S P Pe Ratio

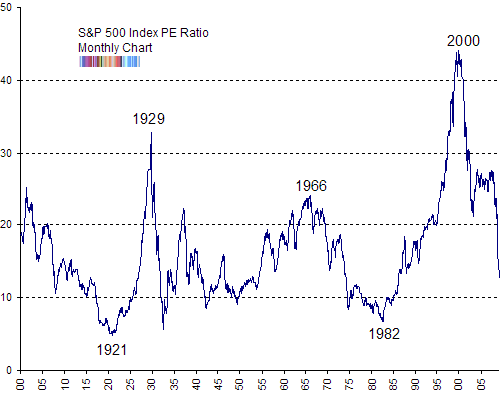

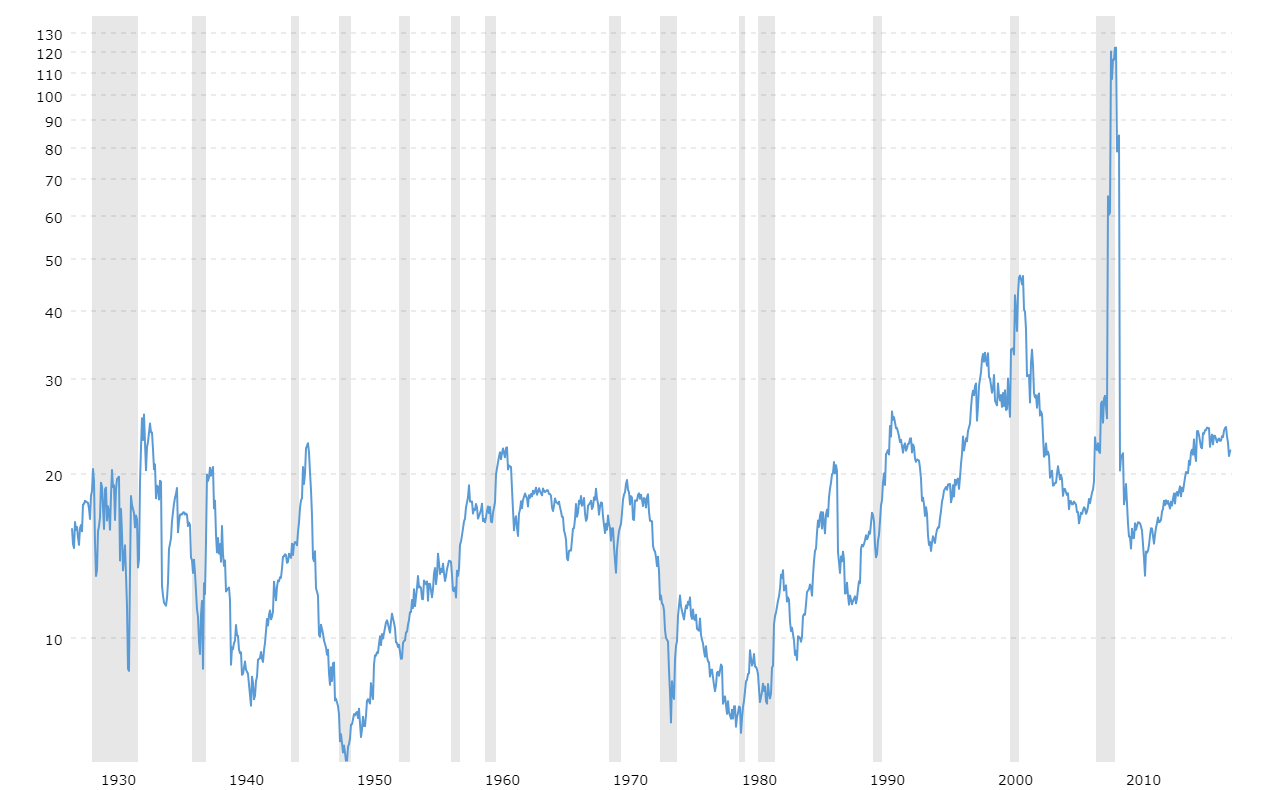

This interactive chart shows the trailing twelve month s p 500 pe ratio or price to earnings ratio back to 1926.

