Public Bank Saving Account Type

They are the primary business of banks.

Public bank saving account type. Easy access to your account through any public bank branches atm or pbe. The interest rate is also often higher on notice accounts. Rm10 00 plus stamp duty. Public bank hong kong presents you and your children with the most fascinating wealthy kid savings account wealthy kid.

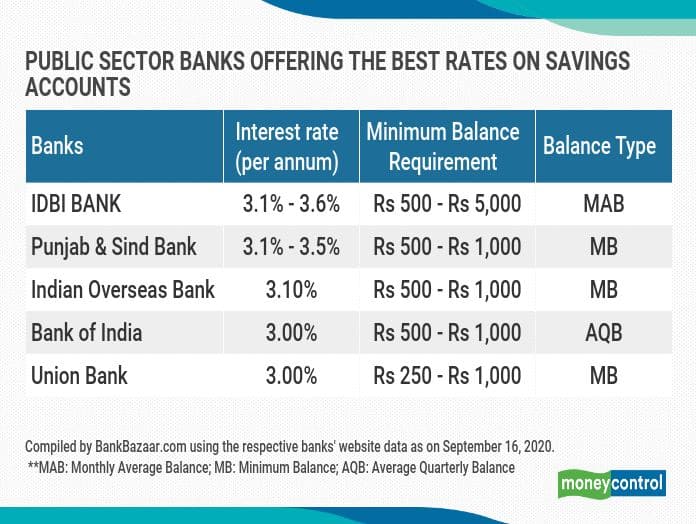

Therefore all public and private sector banks with retail operations offer savings bank accounts to individuals. A savings account allows you to accumulate interest on funds you ve saved for future needs. Pehla kadam and pehli udaan woman s savings account catering specifically to women banks around the country have rolled out a number of women s savings accounts that allows them to avail high value loans at attractive interest rates for female entrepreneurs or for them to start a business. The minimum balance of rs 25 000 should be maintained.

