S P 500 Pe Ratio History

S p pe ratio definition.

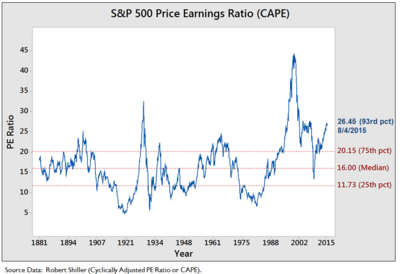

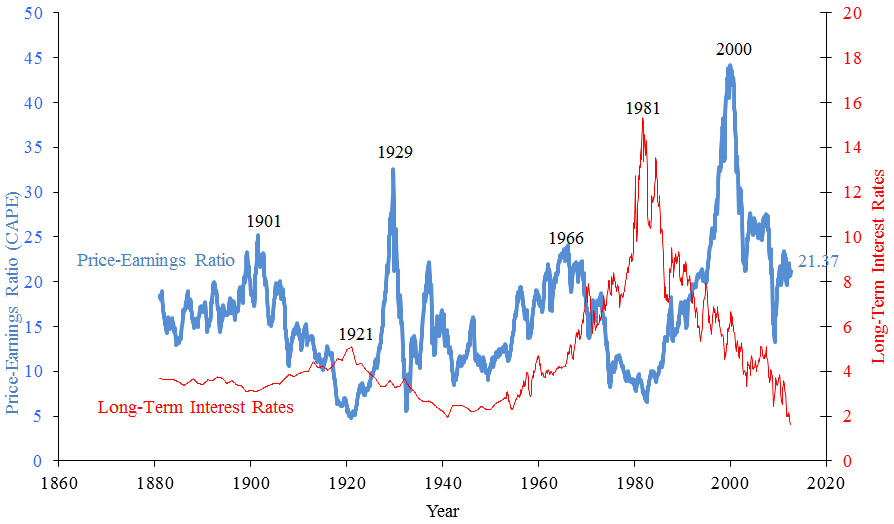

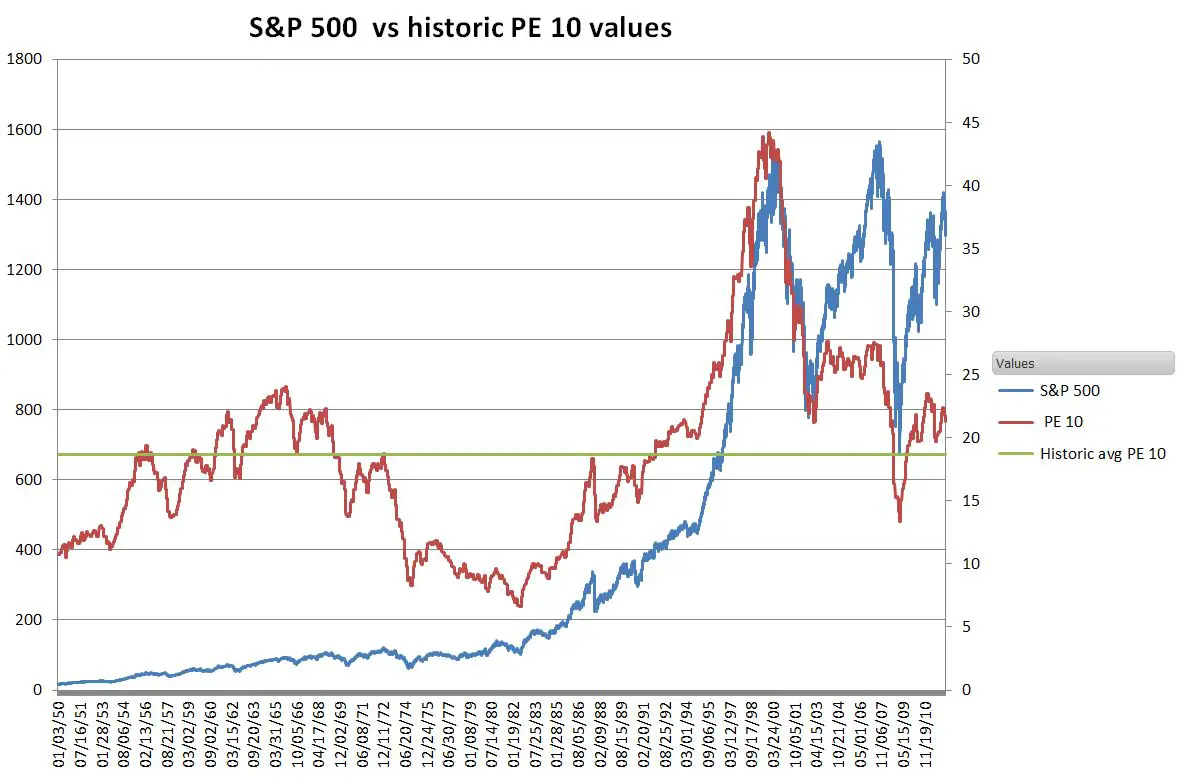

