S P 500 Sector Performance 2020

As of market close june 10 2020.

S p 500 sector performance 2020. S p 500 index sector performance as of aug 28 2020. One of the stats followed by investors is the p e ratio. S p 500 performance during major crashes as of august 2020 largest s p 500 companies by market cap 2020 returns of s p 500 index in the u s. Stock index is now positive for the year yet most of its components have sat out the rally.

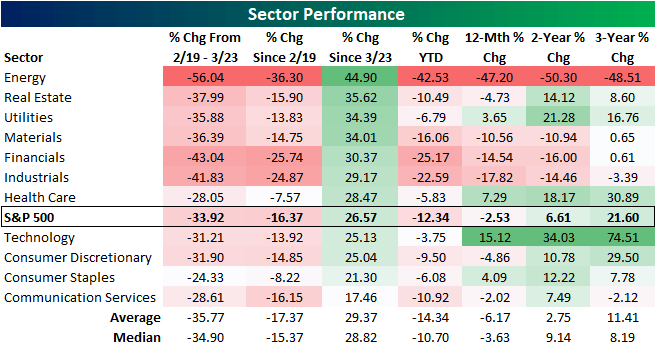

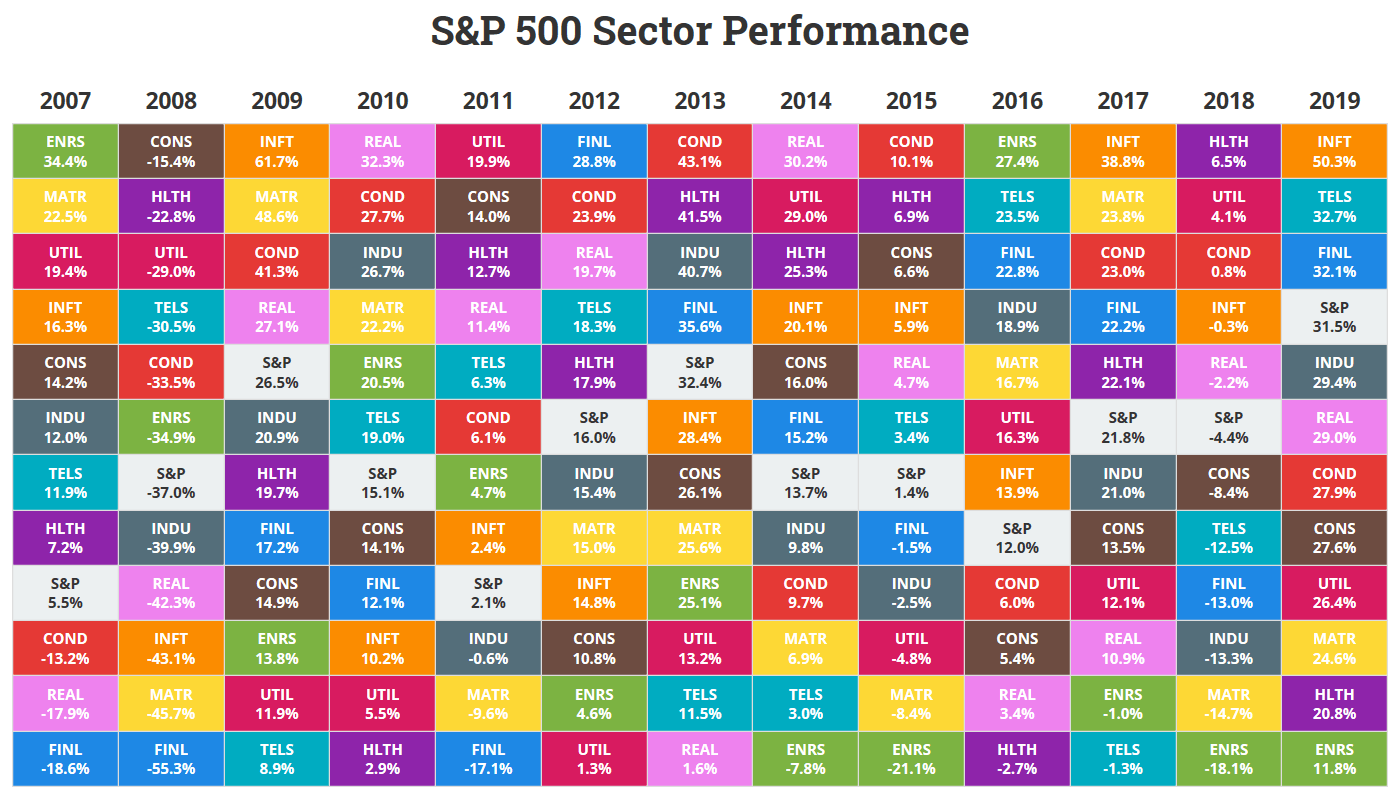

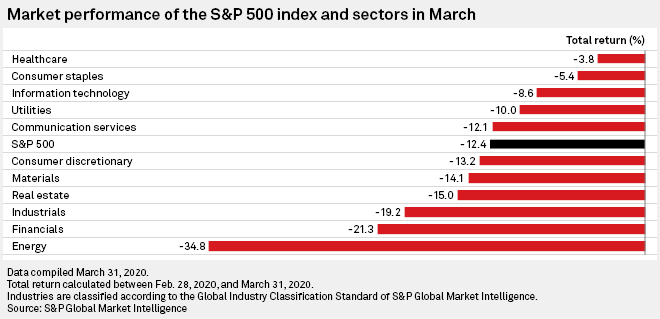

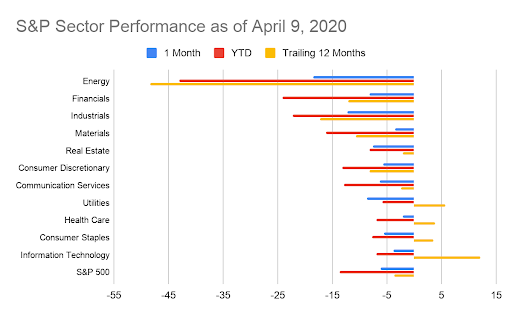

The benchmark s p 500 spx u s. Jan feb mar apr may jun jul aug sept oct nov dec 2020 40 30 20 10 0 10 20 30 40 50 40 30 20 10 0 10 20 30 40 50 s p communication services indexes 2020 performance percent change ytd communication services. This is impressive considering that over the last decade the sector averaged 17 in annualized returns. As of june 11th the s p 500 information technology sector has returned 13 5 ytd.

