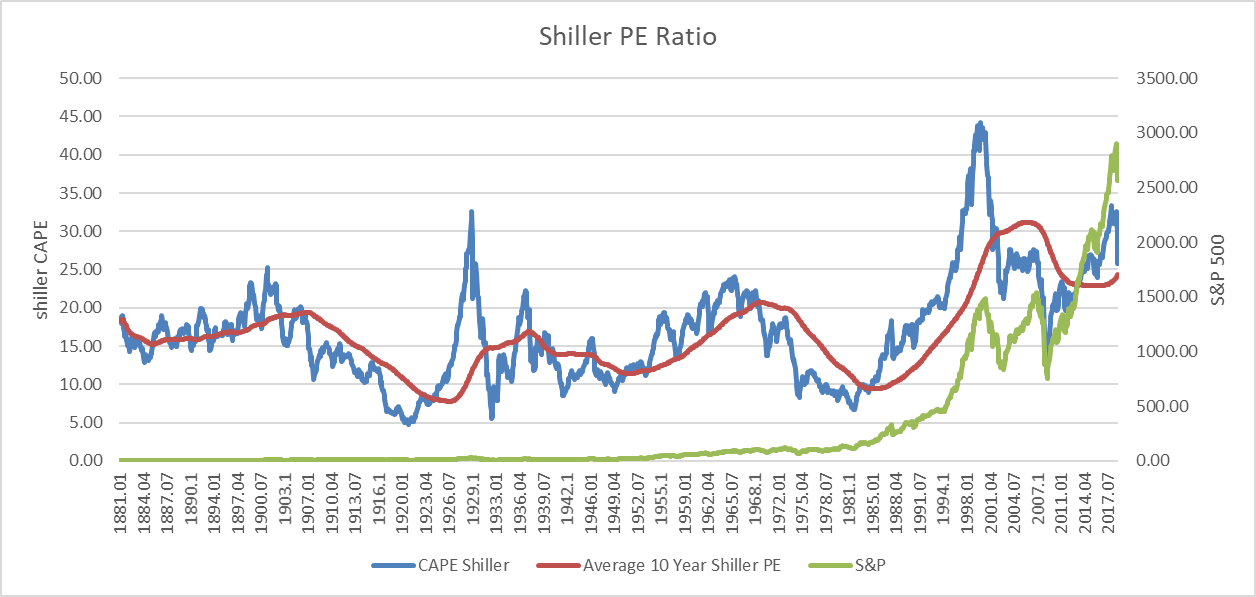

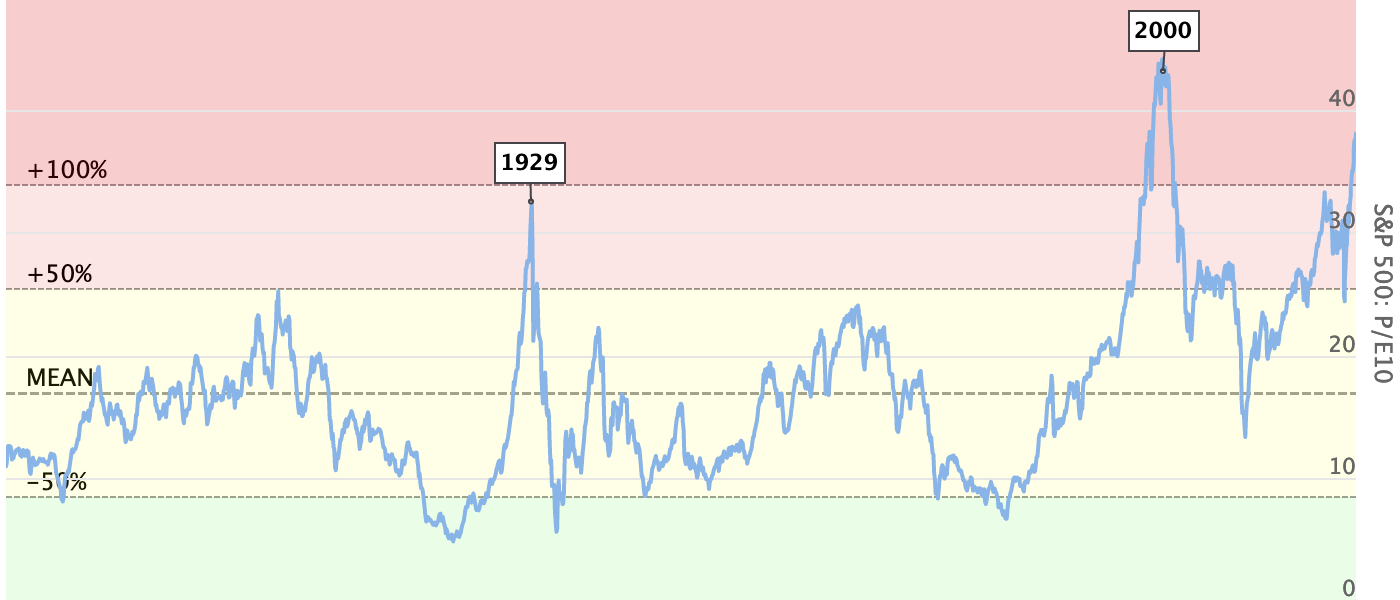

Historical data is inflation adjusted using the headline cpi and each data point represents the month end closing value. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926. S p 500 index 90 year historical chart. Instead of dividing by the earnings of one year see chart above this ratio divides the price of the s p 500 index by the average inflation adjusted earnings of the previous 10 years.

The ratio is also known as the cyclically adjusted pe ratio cape ratio the shiller pe ratio or the p e10.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)