How To Declare Dividend In Malaysia

If the company does not pay the dividend within the period every person who is a party to the default is punishable with simple imprisonment up to seven days and also with a fine.

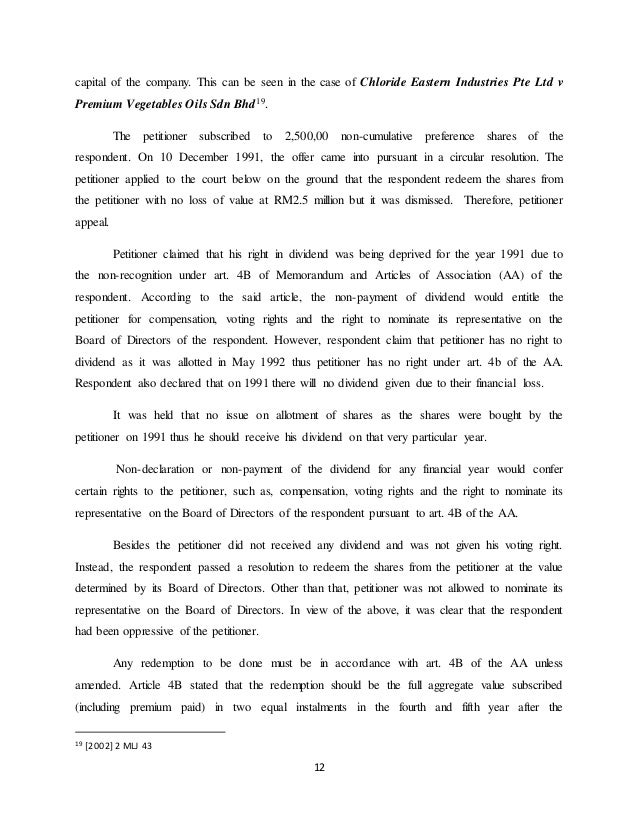

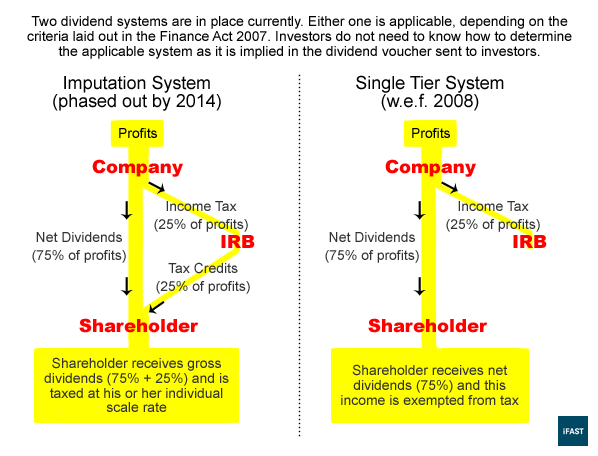

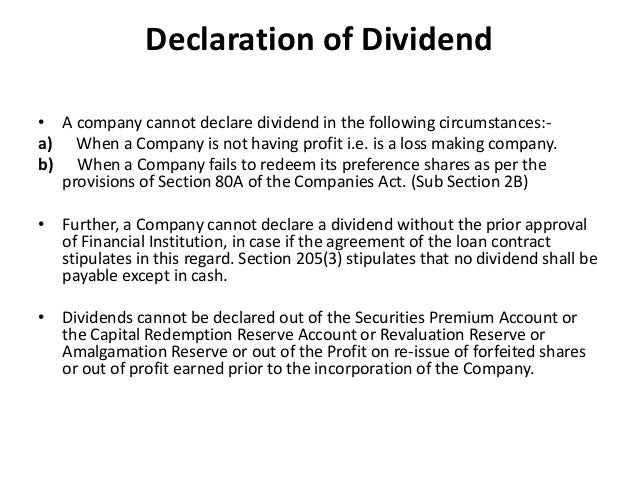

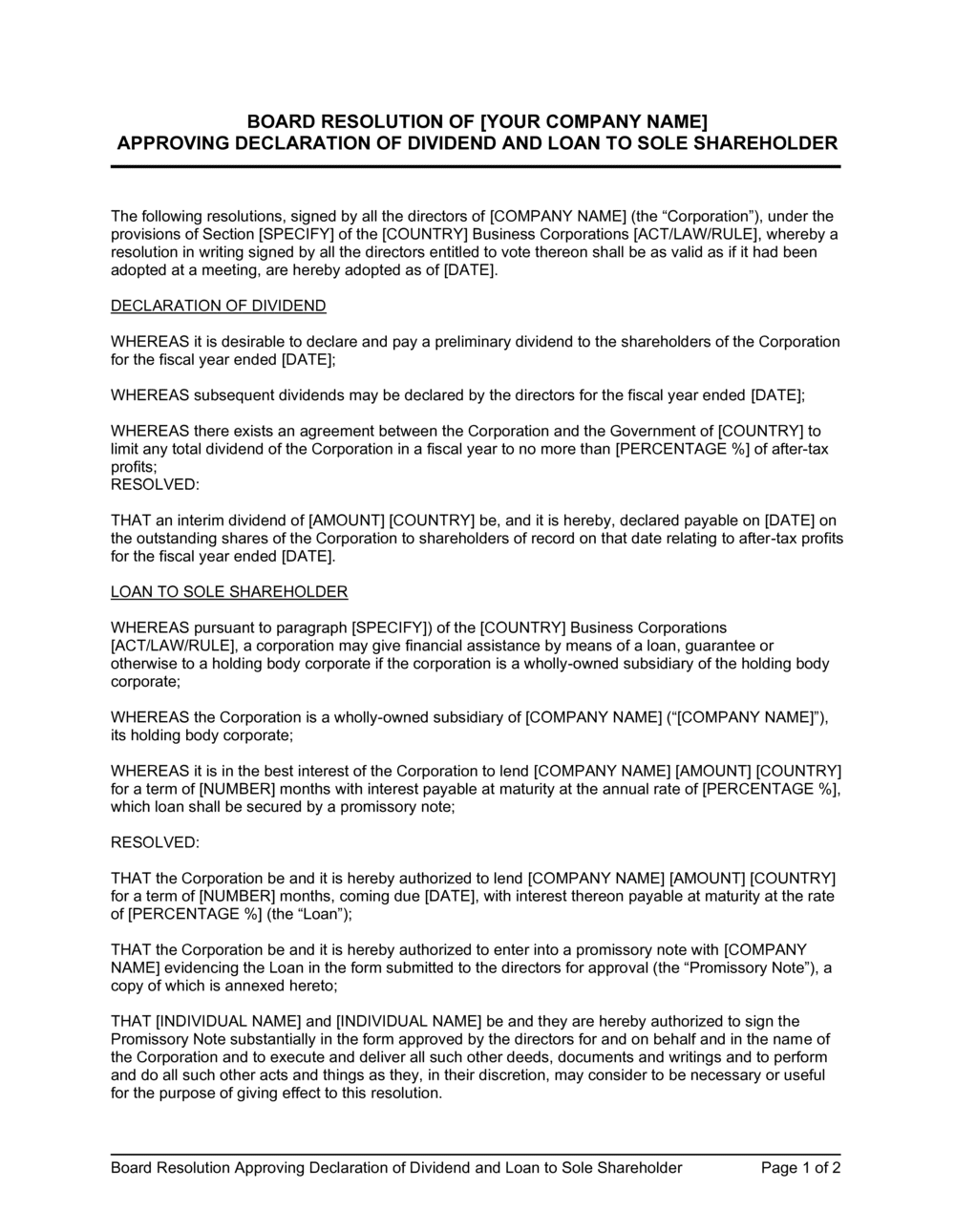

How to declare dividend in malaysia. Epf s dividend payouts are derived from total gross realised income for the year after deducting the net impairment on financial assets realized losses on listed equity undistributable unrealised gains or losses investment expenses operating expenditures statutory charges as well as dividend on withdrawals. Key changes to the dividend regime. To be found guilty the director must have known at the time that the dividends were declared of circumstances that show there had been insufficient profits to properly declare dividends. Rhb bank declared an interim single tier dividend of 12 5 sen per share after posting a 7 3 net profit increase to rm1 25 billion in the first half ended june 30th 2019 from rm1 16 billion net profit a year ago.