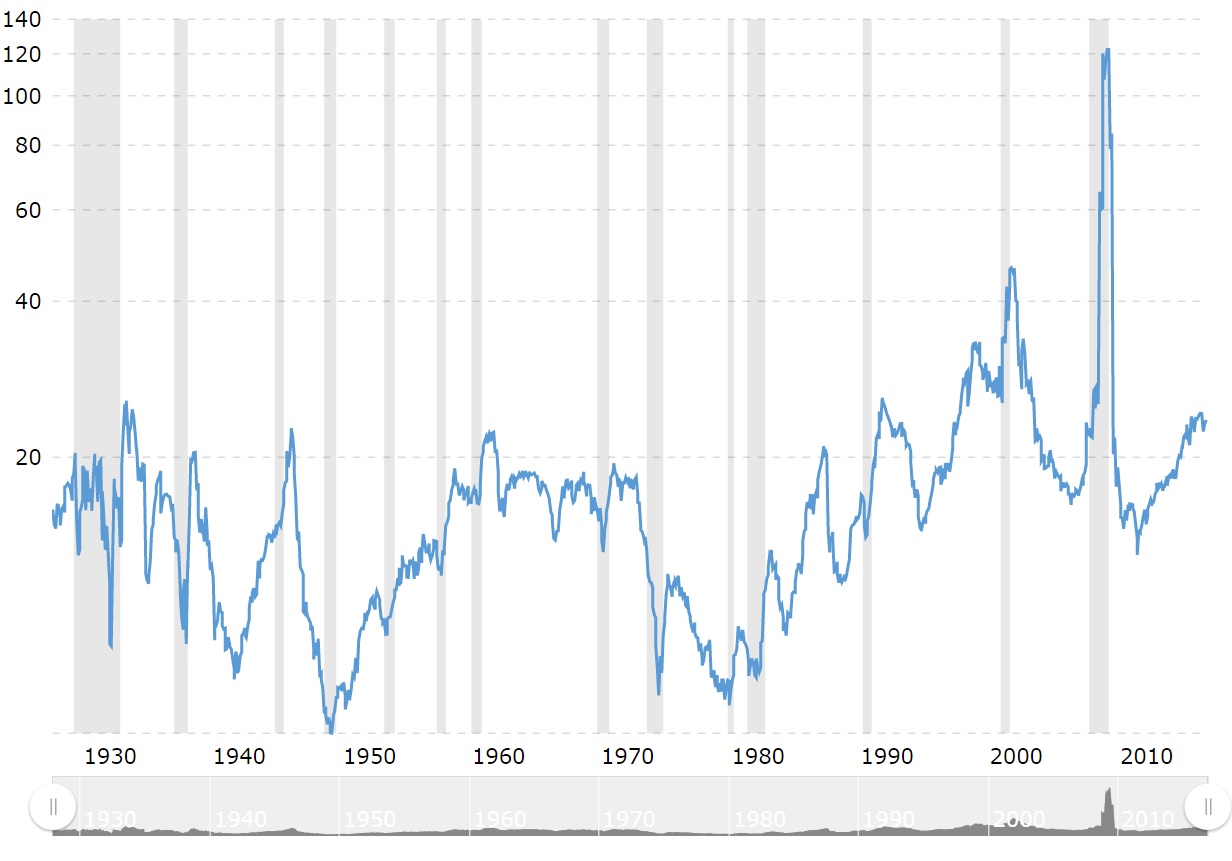

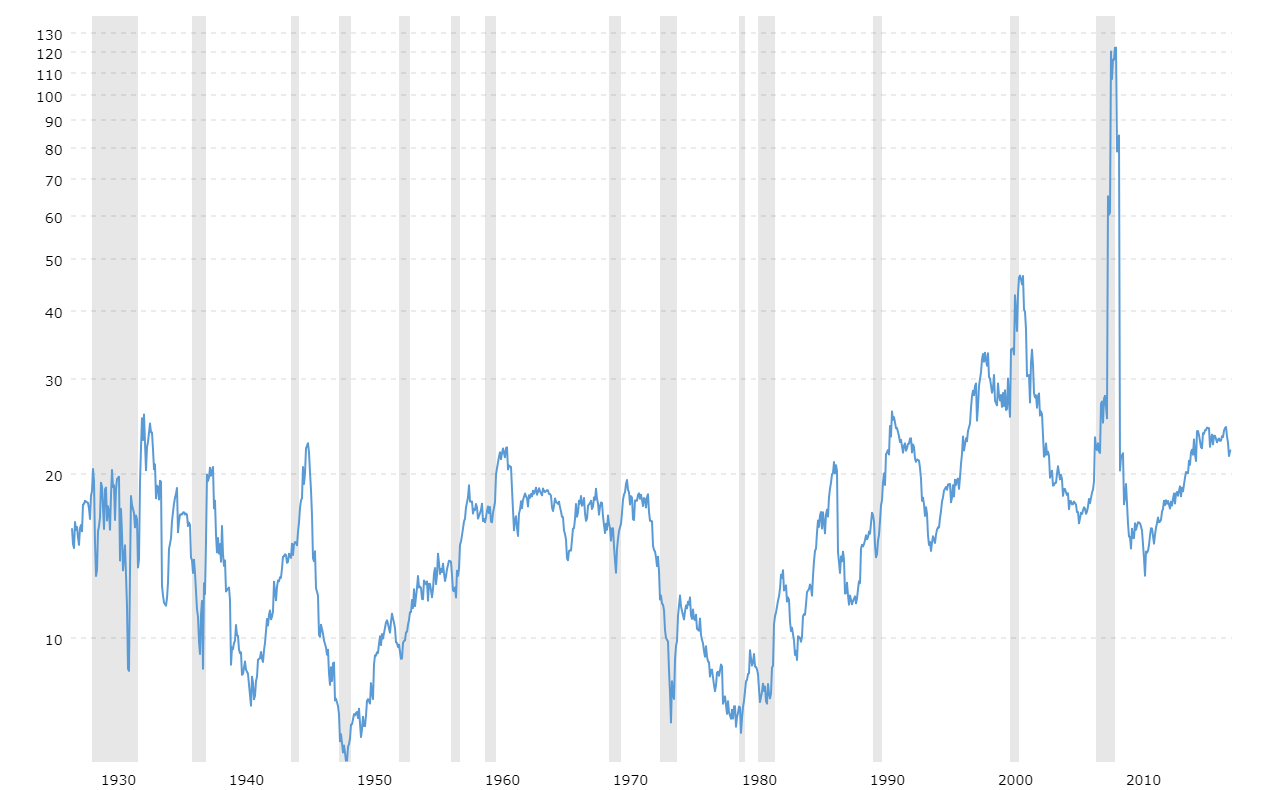

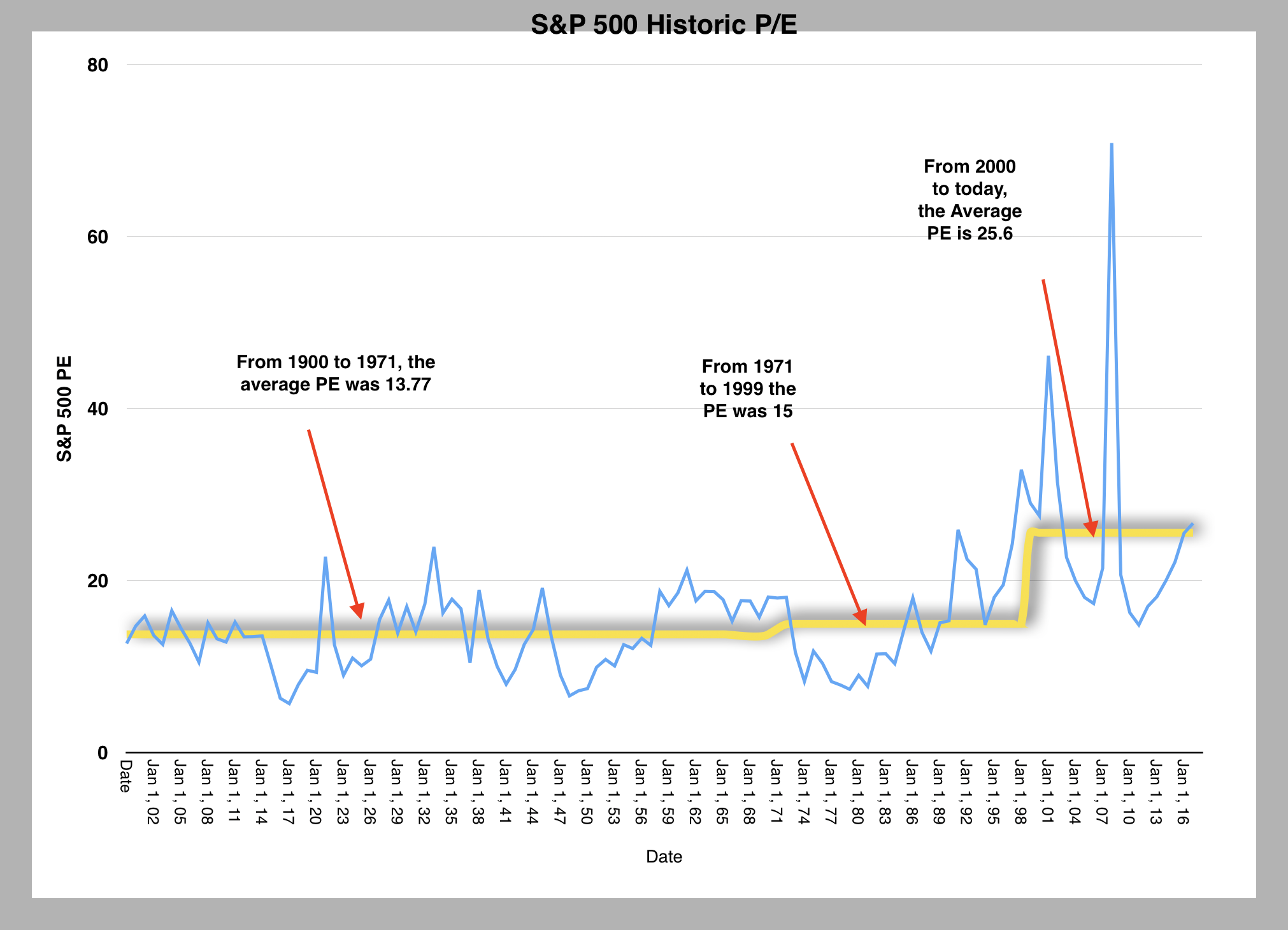

