S P 500 Pe Ratio Vs Price

Stock prices fell in the first quarter q1 of 2020.

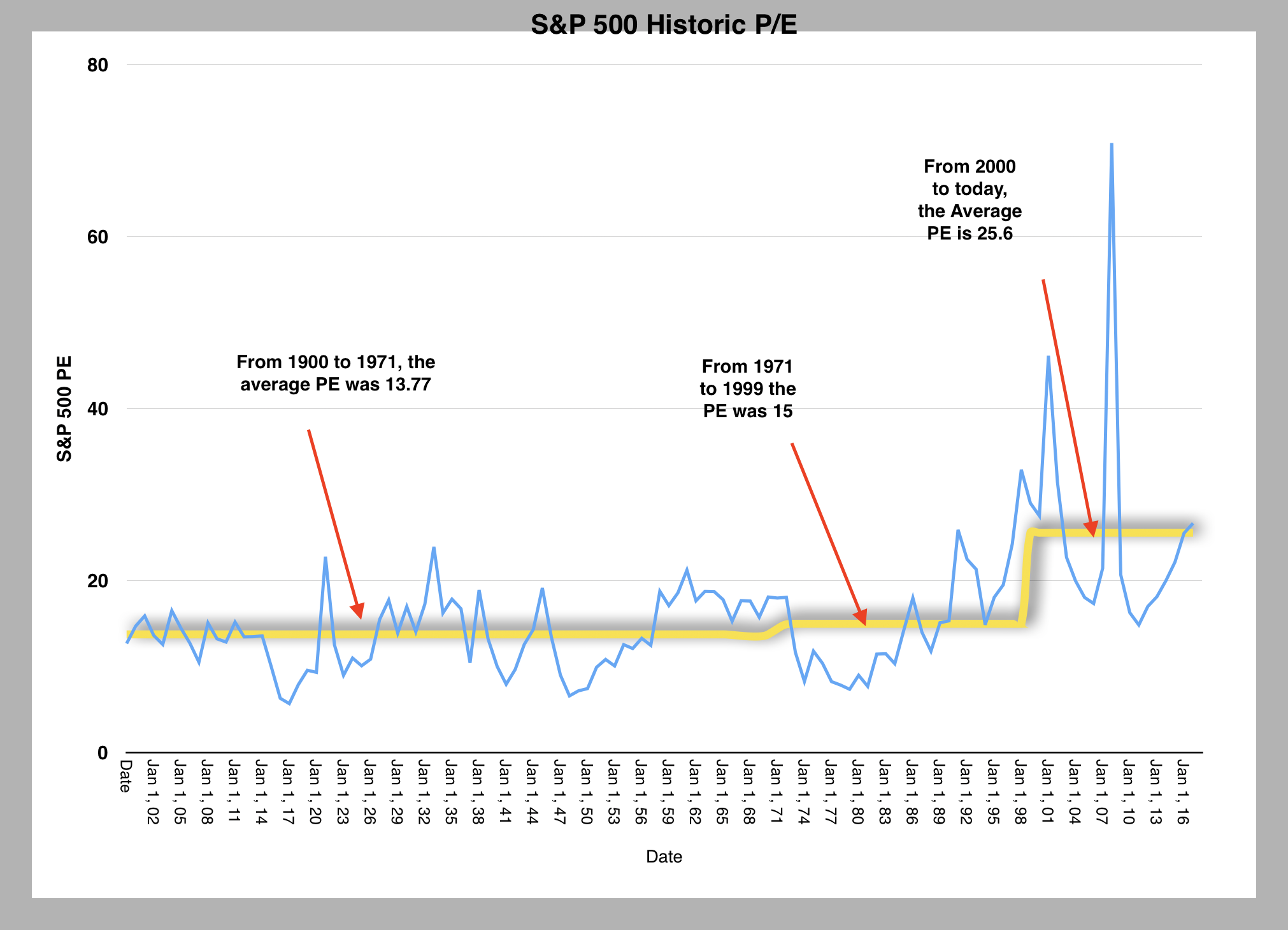

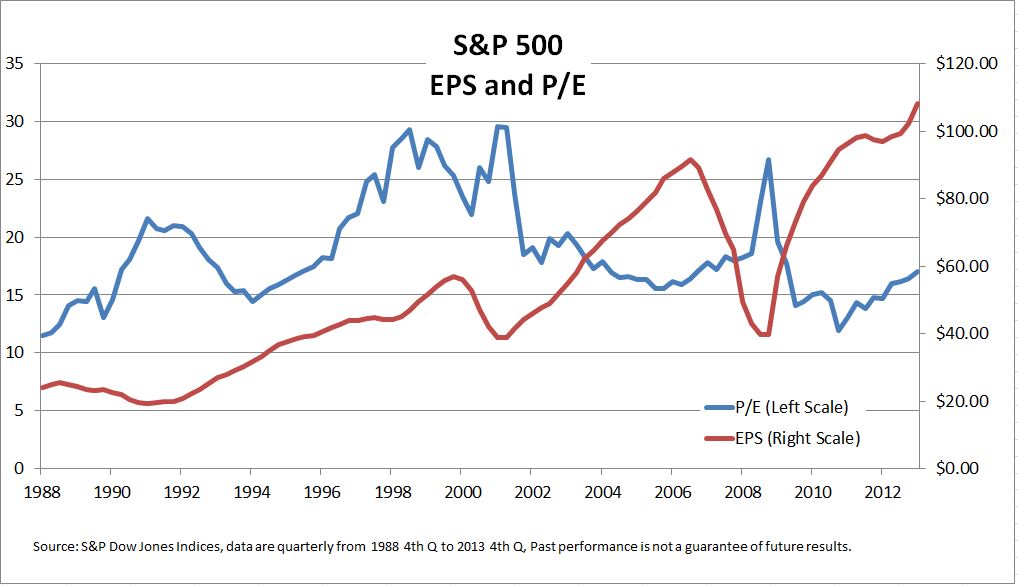