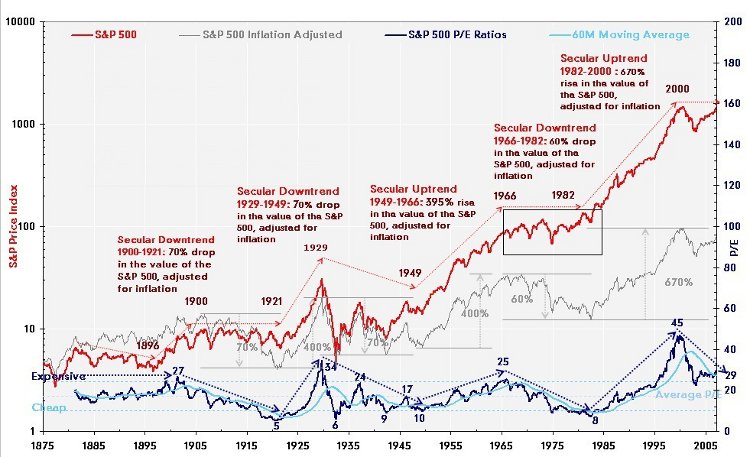

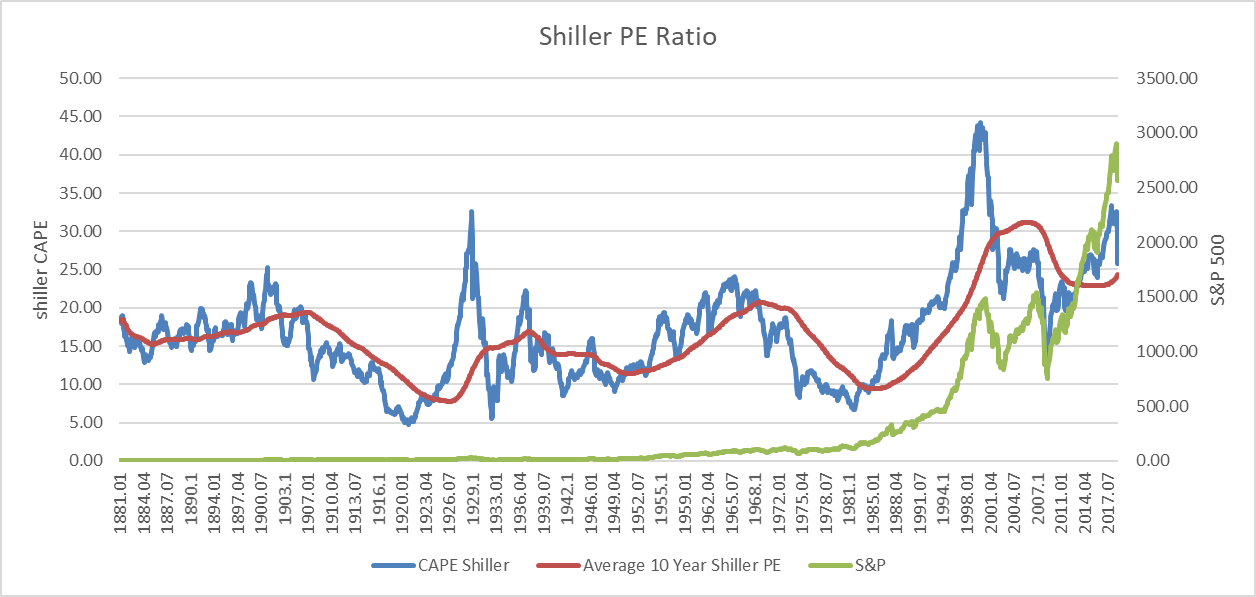

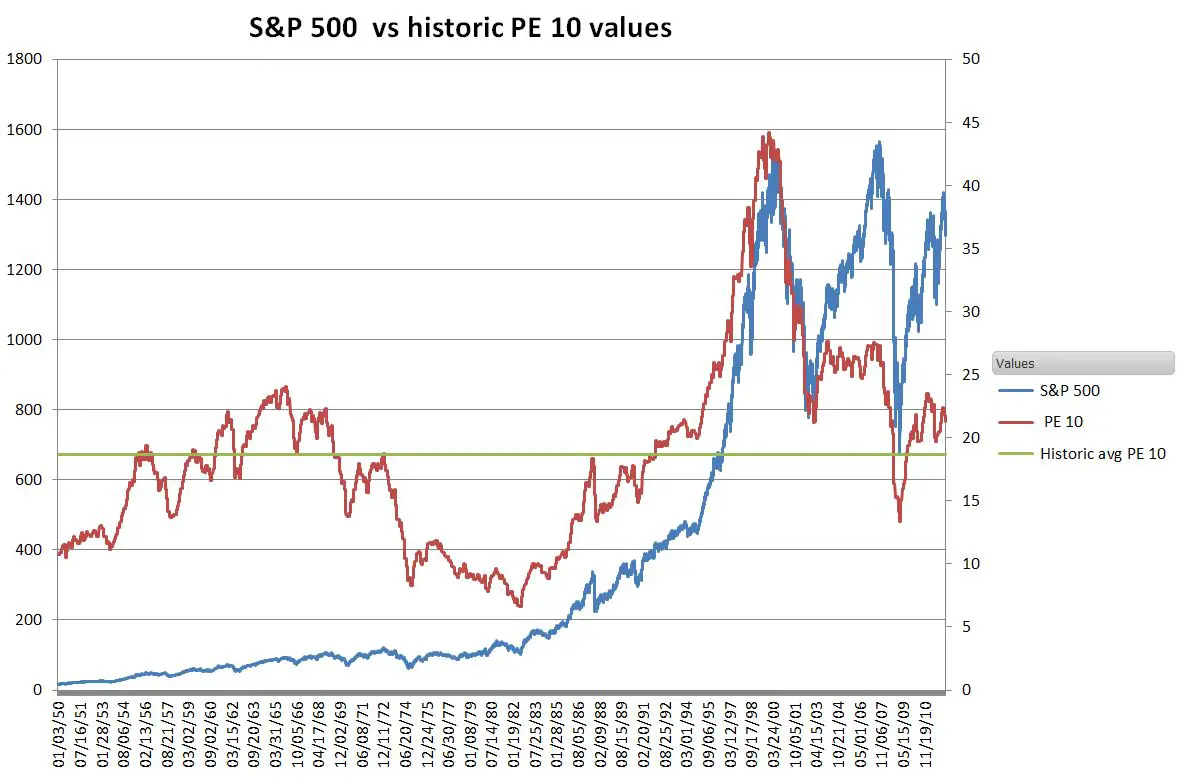

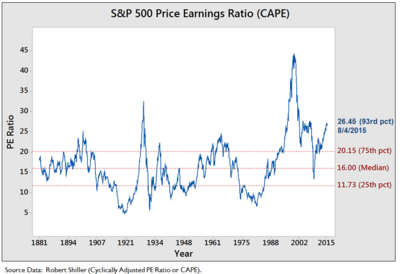

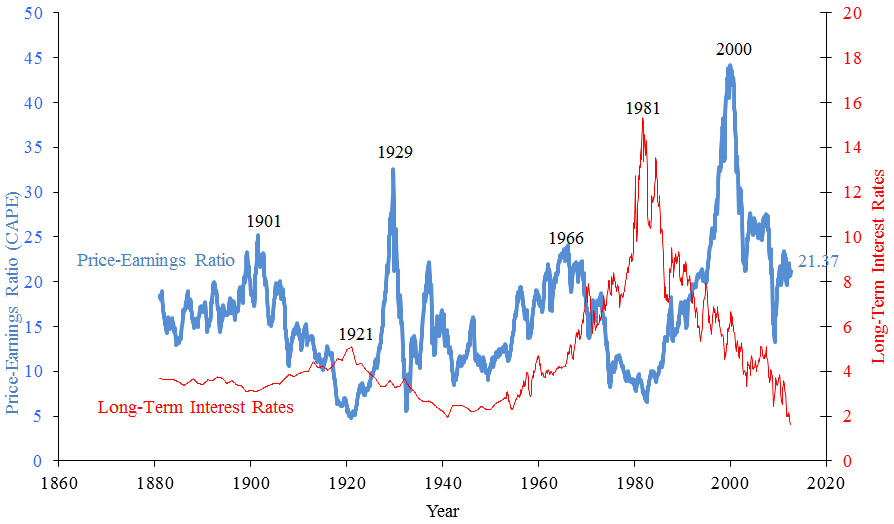

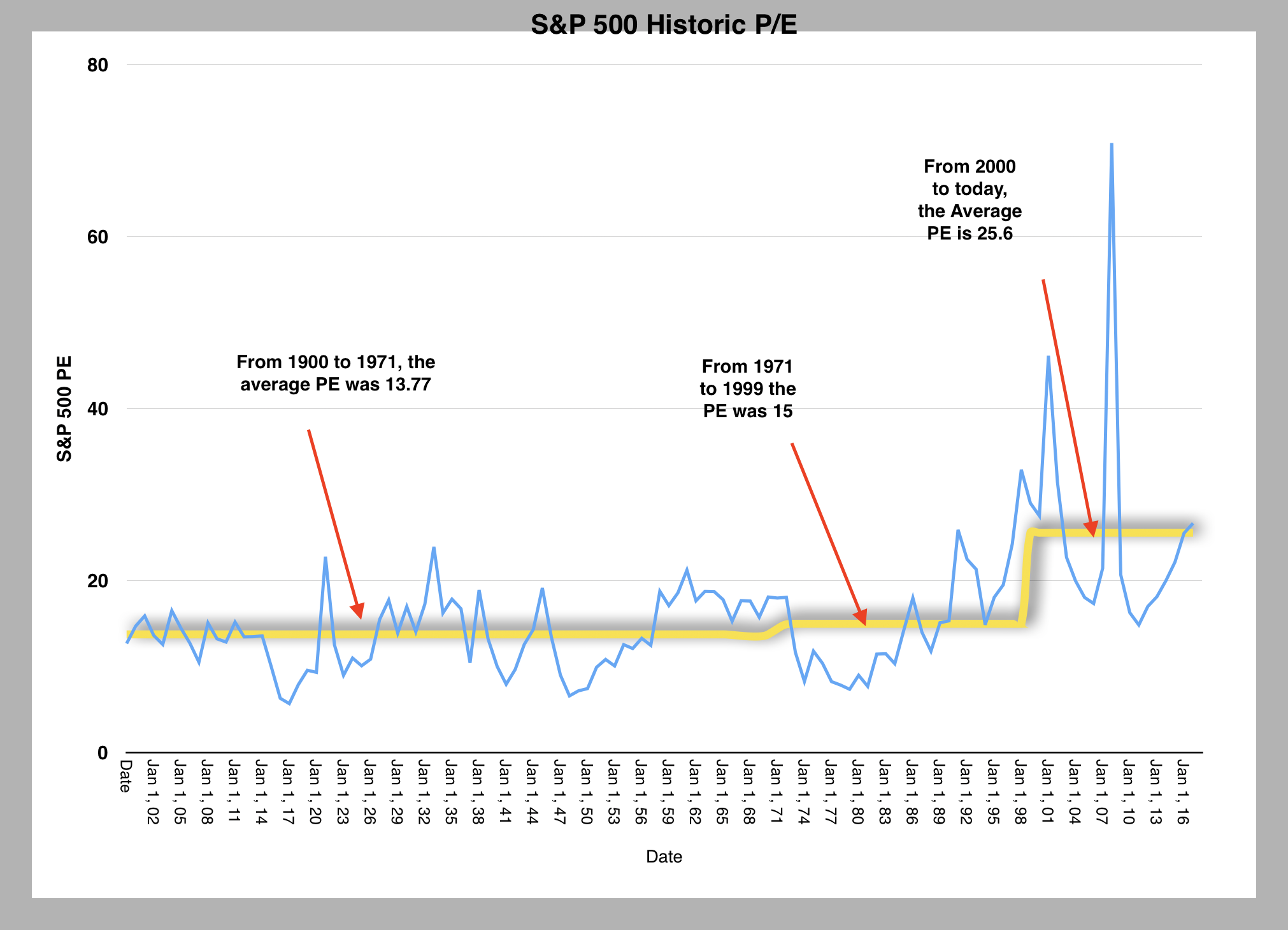

S p pe ratio. S p 500 p e ratio forward estimate is at a current level of 24 19 down from 25 62 last quarter and down from 39 28 one year ago. The s p 500 includes the 500 largest companies in the united states and can be viewed as a gauge for how the united states stock market is performing. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. Price earnings ratio is based on average inflation adjusted earnings from the previous 10 years known as the cyclically adjusted pe ratio cape ratio shiller pe ratio or pe 10 faq.