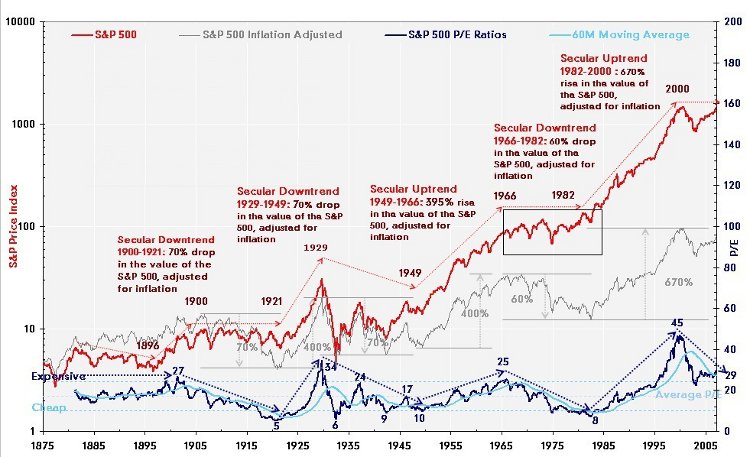

S p 500 pe ratio history. Investing for beginners 101. S p 500 historical pe ratio by year. The s p pe ratio is the share adjusted earnings divided by price of each companies that composes the sp500 index p e pe ratio. The chart below shows the long term historical p e ratio for the s p 500.