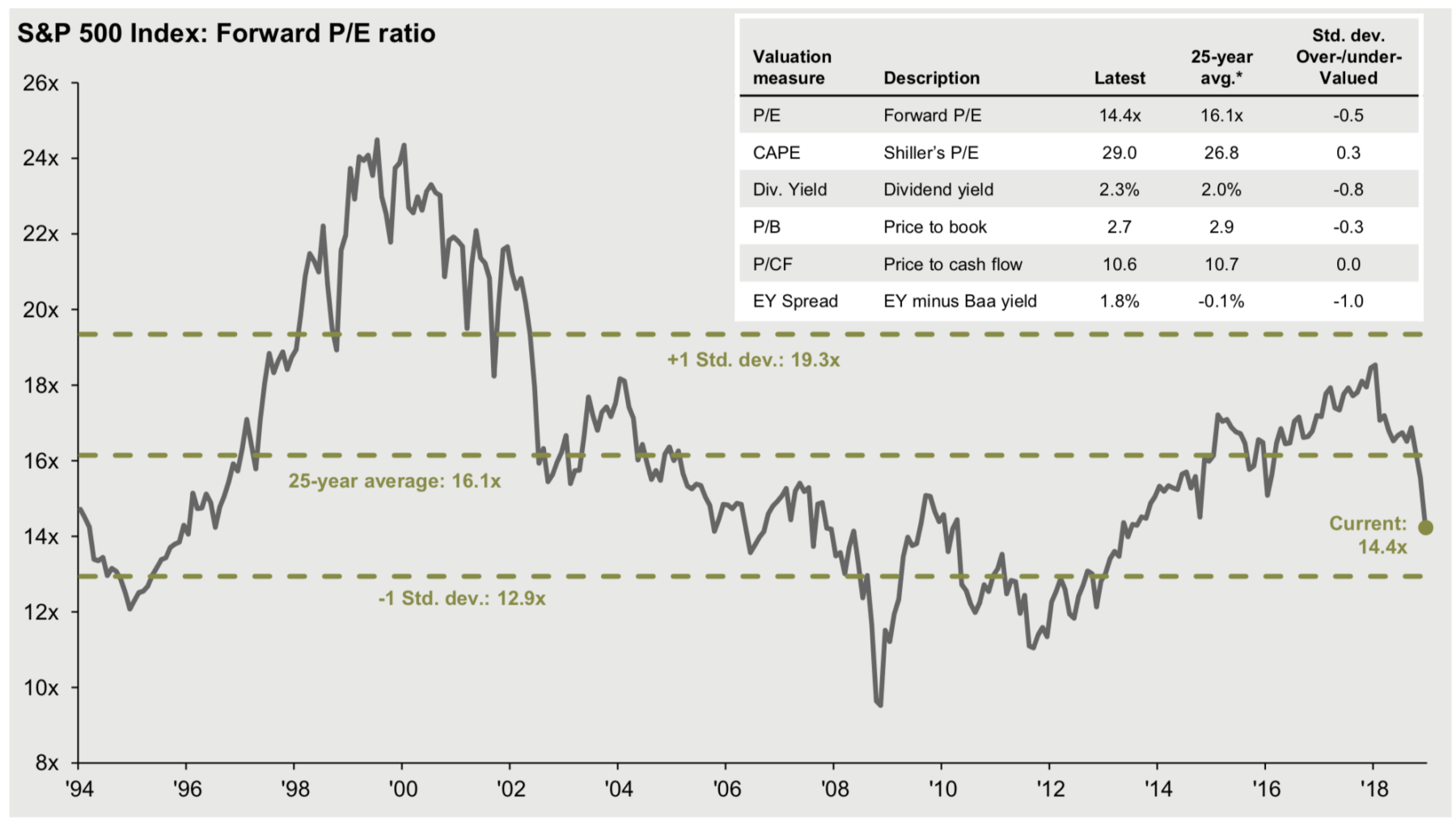

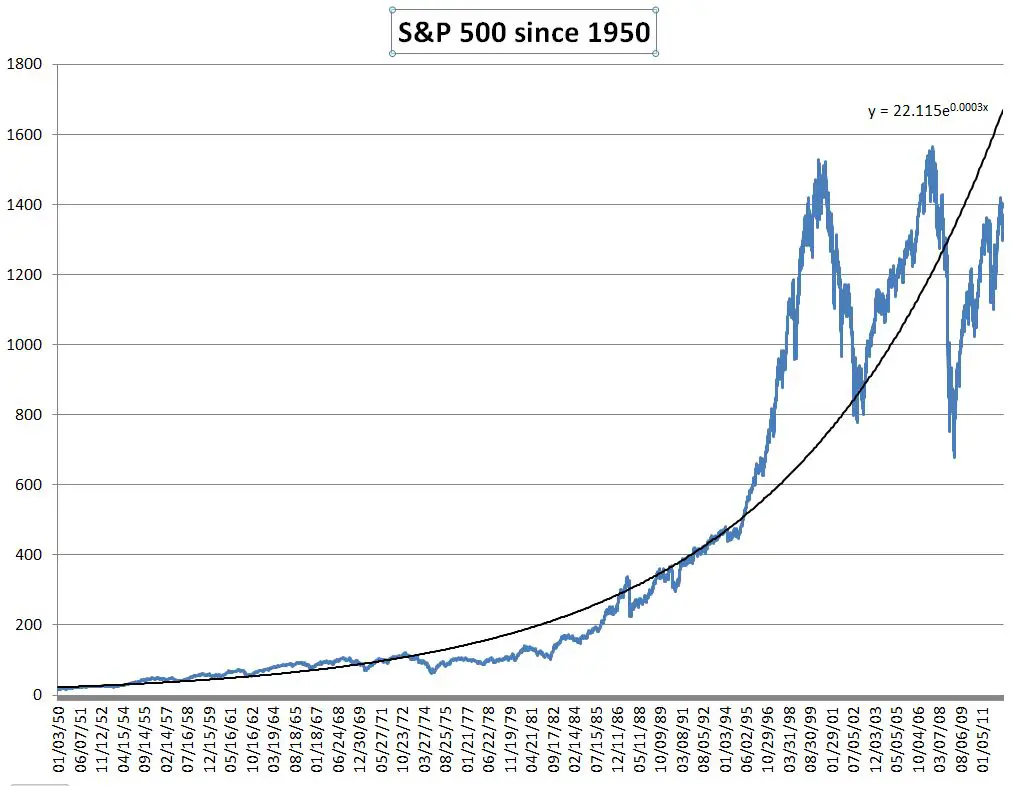

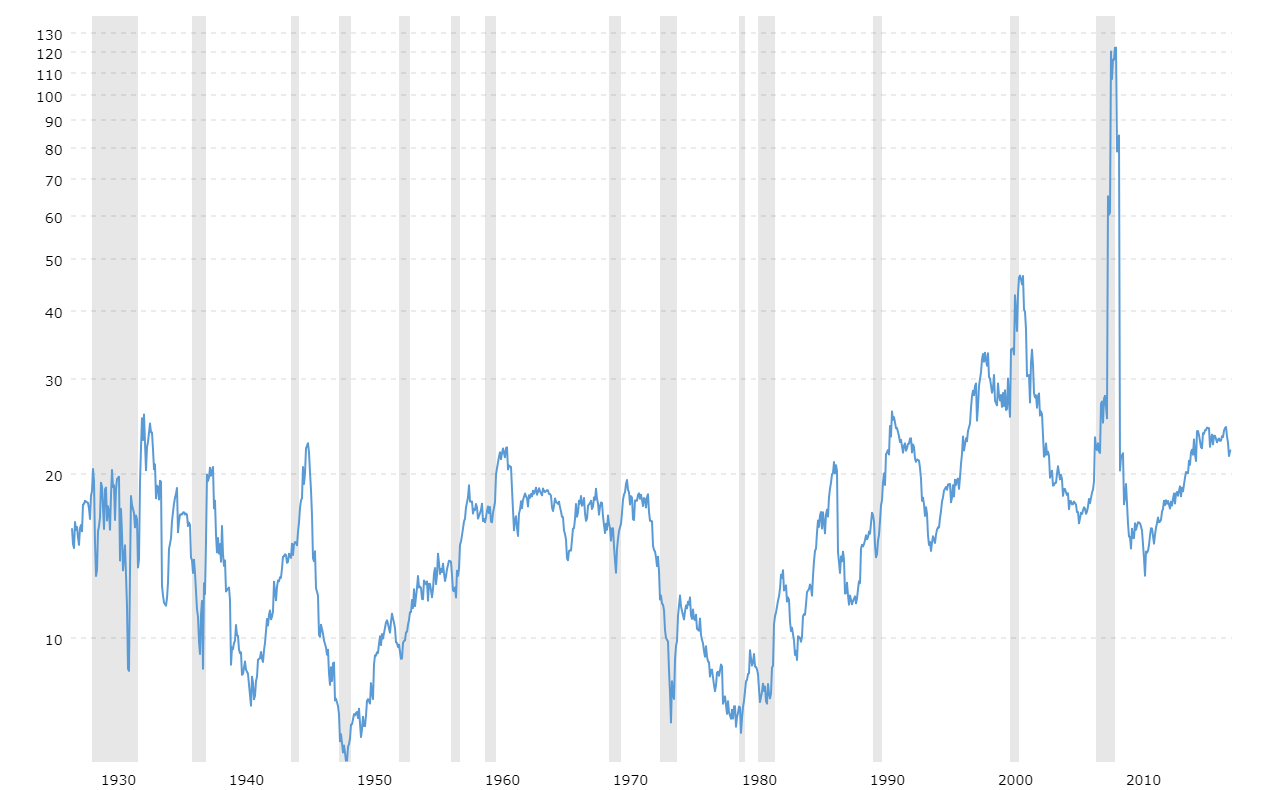

