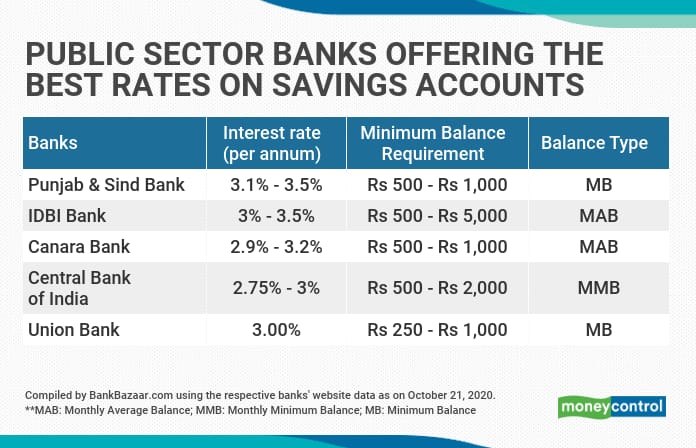

Public Bank Saving Account Minimum Balance

Initial deposit of rm250 00 for an individual or non individual to open an account.

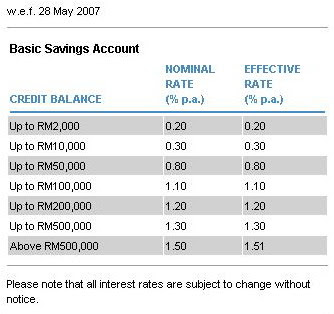

Public bank saving account minimum balance. More information what is the public bank basic savings account. Easy access to your account through any public bank branches atm or pbe. Minimum balance to maintain in the account is rm20. Other terms and conditions apply protected by pidm up to rm250 000 for each depositor.

Automatic conversion to qard savings account i upon account holder turning 18 years. Water electricity telephone bills quit rent assessment note bank statement employer s confirmation letter in your name and address. For balance more than rm10 00. Not applicable to business corporations associations and societies.

Minimum balance to be maintained at any one time is rm20. There are mainly two types of savings account regular savings account and zero balance savings account. Minimum balance of rm20 00 must be maintained. Banks have a certain minimum balance limit which an account holder has to maintain else he she has.

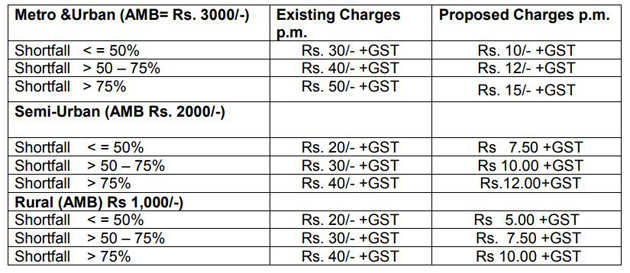

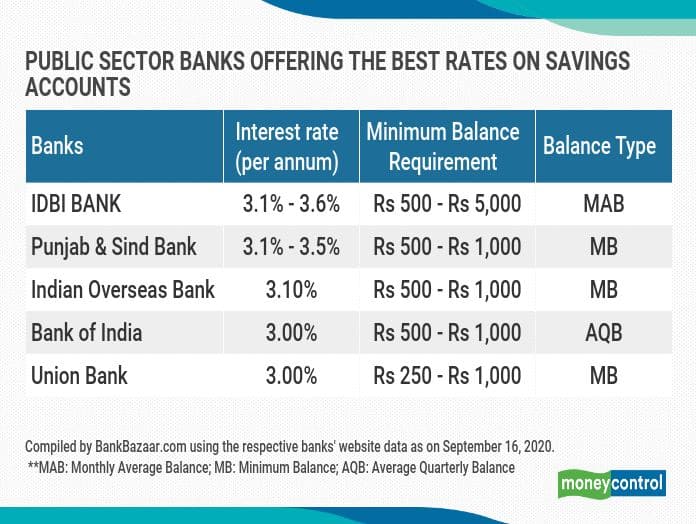

The minimum balance required to maintain a savings bank account is subject to change from one bank to another just like the rate of interest. For student accounts with bonafide certificates no change in minimum balance. Pb lifestyle debit card available. Rm10 00 plus stamp duty.

Replacement of lost savings account passbook. Minimum balance of rm20 00 must be maintained. Public bank a complete one stop financial portal offering a range of accounts credit cards. When opening the current account your introducer must sign the application form.

First published on oct 23 2020 11 11 am tags bank banking savings account. Minimum balance requirement for regular savings account and excluding bsbd account. The public bank basic savings account as its name suggest is a simple account that offers you all basic services at minimal costs. To open a current account with public bank you need to have an introducer who maintains a current or savings account with public bank for more than 12 months and not a bankrupt person.

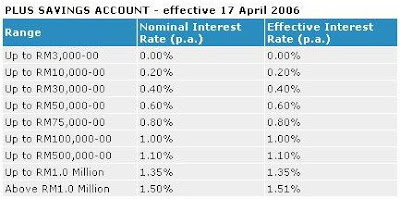

Easy access via any public bank public islamic branches atm or pbe. Rm10 00 per account is charged annually. Closure of account within 6 months from date opened. Interest is calculated daily and credited half yearly as at 30 june and 31 december every year.

Minimum initial deposit rm20 minimum balance rm20 related products. Other terms and conditions apply. Hibah if any may be credited into the account.