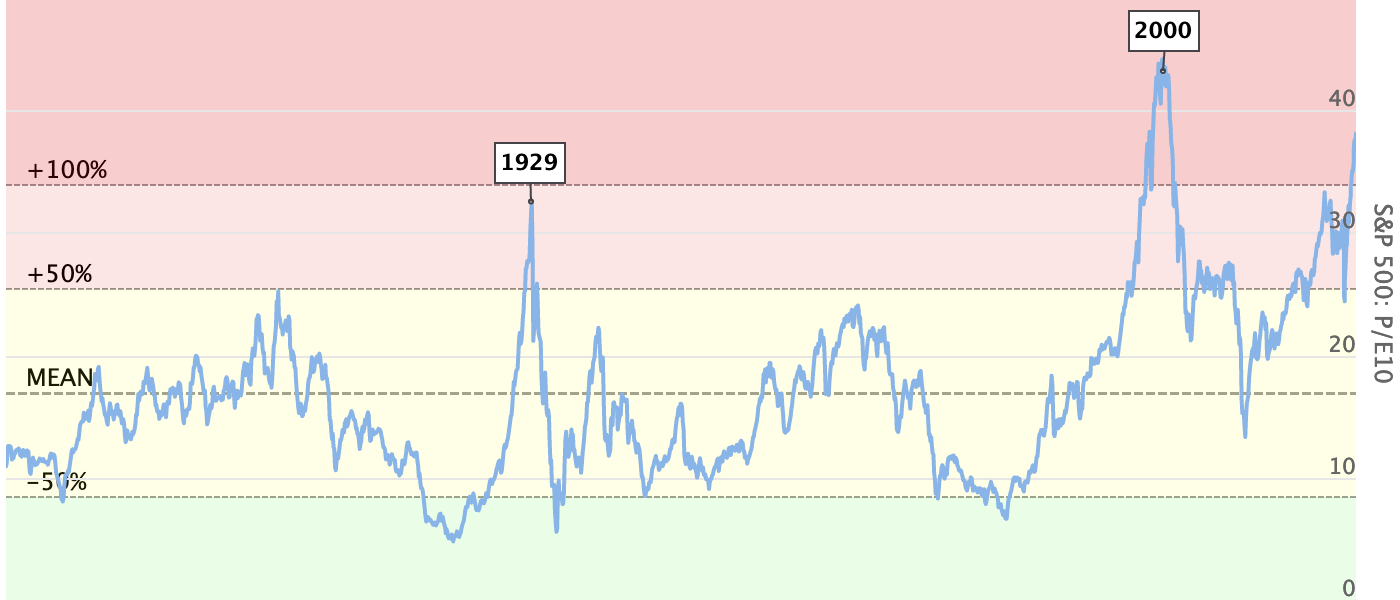

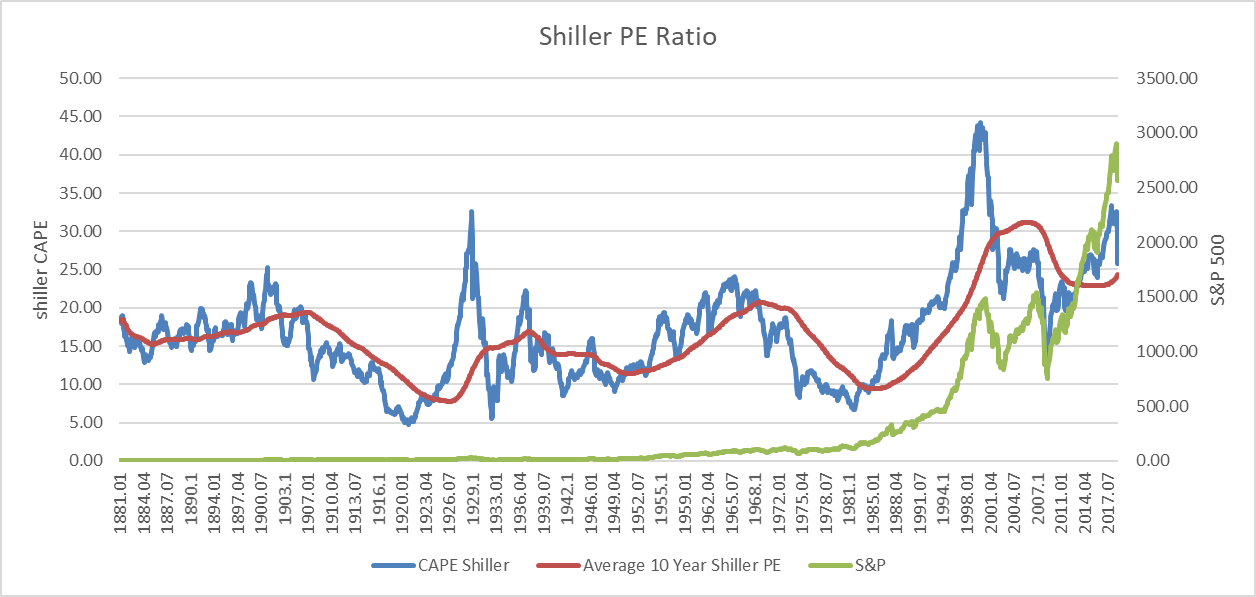

Negative pe ratio. This ratio is in the 84 th percentile of the historical distribution and was only exceeded during the early 2000s and the 2008 2009 recession. Stock market as a whole is currently 31 90 oct 14th 2020. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

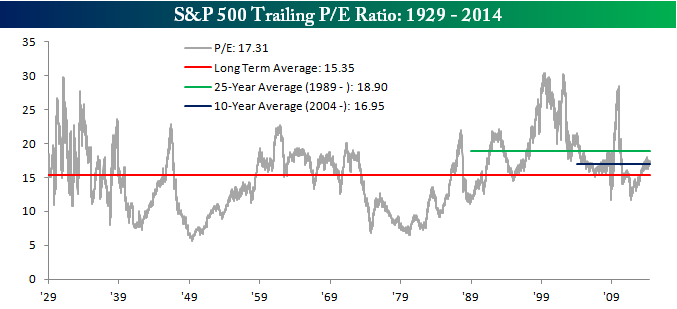

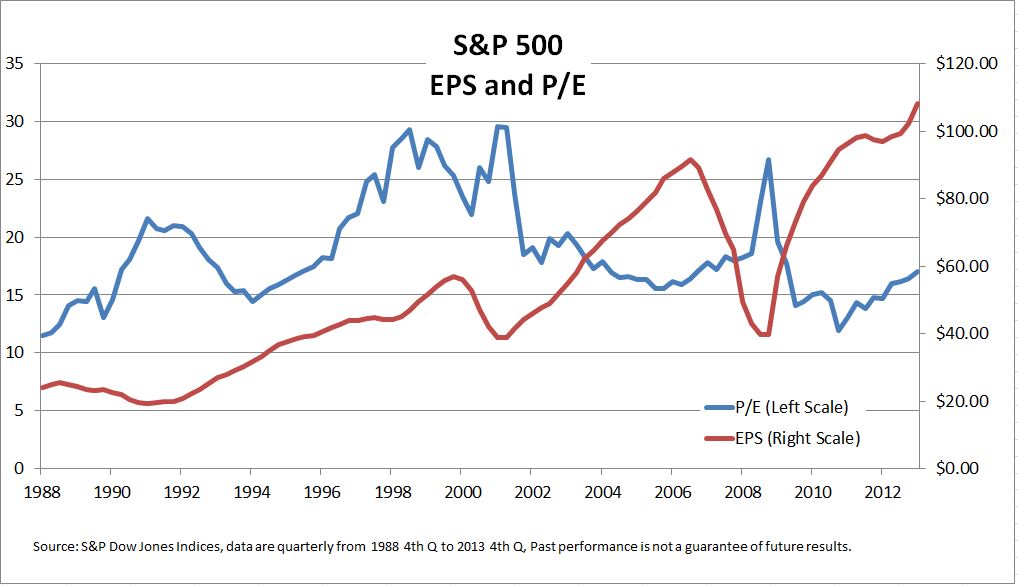

S p 500 pe ratio table by year historic and current data. The table below lists the current historical cape ratios by sector calculated using the 500 largest public u s. At a current level of 17 31 the trailing p e ratio is nearly two points above its historical average 15 35. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

Explaining ipos in simple terms with examples. Companies if the shiller pe ratio of a sector is lower than its historical average this might indicate that the sector is currently undervalued and vice versa. Too much money for a roth selling tesla and netflix. The overall cape of the u s.

Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close. S p 500 pe ratio chart historic and current data. Metrics and data to guide value investing. Higher ratios indicate higher valuations whereas lower ratios indicates investors are willing to pay less per 1 of earnings.

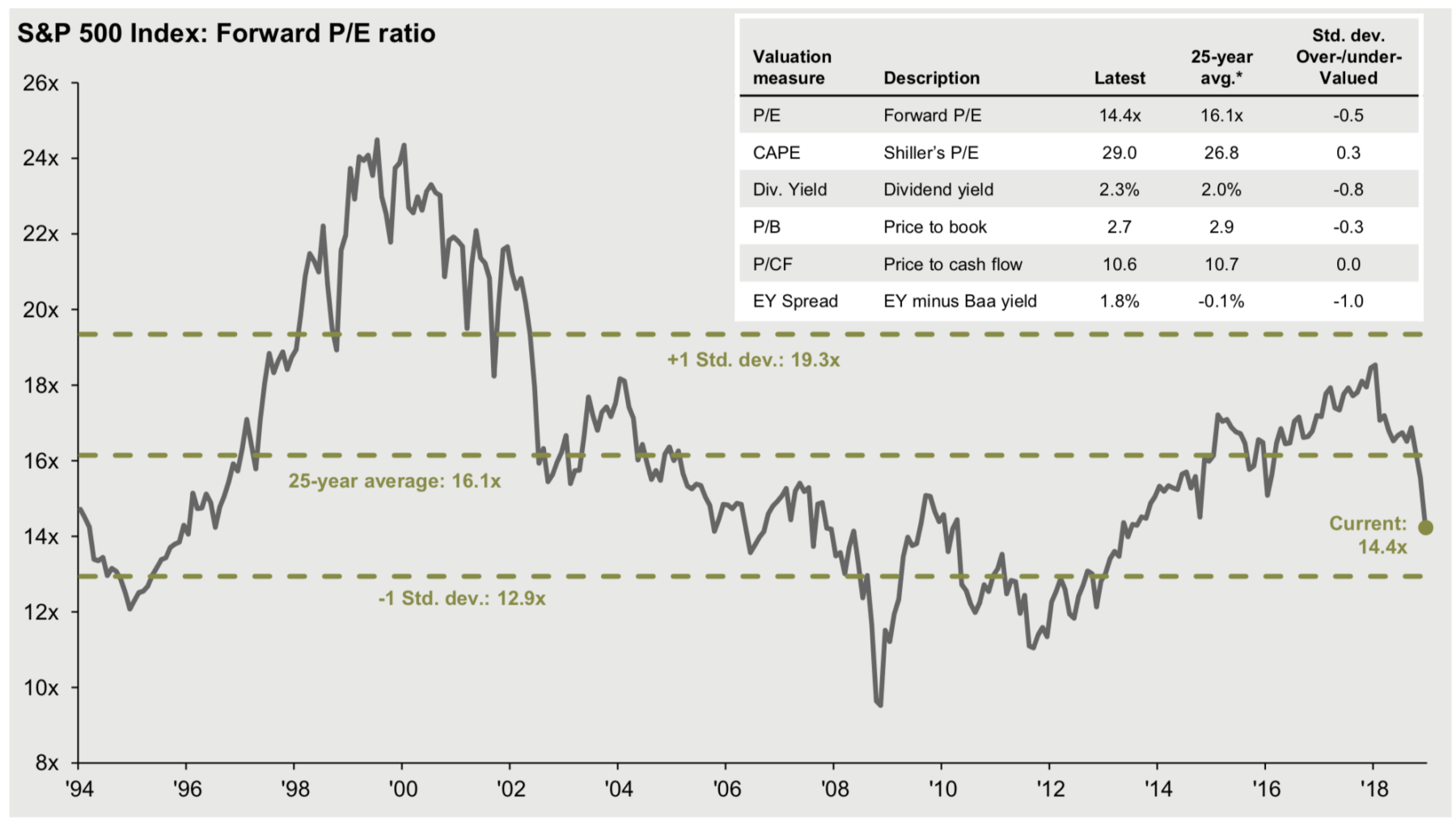

Historical eps data for the s p 500 20 years of average yoy growth. The s p 500 p e ratio as of june 1 2017 was 25 7x which is 32 47 higher than the historical average of 19 4x. S p 500 pe ratio 90 year historical chart. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio.

7 steps to understanding the stock market. A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)