S P Pe Ratio History

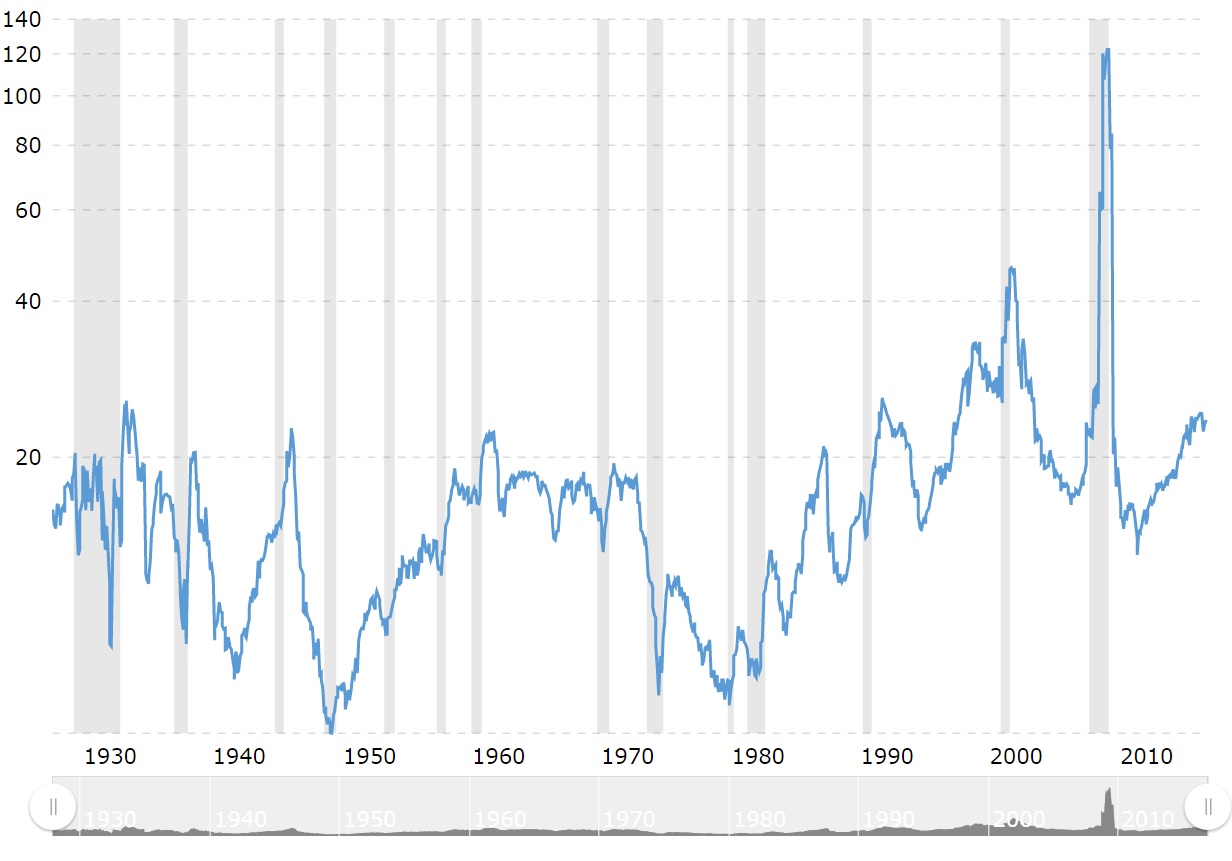

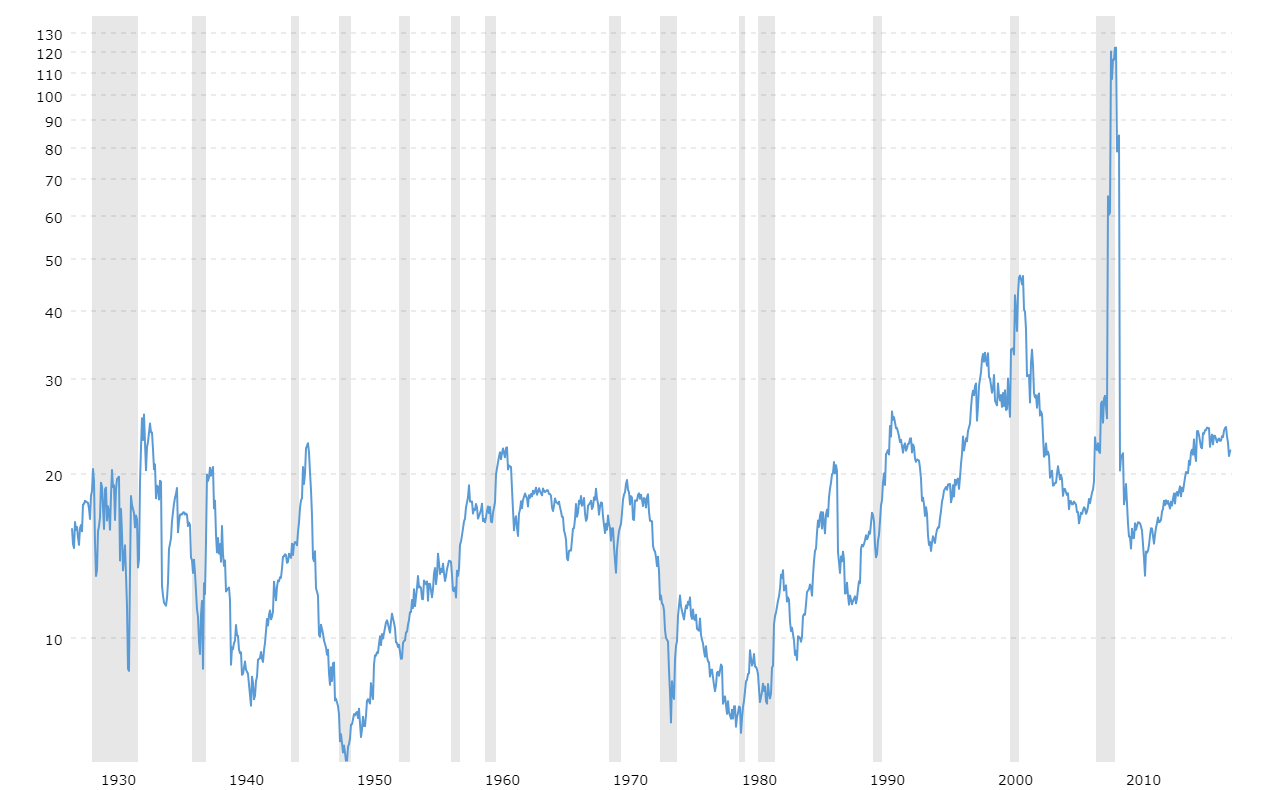

Historically the s p 500 pe ratio peaked above 120 during the financial crisis in 2009 and was at its lowest in 1988.

