S P 500 Sharpe Ratio

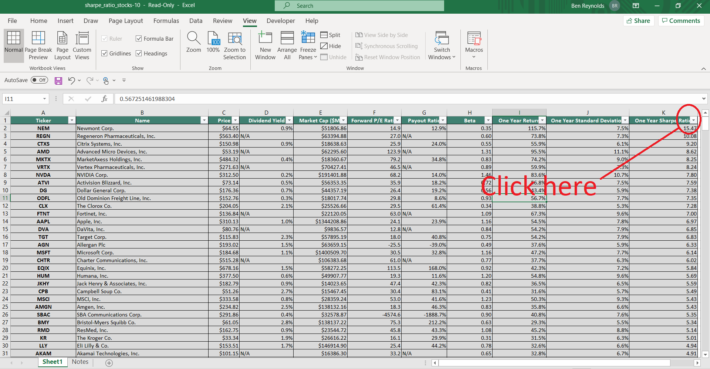

The sorted beta and sharpe ratio for all companies listed in the s p 500 as of october 2020 are now available.

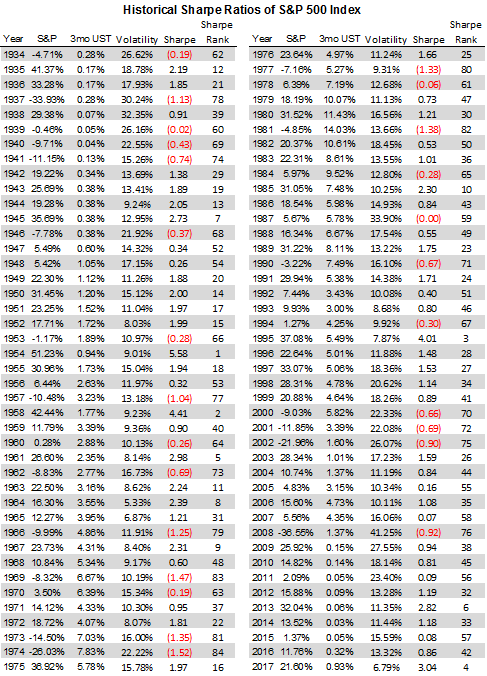

S p 500 sharpe ratio. S p 500 performance is 10. Download your list of the 100 stocks in the s p 500 with the highest sharpe ratio a popular investing metric for assessing stock risk adjusted returns. Beta and sharpe are calculated using 3 years of bi weekly returns. The 5 companies with the highest beta are as follows.