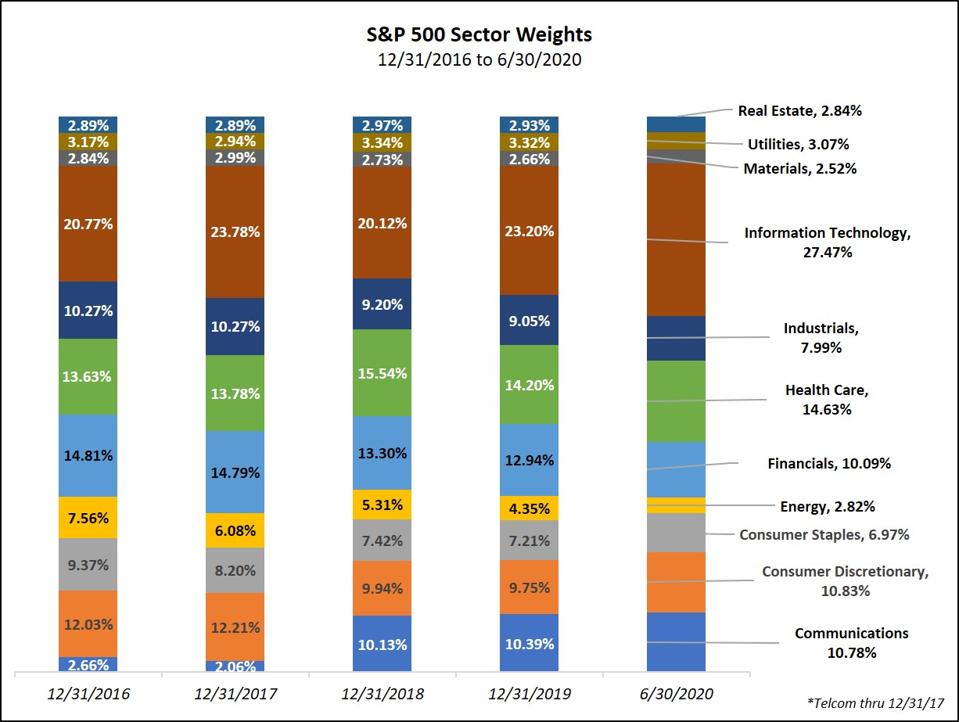

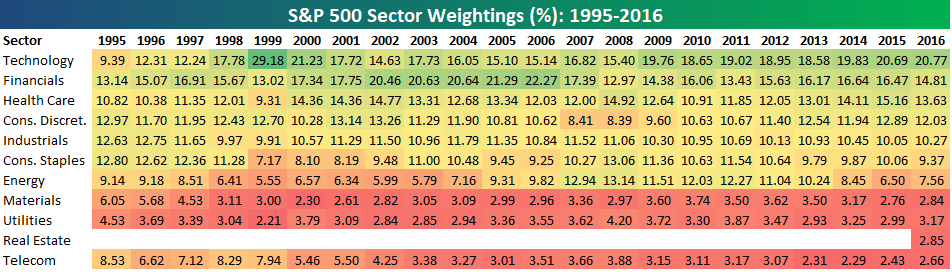

S p 500 turns positive for 2020 but most stocks are missing the. Last change is the nominal change in the price of the index from the previous trading day s close expressed as a percentage as of the index value at the time noted in the date time field. Page 9 october 30 2020 performance 2020. In total the s p 500 tracks 126 industries and each one presents unique risks and opportunities.