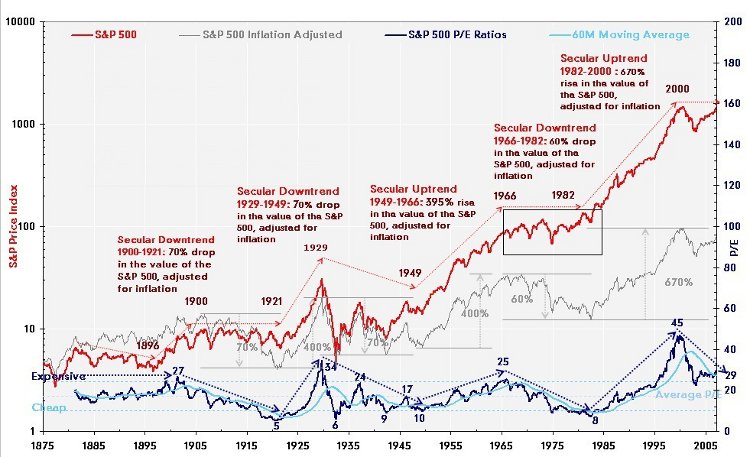

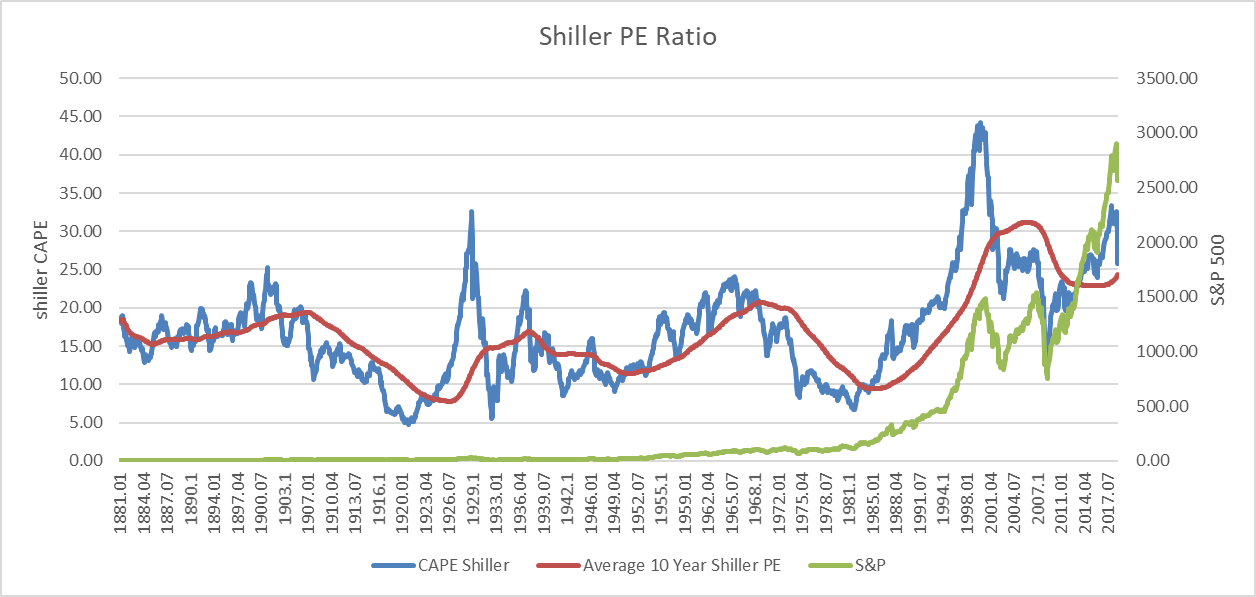

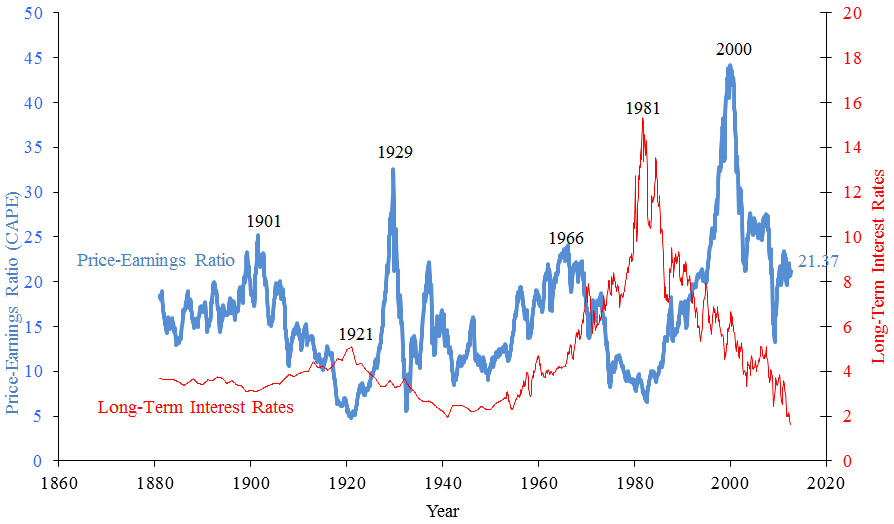

S p 500 pe ratio vs price. The forward 12 month p e ratio for the s p 500 is 21 7x in comparison to a 10 year. This smooths out the p e ratio and is a better gauge of valuation during recessions. Back on december 31 the trailing 12 month p e ratio was 17 9. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