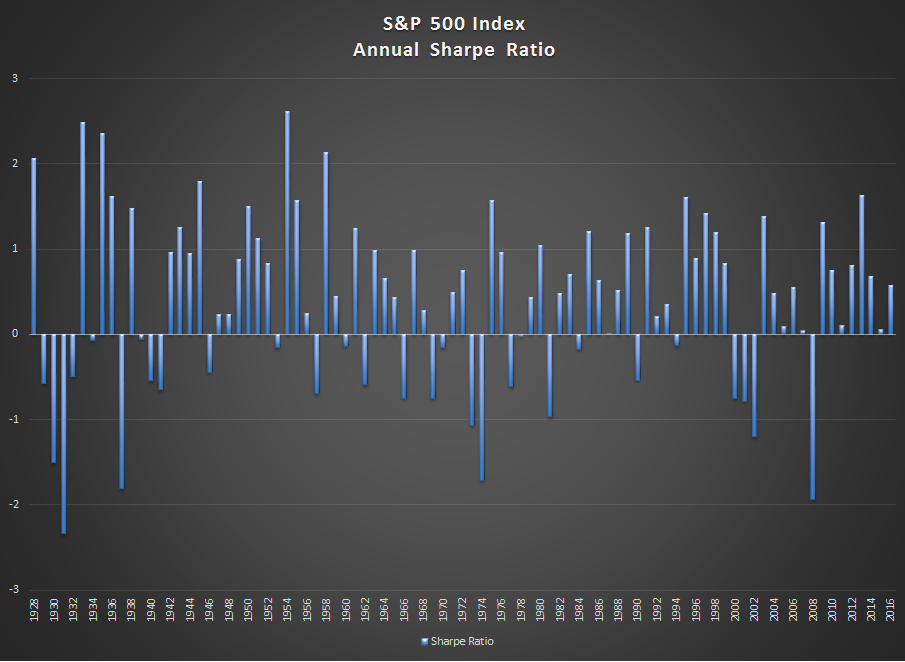

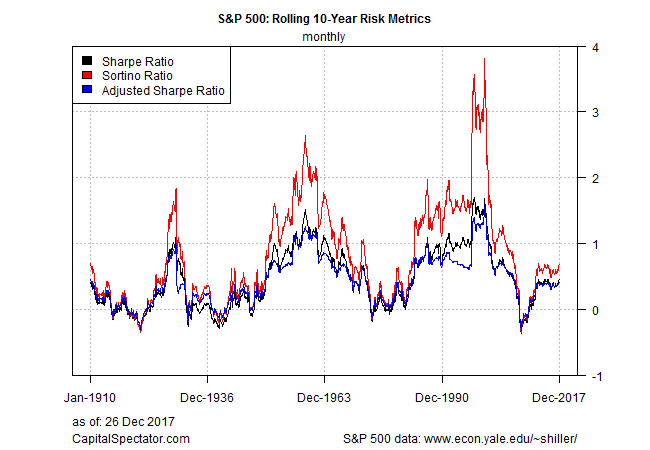

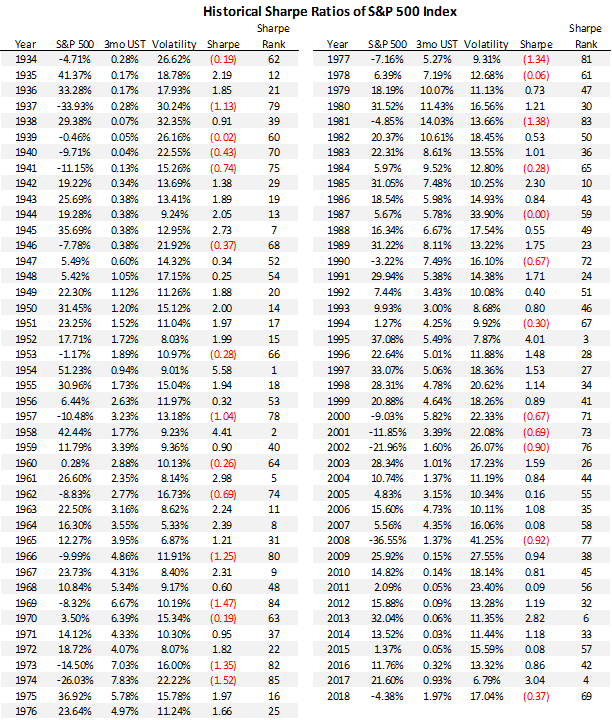

Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close. The sharpe ratio is a measure of risk adjusted return which compares an investment s excess return to its standard deviation of returns. Top 10 highest sharpe ratio from s p 500 jan 3 2020. Generally speaking the higher the sharpe ratio the better.