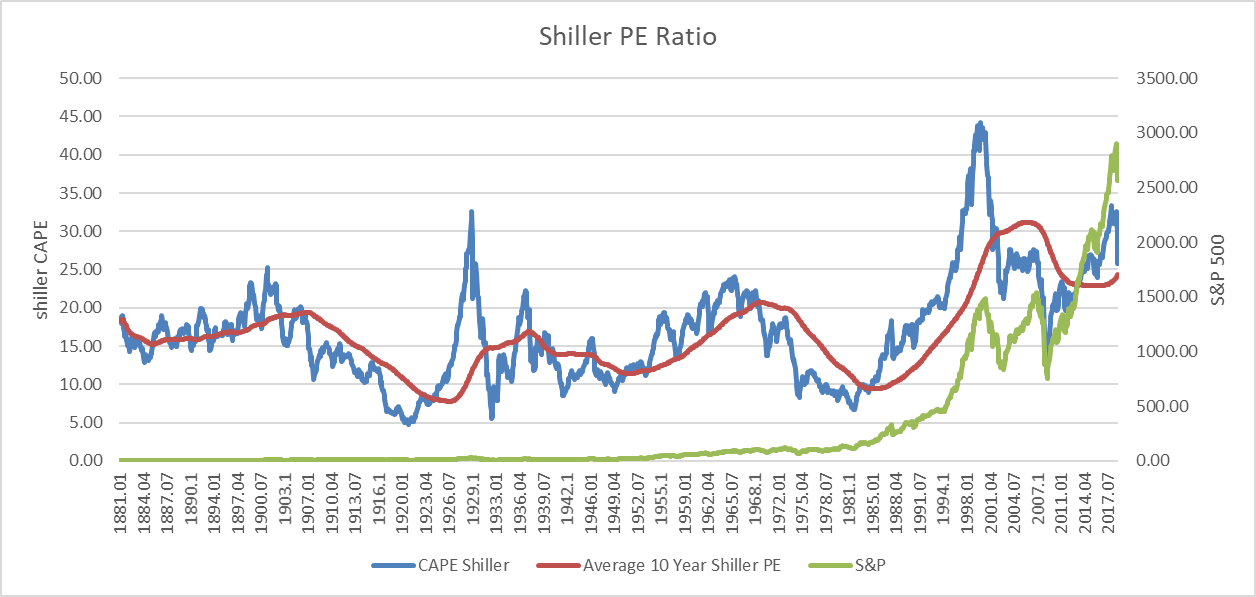

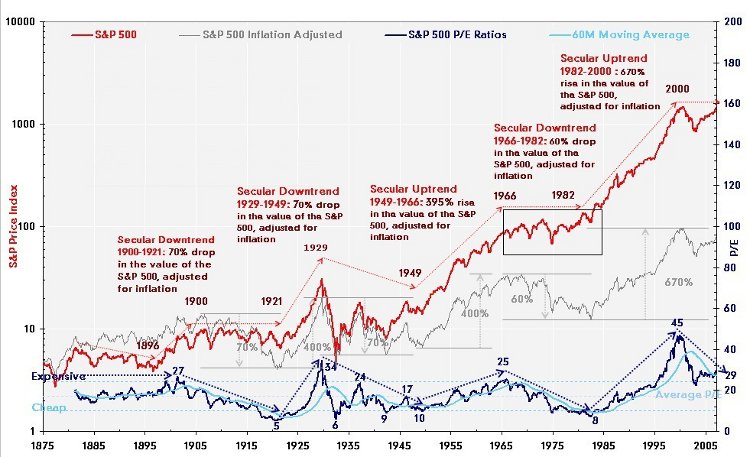

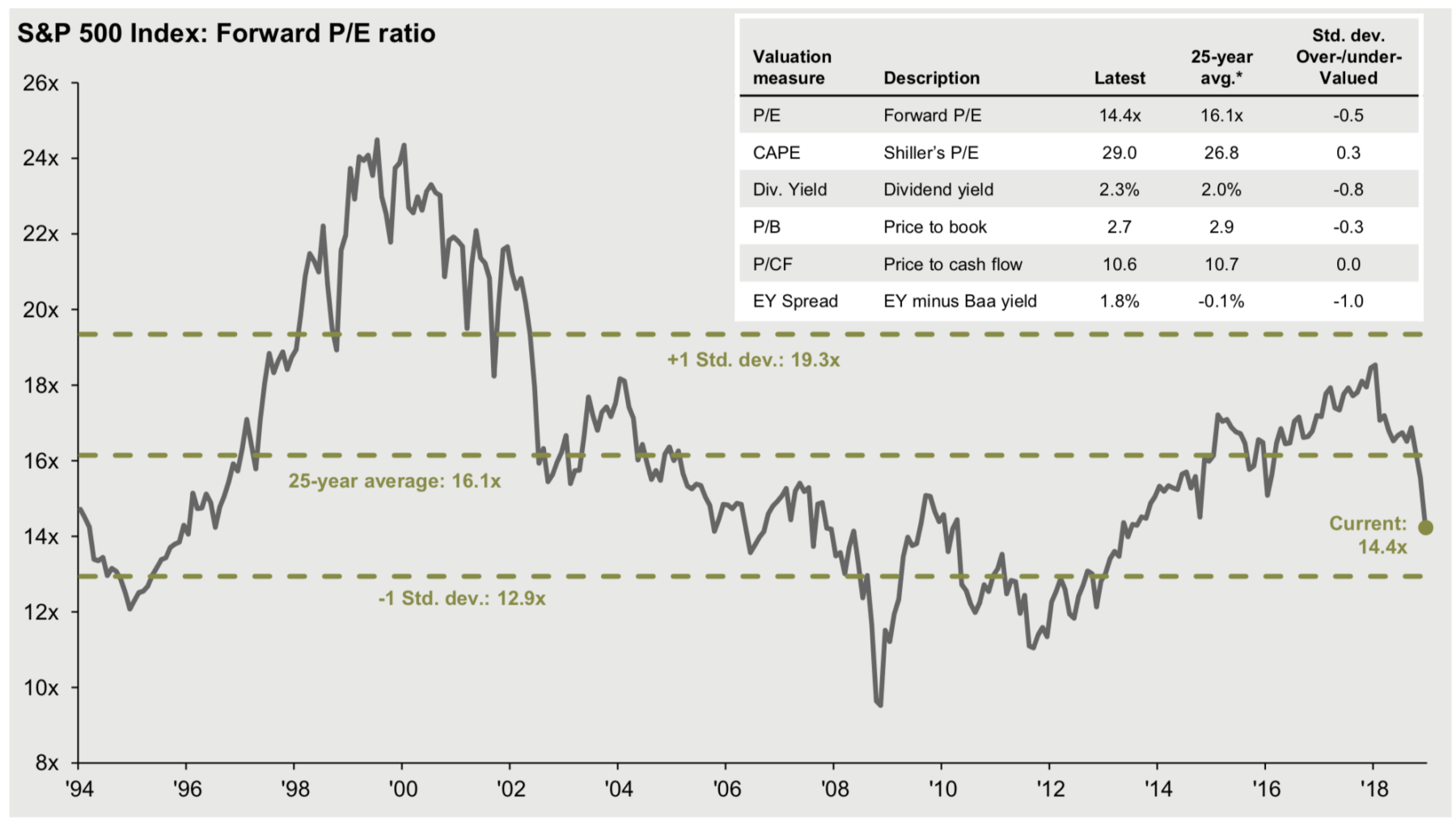

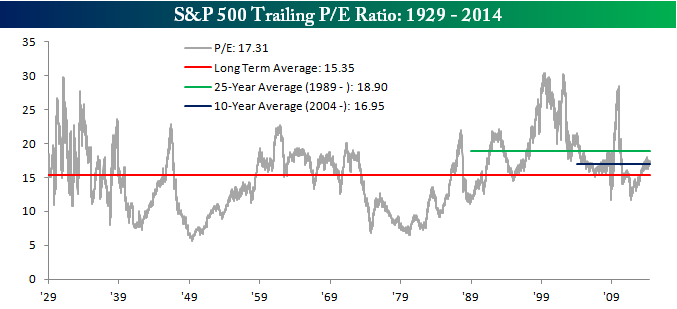

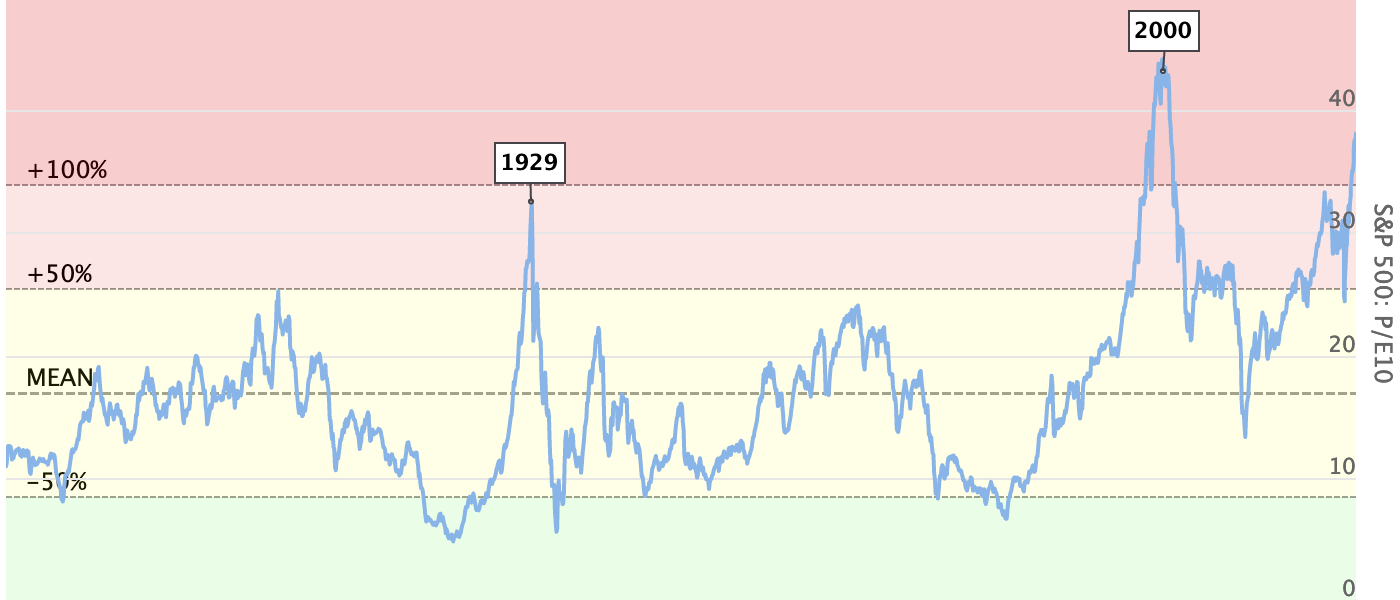

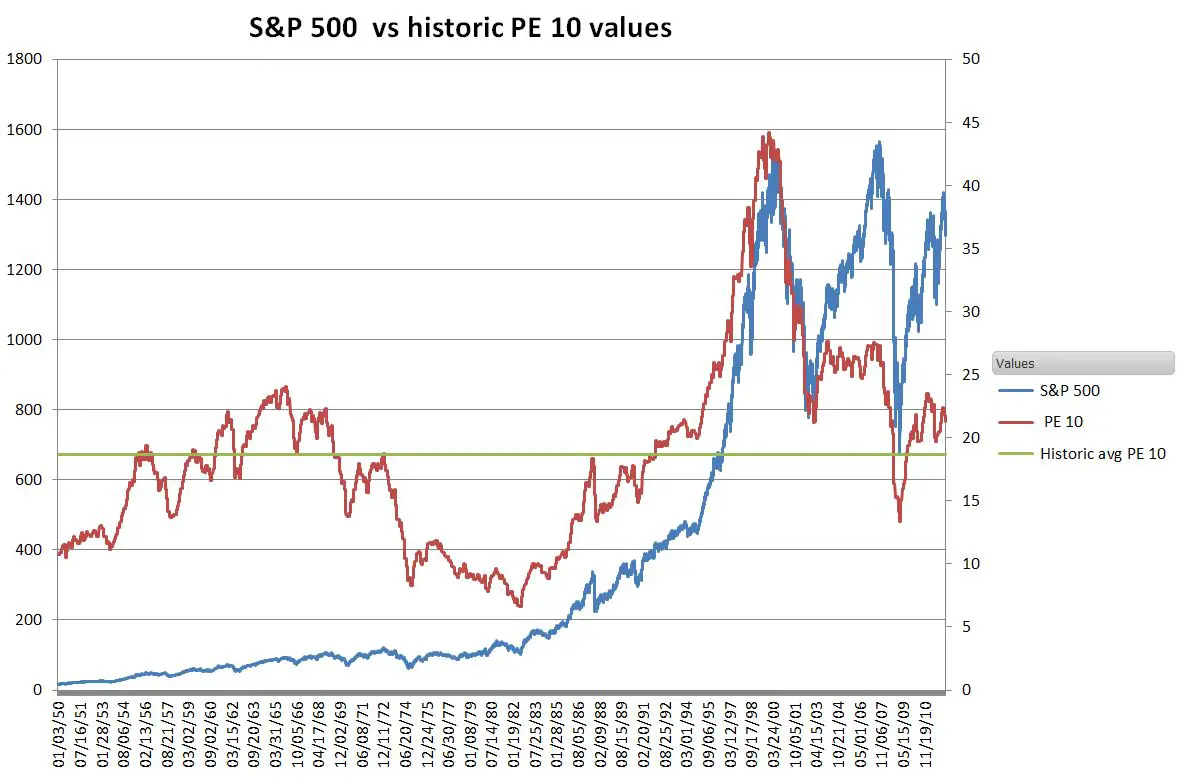

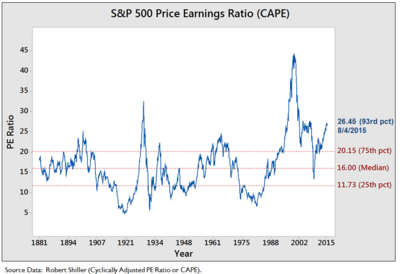

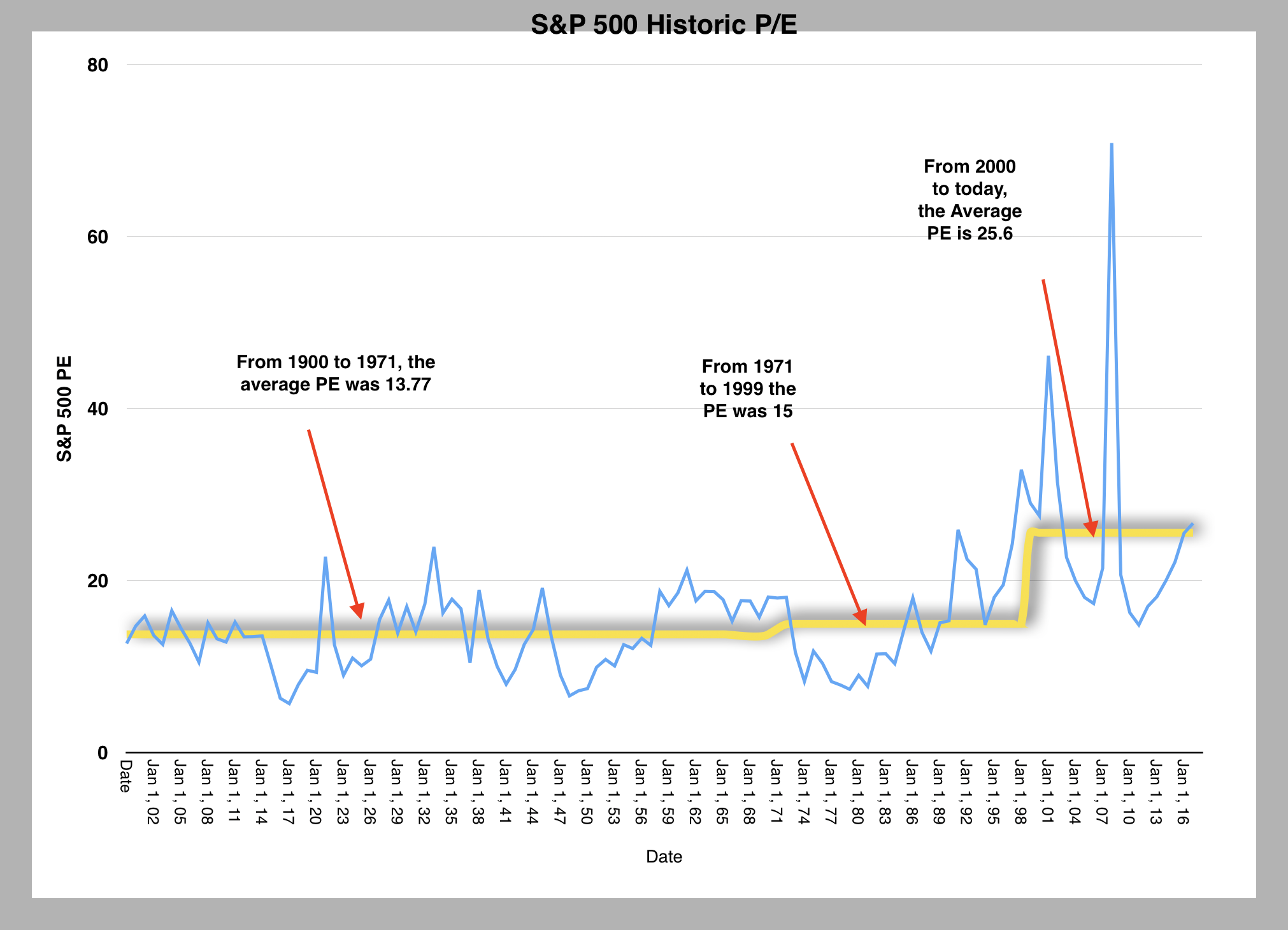

S p pe ratio history. Current s p 500 pe ratio is 32 95 a change of 0 40 from previous market close. S p 500 p e ratio