P S Ratio

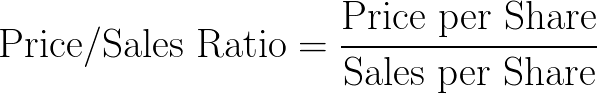

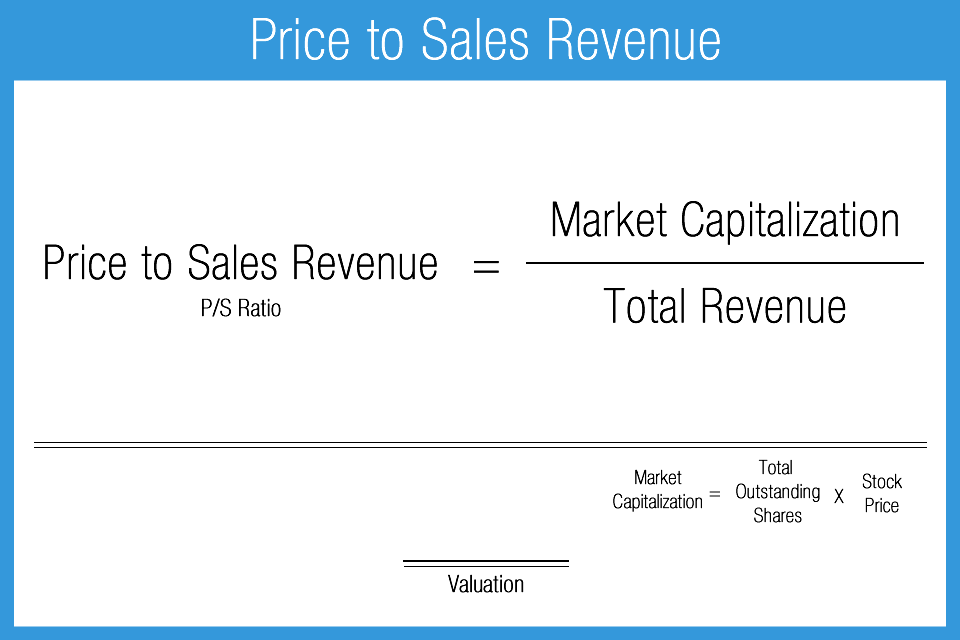

The price to sales ratio often called the p s ratio or simply price sales is a financial metric that measures the value investors put on a company for each dollar of revenue generated by the firm by comparing the stock price with total revenue.

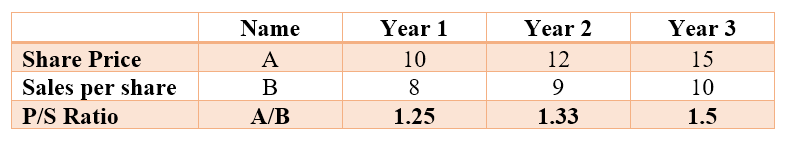

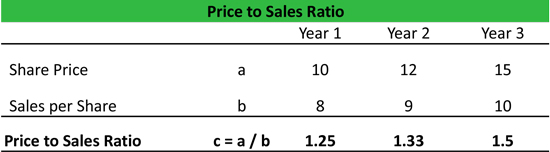

P s ratio. It is a measure of. The justified p s ratio is calculated as the price to sales ratio based on the gordon growth model. For this reason it can help determine the valuation of. A ratio of a company s share price to its revenue from sales over a given period of time especially a quarter or a year.

The price to sales ratio. Current and historical data on the trailing and forward s p 500 price to earnings ratio pe ratio or p e ratio. The current p s ratio is shown on all financial websites as 0 96 generally indicating an undervalued company but based on the actual commissions received by the company the p s ratio would be 3 64. The p s ratio is an investment valuation ratio that shows a company s market capitalization divided by the company s sales for the previous 12 months.

Therefore when comparing p s ratios make sure the firms are within the same industry. The price to sales ratio is an indicator of the value placed on. The price to sales ratio is a valuation ratio that compares a company s stock price to its revenues. Metrics and data to guide value investing.

Or equivalently divide the per share stock price by the per share revenue. Fundamentalists and value investors see a low ratio as more positive because it indicates that the company has a great deal of revenue and a fair price while technicians see a high ratio as more positive because it indicates that share price has increased and will likely. These firms have no earnings from which to use p e but comparing p s ratio against historical norms and competitors could help give an idea of a reasonable price for the stock. Price to sales ratio psr.

Price sales ratio p s ratio or psr is a valuation metric for stocks it is calculated by dividing the company s market capitalization by the revenue in the most recent year. Price to sales is a useful ratio across the board but probably most valuable for valuing currently unprofitable companies.