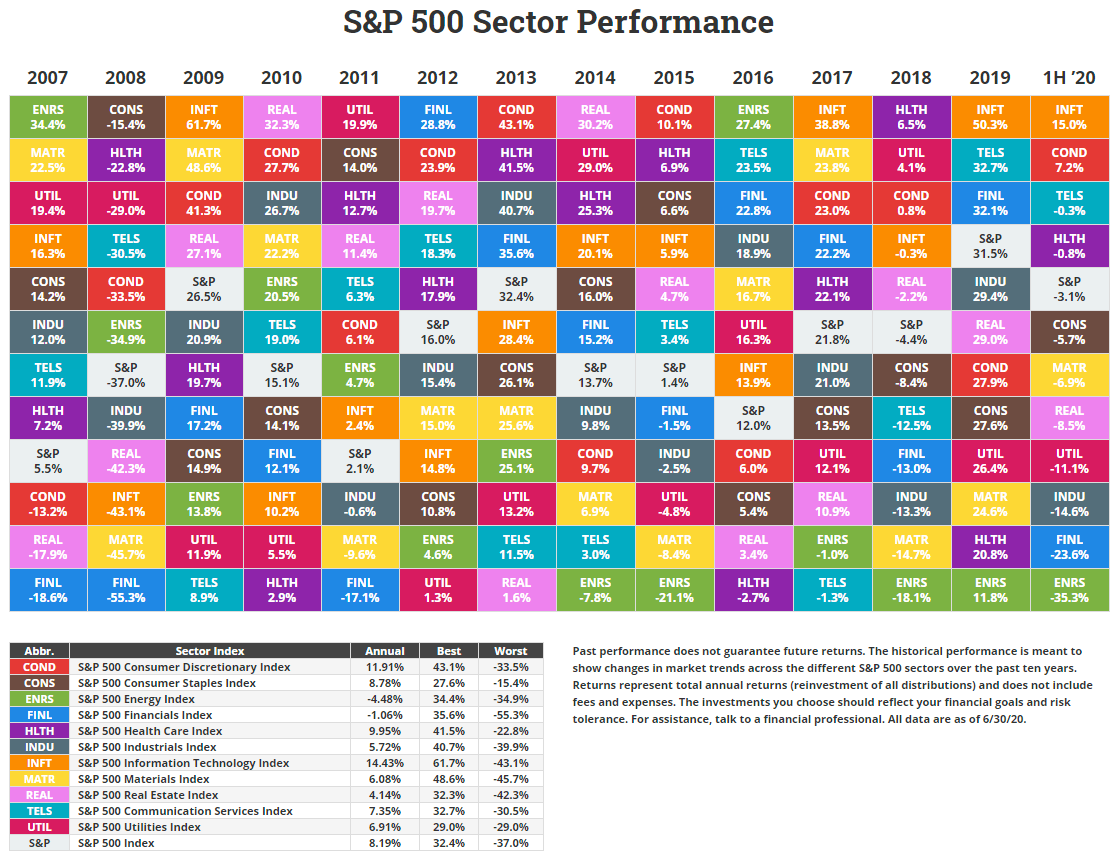

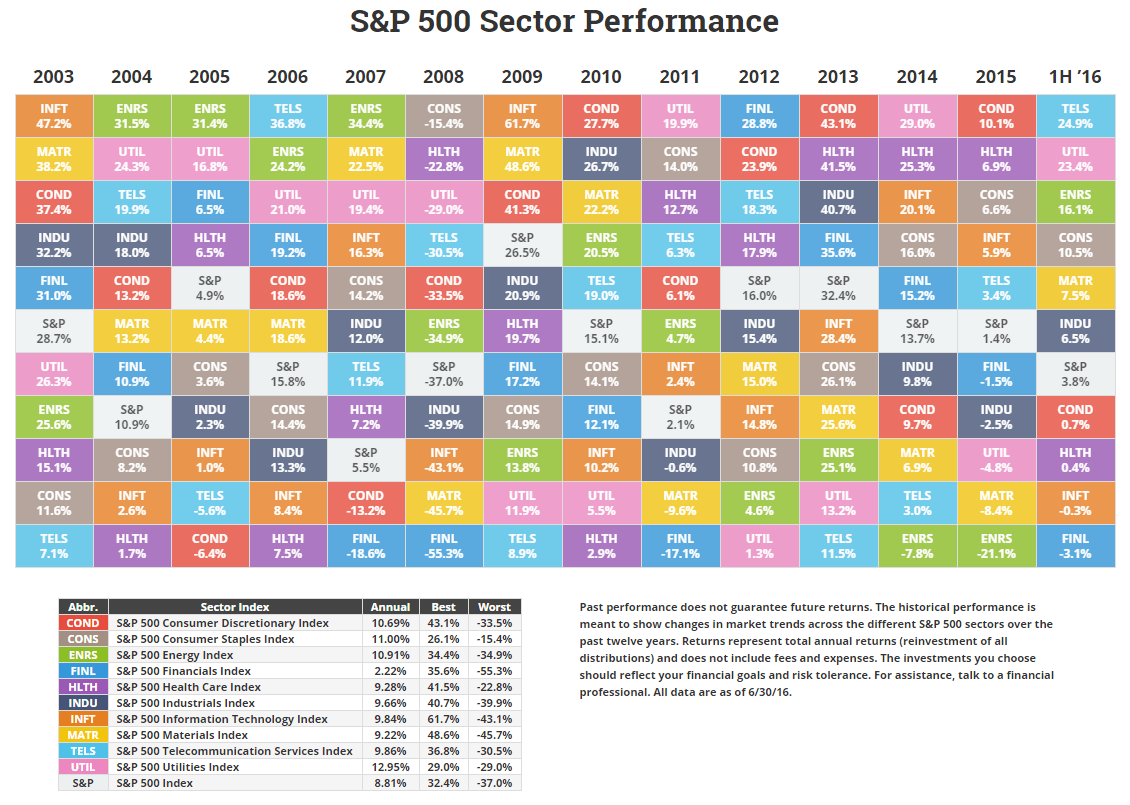

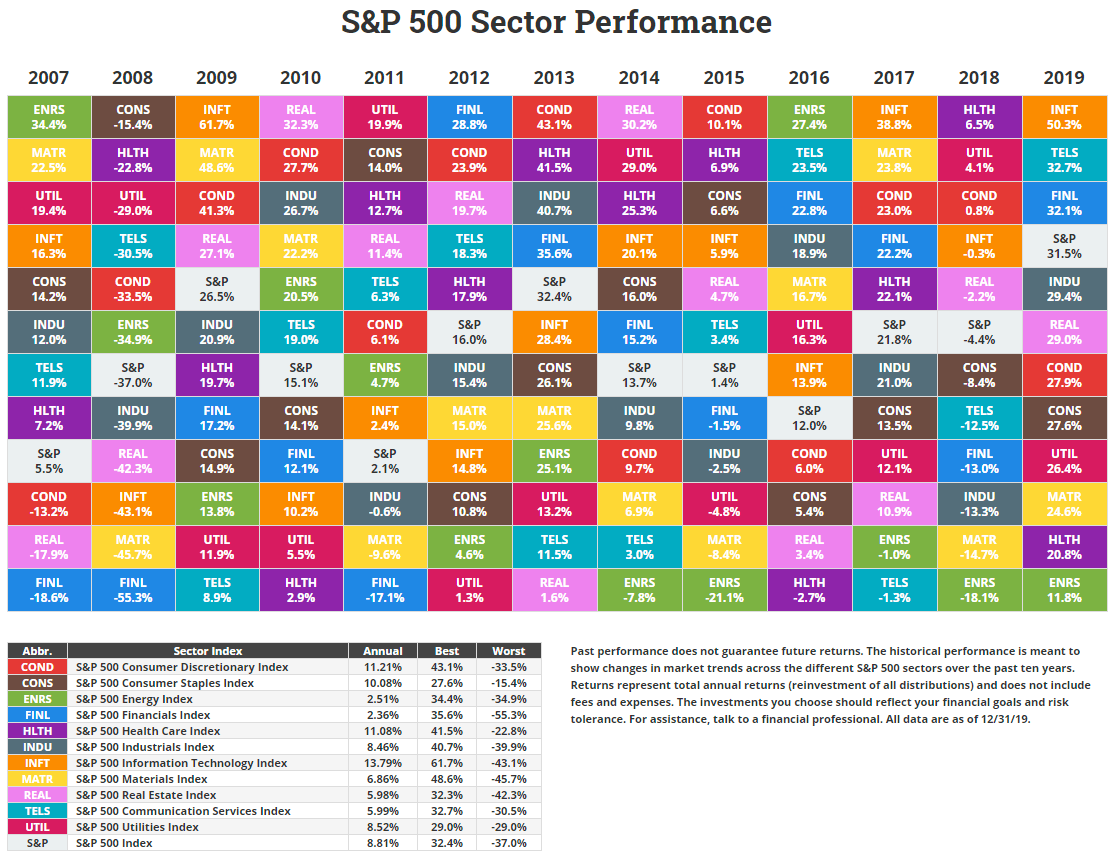

The main s p 500 sectors can be easily replicated by etfs. Sectors industries performance is represented by the s p 500 gics global industry classification standard indices. A 1 year chart of the s p 500 index showing percent