is at a current level of 31 24 up from 22 22 last quarter and up from 21 75 one year ago. The historical average for the s p 500 dating back to when the index was created in the 1800s is around 16. A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years.

The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months. This is a change of 40 62 from last quarter and 43 67 from one year ago. The historical pe ratio graph illustrates the historical valuations the s p companies have experienced. This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

The price to earnings ratio is calculated by taking the latest closing price and dividing it by the most recent earnings per share eps number. S p 500 pe ratio 90 year historical chart. S p 500 pe ratio chart historic and current data. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio.

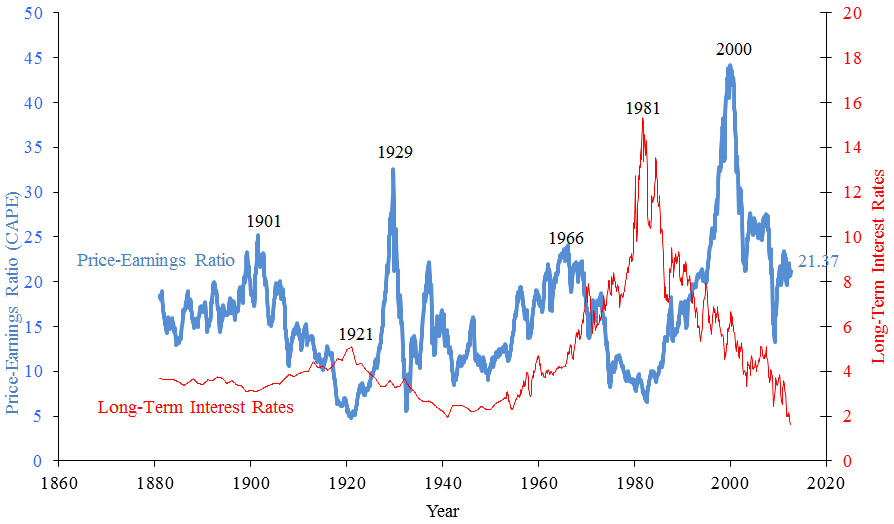

Factors that impact the s p p e ratio includes federal interest rates economic growth and productivity. In 2009 when earnings fell close to zero the ratio got out of whack. S p 500 pe ratio table by year historic and current data. Here s a historical.

Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close. The pe ratio is a simple way to assess whether a stock is over or under valued and is the most widely used valuation measure. Current and historical p e ratio for domino s pizza inc dpz from 2006 to 2020. Metrics and data to guide value investing.

Historical pe ratios are often used with the s p 500 when analyzing trends and deciding whether the overall market is expensive or cheap for example the current p e ratio of the s p 500 is around 20.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S&P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S&P%20500%20Forward%2012%20month%20PE%20ratio.png)