The dividend yield shows you how much dividends you ll get if you buy a certain amount of the company s stock. There may also be a breach of fiduciary duty or negligence on the part of the director in relation to the company. The brand new registered enterprises in malaysia can postpone the dividend payment to the shareholder for the first two years retaining the profits to a further development of the company. The dividends in malaysia can be distributed once twice per year or quarterly according to the rules of the company and considering the financial status.

While a trailing dividend can be indicative of future dividends it can be misleading as it does not account for dividend increases or decreases nor does it consider any special dividend that may or may not be declared in the future. The dividend when declared shall become a debt due from the company. The total dividend liability is now 90 000 and the journal to record the. Date ex date payment date type subject amount view.

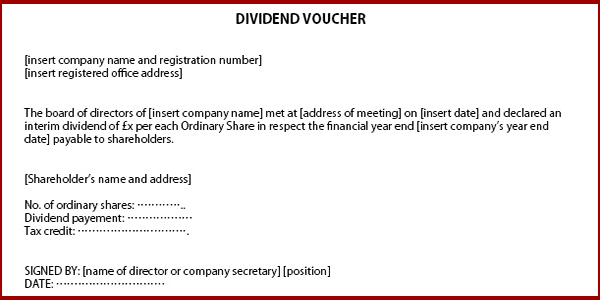

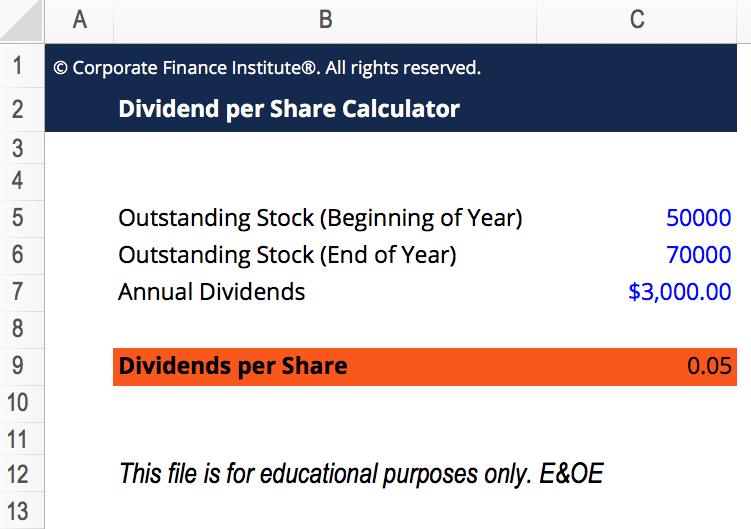

Pursuant to the application of a company s share premium account towards payment of dividends if such dividends are satisfied by the issue of shares i e. When a dividend is declared it should be paid within 42 days from the date of declaration. Total dividend amount declared for financial year ended june 2019 was 8 sen and the dividend yield was 1 75 and p e ratio 45 21. A trailing twelve month dividend yield abbreviated as ttm includes all dividends paid during the past financial year year to calculate the dividend yield.

As soon as the dividend has been declared the liability needs to be recorded in the books of account as a dividend payable. The epf declares its annual dividend payout based on its net realised income. For example if a stock has a 4 dividend yield and you have bought rm10 000 worth of shares you ll get rm400 in dividends.