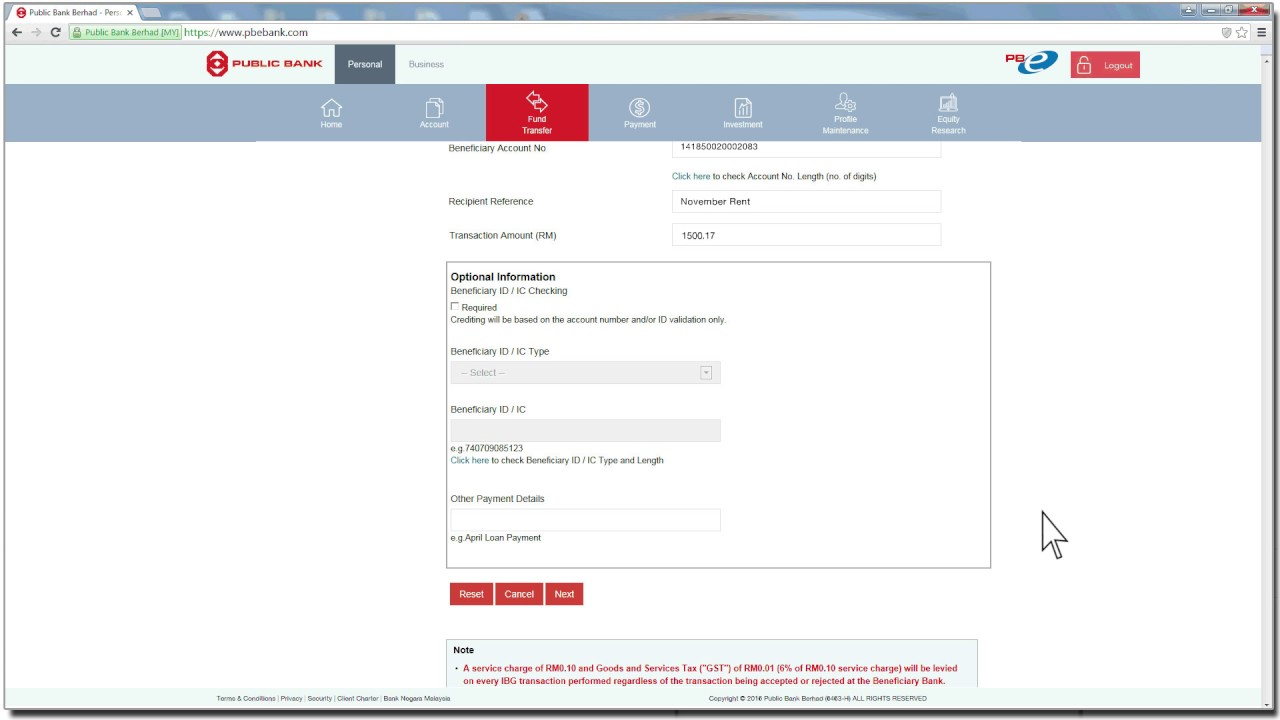

Cheques and cash deposits via deposit machines. Account enquiries and fund transfers within the bank via atm internet banking and mobile banking. This type of account allows you to save money in an account but it does not allow withdrawals without notice in advance usually more than a calendar month. Rm10 00 per account is charged annually note.

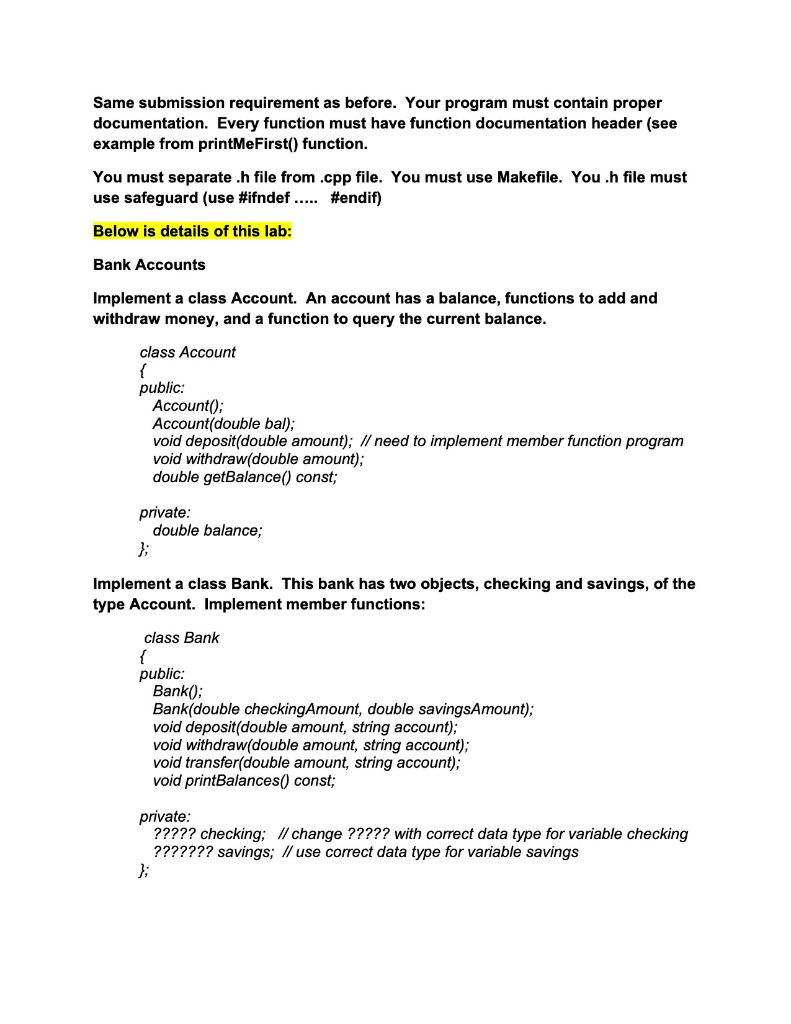

Savings bank account for minors savings account for minors. Bill payments via internet banking and mobile banking. Replacement of lost savings account passbook. Savings plus account is a savings bank account linked where any amount over rs 25 000 would be transferred to a fixed deposit.

Interest rates can be compounded on a daily weekly monthly or annual basis. The annual service fee is only imposed on inactive savings or current accounts which do not have any deposit or withdrawal transaction for a continuous period of at least twelve 12 months. With wealthy kid you can help your children to develop a good saving habit plan ahead with them and start turning your beloved children into the real wealthy kids. Other free services offered.

Current account is mainly for business persons firms companies public enterprises etc and are never used for the purpose of investment or savings these deposits are the most liquid deposits and there are no limits for number of transactions or the amount of transactions in a day. While there is no interest paid on amount held in the account banks charges certain service charges on such. Public bank a complete one stop financial portal offering a range of accounts credit cards loans deposits and other financial aids for our personal and commercial customers.