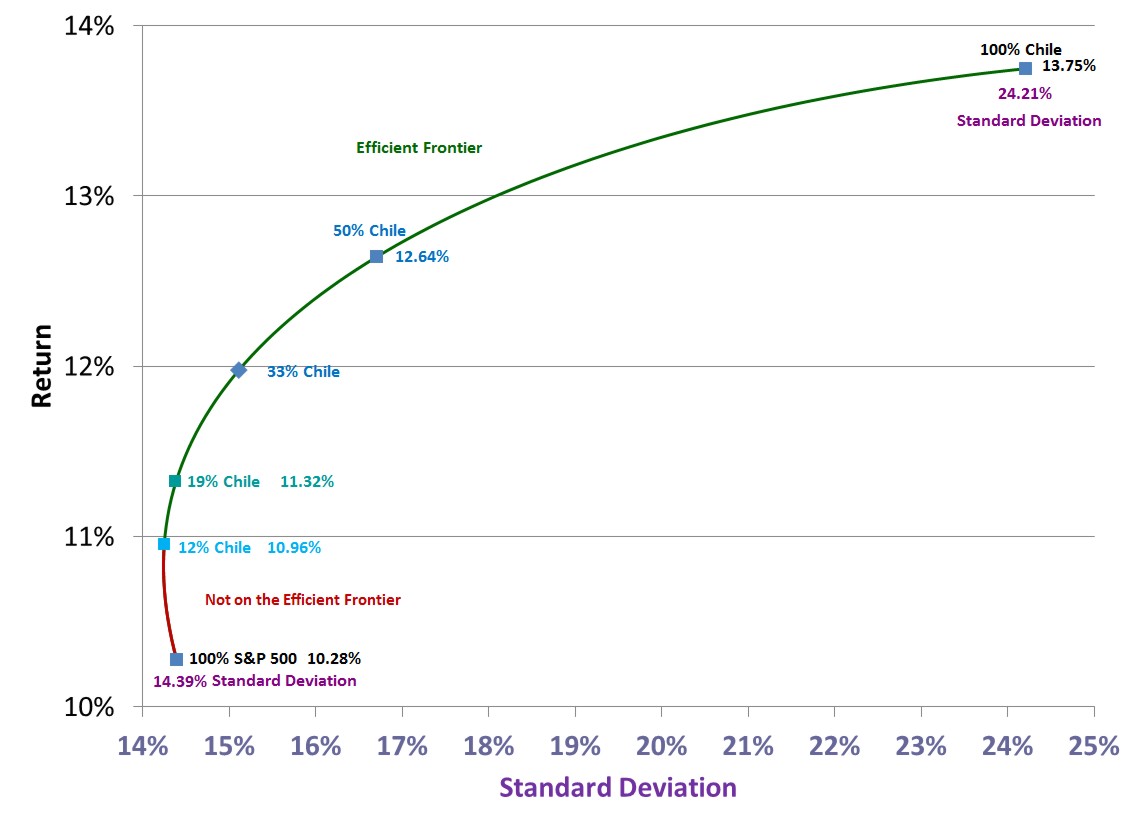

Although it looks like b performs better in terms of return when we look at the sharpe ratio. The calculation for the sharpe ratio is the return of an asset in excess of cash divided by the volatility of that asset over that same period. To learn more about beta and the sharpe ratio check out my post about measuring risk and return. S p 500 ends friday higher but posts first weekly loss in a month as stimulus concerns linger breaking news oct 23 2020 nielsen.