comparisons against the 11 s p sectors is shown at the top of the page. Jan feb mar apr may jun jul aug sep oct nov dec 2020 40 35 30 25 20 15 10 5 0 5 10 15 20 25 30 35 40 45 40 35 30 25 20 15 10 5 0 5 10 15 20 25 30 35 40 45 s p 500 communication services industry performance.

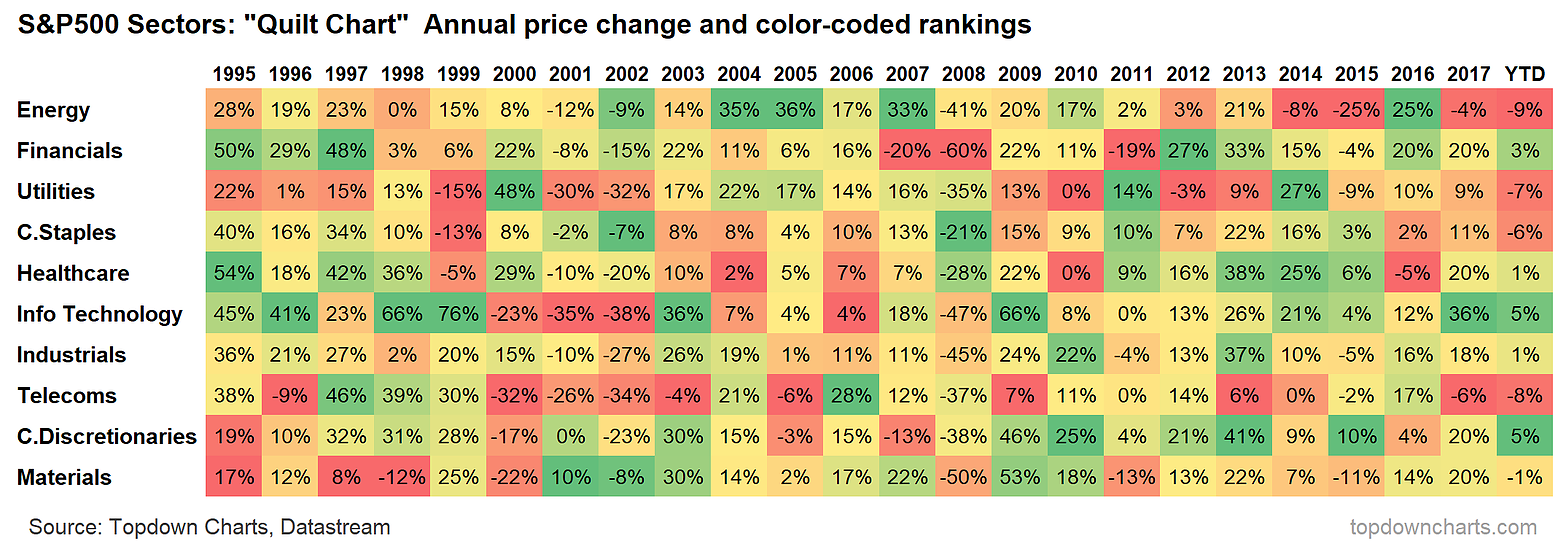

The best performing sector in the last 10 years is s p information technology that granded a 18 28 annualized return. Use the check boxes to show or hide certain sectors. Data as of july 31 2020. It goes without saying then that large technology firms have proven resistant to 2020 s severe market upheavals.

The worst is s p energy with a 4 03 annualized return in the last 10 years.