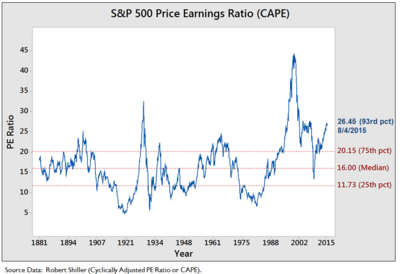

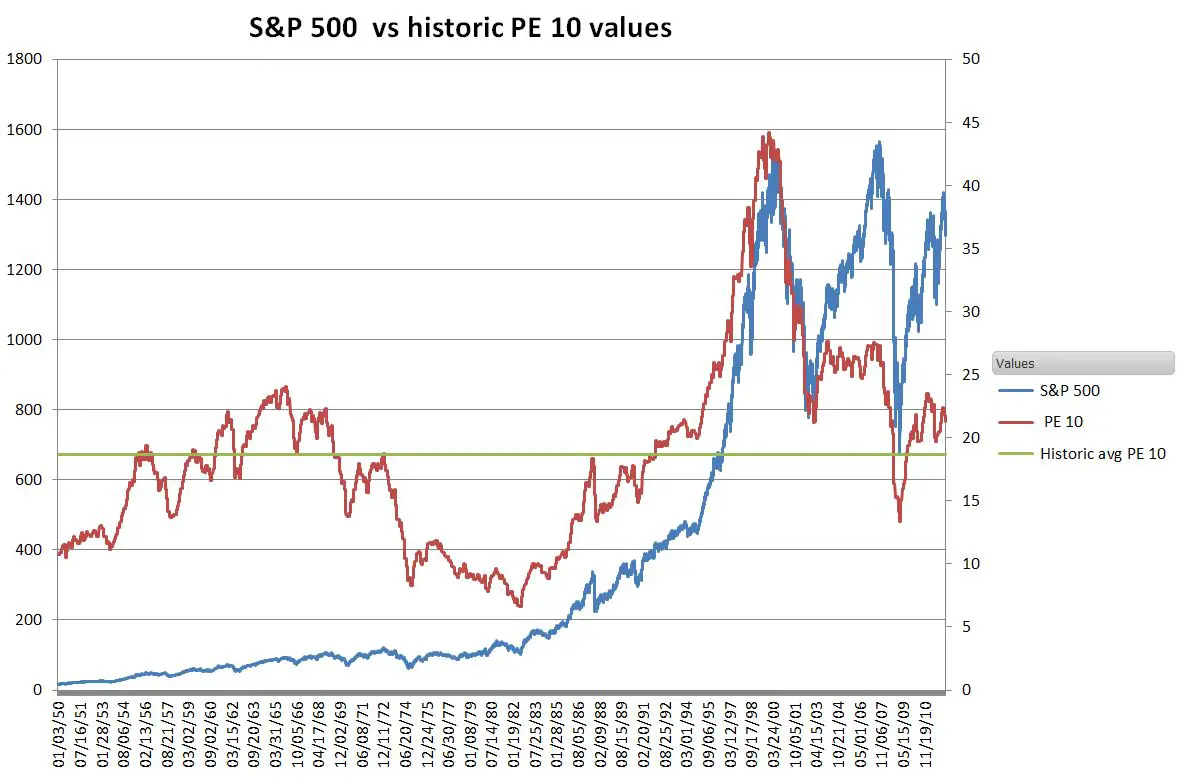

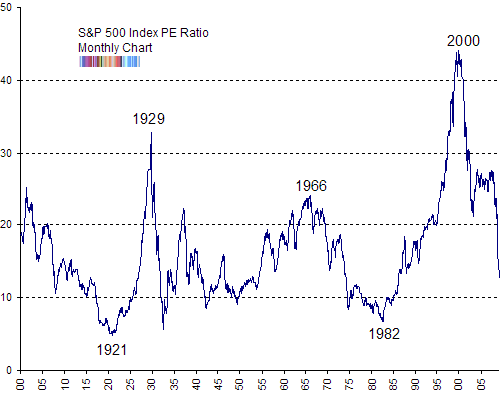

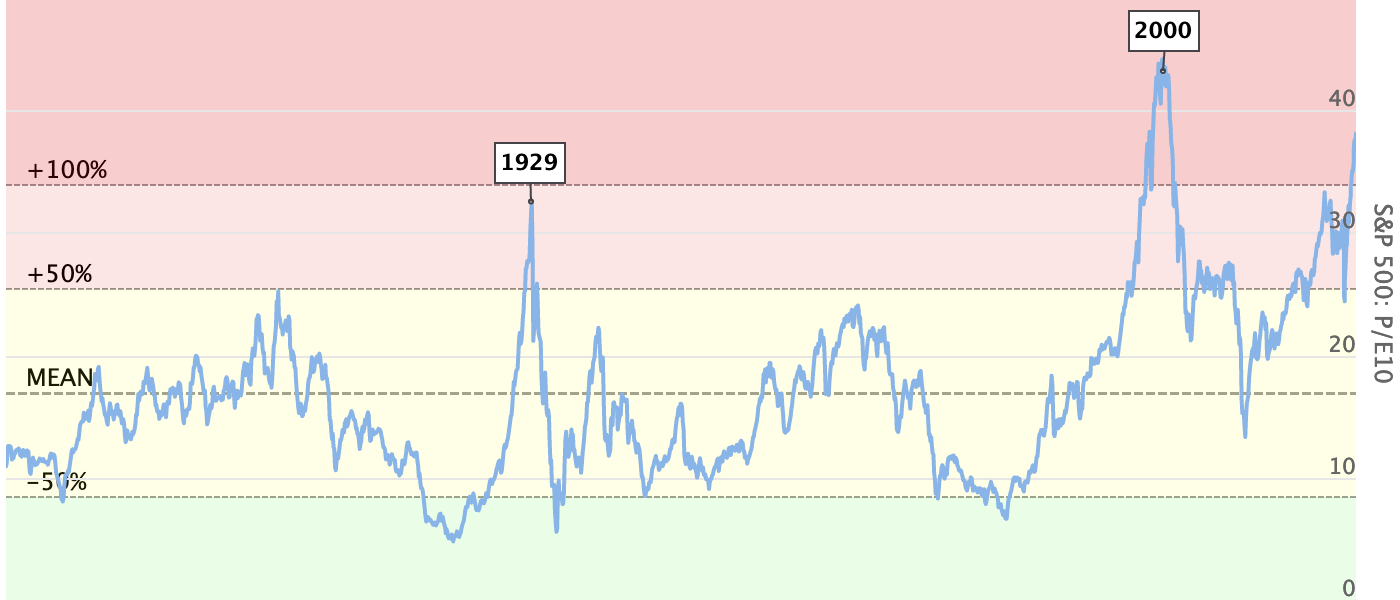

S p 500 by president from election date s p 500 90 year historical chart. S p 500 by president. This smooths out the price to earnings ratio and is a better gauge of valuation during recessions. A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years.

S p 500 pe ratio table by year historic and current data. S p 500 pe ratio chart historic and current data. As an example the s p 500 s p e ratio in 2009 was 70 9 which would be wildly overvalue. The shiller pe of the s p 500 currently stands at just over 30 as of early august 2020.

As an example the s p 500 s p e ratio in 2009 was 70 9 which would be wildly overvalued. In 2009 when earnings fell close to zero the ratio got out of whack. Since this date the price of the s p 500 has increased by 5 9 to 2163 75 from 2043 94 while the trailing 12 month eps. S p 500 ytd performance.

How to use the p e ratio the most common use of the p e ratio is to gauge the valuation of a stock or index. The price to earnings p e ratio rose to 26 6 in q1 2020 the highest since the 2009 financial crisis and well above the historically applicable benchmark of 15 5. The pe10 ratio or shiller pe ratio divides the current price by average earnings over the last decade. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

If we look at how expensive stocks are on a forward 12 month basis we also arrive at the same conclusion. S p 500 historical annual returns. The pe10 ratio or shiller pe ratio divides the current price by average earnings over the last decade.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/05.2020/05.11.2020_TOW/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2020%20Years.png)