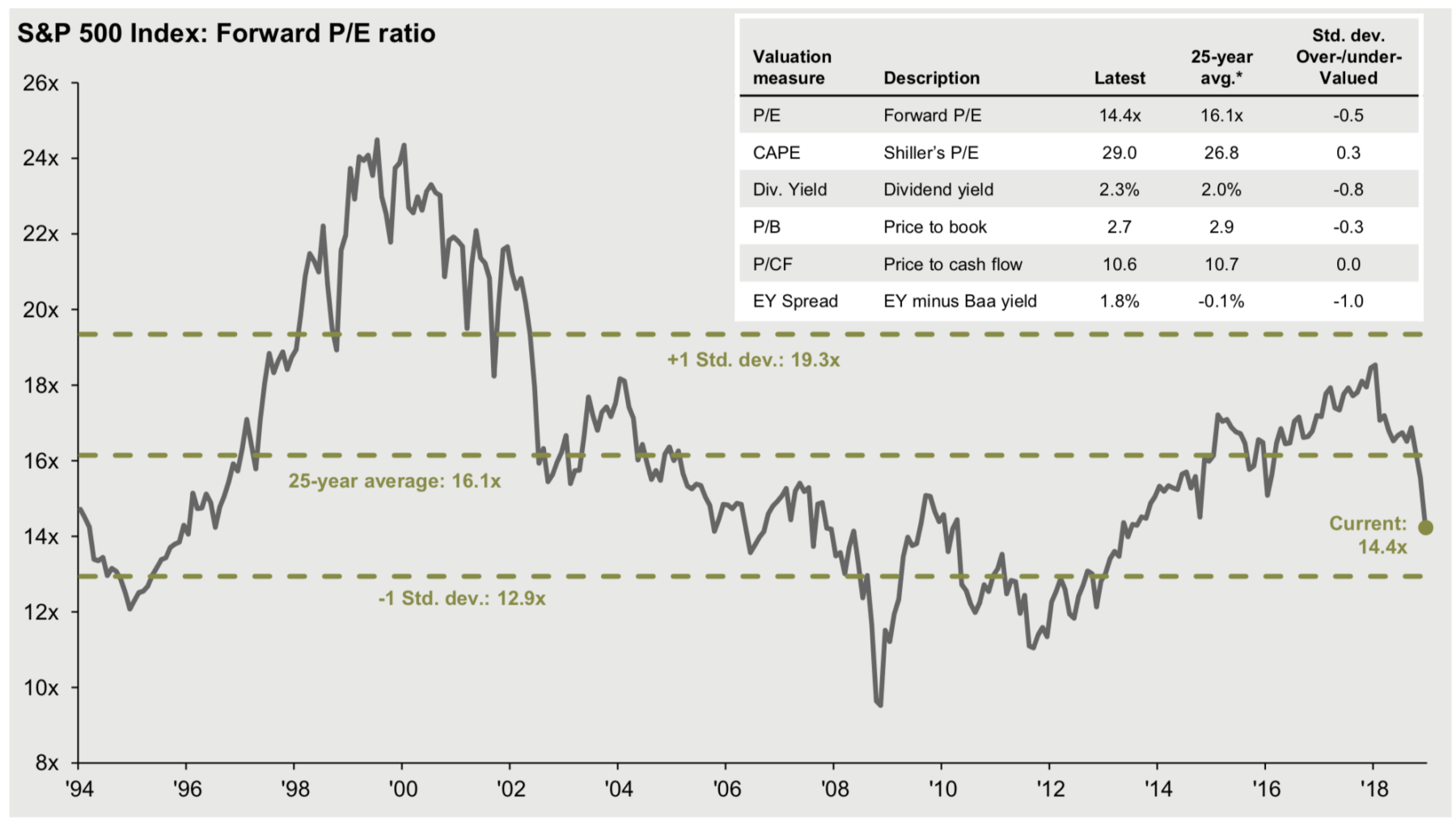

A solution to this phenomenon is to divide the price by the average inflation adjusted earnings of the previous 10 years. The price earnings ratio p e ratio is the ratio for valuing a company that measures its current share price relative to its per share earnings. The forward 12 month p e ratio for the s p 500 is 21 7x in comparison to a 10 year. The s p 500 pe ratio is the price to earnings ratio of the constituents of the s p 500.

How to use the p e ratio the most common use of the p e ratio is to gauge the valuation of a stock or index. S p 500 pe ratio 90 year historical chart. This is a change of 5 62 from last quarter and 38 43 from one year ago. Price earnings ratio p e ratio.

Data courtesy of robert shiller from his book irrational exuberance. The pe ratio of the s p 500 divides the index current market price by the reported earnings of the trailing twelve months. The shiller pe of the s p 500 currently stands at just over 30 as of early august 2020. Current s p 500 pe ratio is 33 36 a change of 0 41 from previous market close.

In 2009 when earnings fell close to zero the ratio got out of whack. Shiller pe ratio for the s p 500.

Insight/2020/03.2020/03.13.2020_EI/S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png?width=912&name=S&P%20500%20Forward%2012-Month%20PE%20Ratio%2010%20Years.png)

Insight/2020/02.2020/02.21.2020_EI/S%26P%20500%20Forward%2012%20month%20PE%20ratio.png?width=911&name=S%26P%20500%20Forward%2012%20month%20PE%20ratio.png)