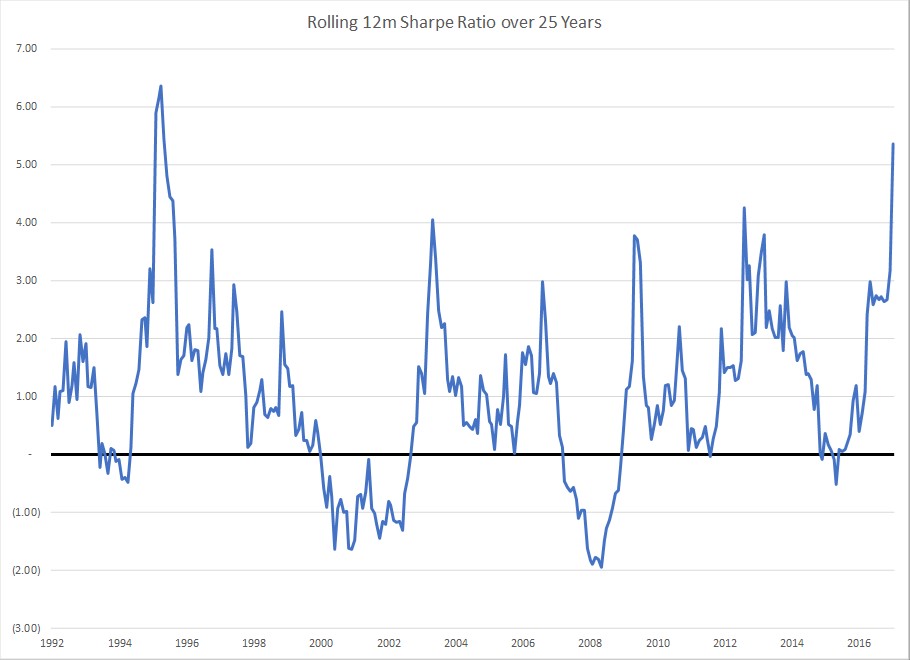

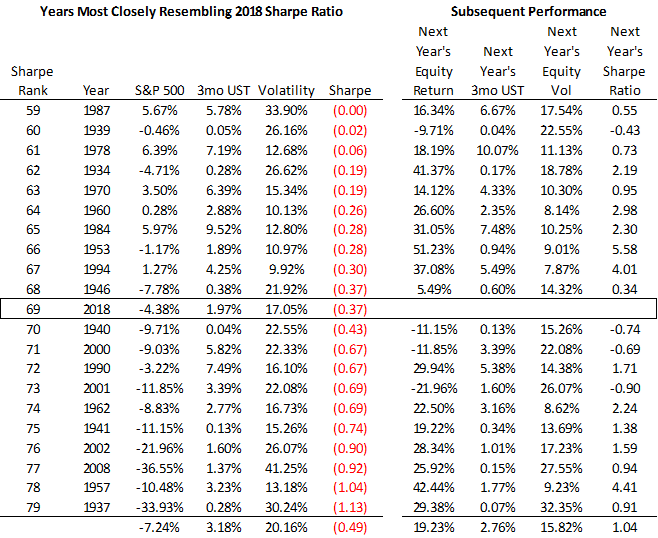

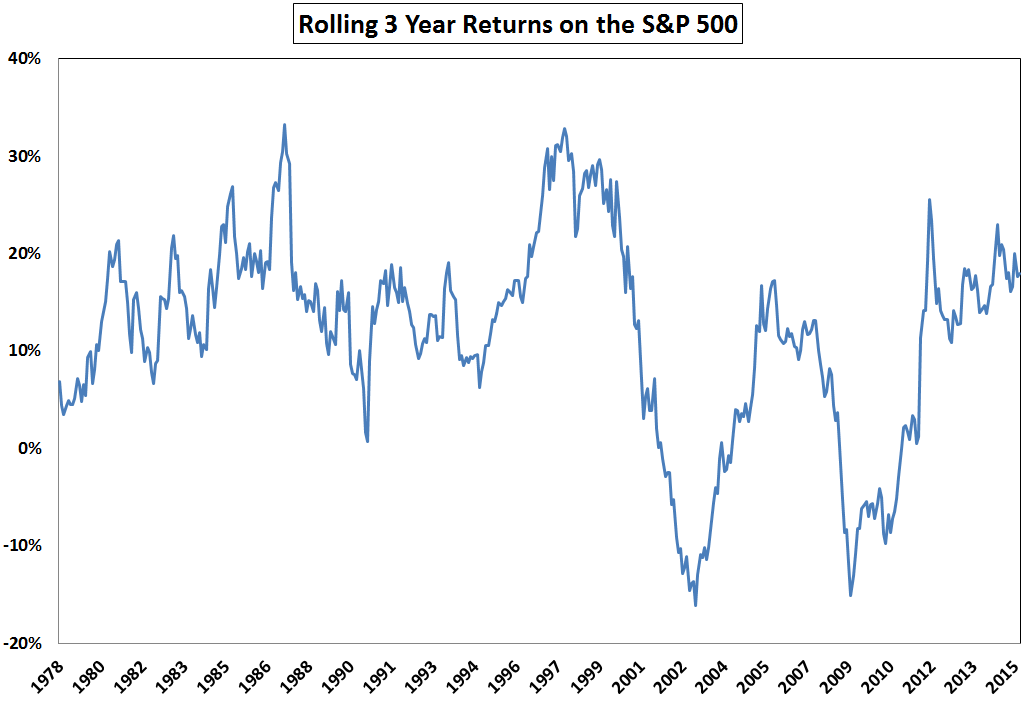

Final trump biden debate drew in 21 4 million down sharply. Over the past 25 years the average annual sharpe ratio for the s p 500 has been 1 0 with frequent periods of much higher and lower levels. The sharpe ratios are calculated for 3 years and 5 years and ranked for top 10.